Tax-Efficient Investing Guide Where to Hold Assets IRA vs Brokerage

Learn tax-efficient investing strategies to optimize asset location between IRAs and brokerage accounts for maximum after-tax returns.

Browsing Category

Learn tax-efficient investing strategies to optimize asset location between IRAs and brokerage accounts for maximum after-tax returns.

Most taxpayers realize that the sooner they file their tax return, the quicker they will receive a refund. Beyond that simple common sense truth, however, there are a number of compelling reasons to file your tax return as early as possible. And, as someone who has often historically waited until the last few weeks before …

Learn how to negotiate lower credit card interest rates with proven scripts and tips to reduce your APR and save on credit card debt.

Last week I made a case for why you need to start investing, even if you have a fear of investing in small amounts because you do not think you have enough savings to do so. The other big fear I mentioned, but did not dive in to, involved the “how” of investing. Before going …

Compare Income-Driven and Standard student loan repayment plans to find which option saves more on interest and monthly payments.

At a recent social gathering, I was introduced to a pediatric surgeon – a younger guy, probably in his early 30s. We got to chatting about what we do for a living, as strangers often do. After discovering that I was a personal finance writer, he offered the following admission and question: “I have a …

Fresh off of a second huge stock market rally from a frightening decline in the past year, I thought it would be timely to do a bit of reflecting. For those with very short memories (or news avoiders), the stock market took an absolute nosedive in January through early February as oil prices bottomed out …

I recently highlighted a few different alternatives to stocks and low-interest cash savings. One of the options I mentioned was a money market fund (also known as a money market mutual fund). Money market funds are often confused for similar-sounding money market accounts – a type of savings account that banks offer, but they are …

Credit unions, as fiscally conservative member-focused non-profit institutions that distribute profits to their members, are surely safer than for-profit banks with return-hungry shareholders, right? That was my thought. Much to my surprise, however, my research found that the opposite is true statistically. In the last decade (January, 2015 – January, 2025), 97 federally insured credit …

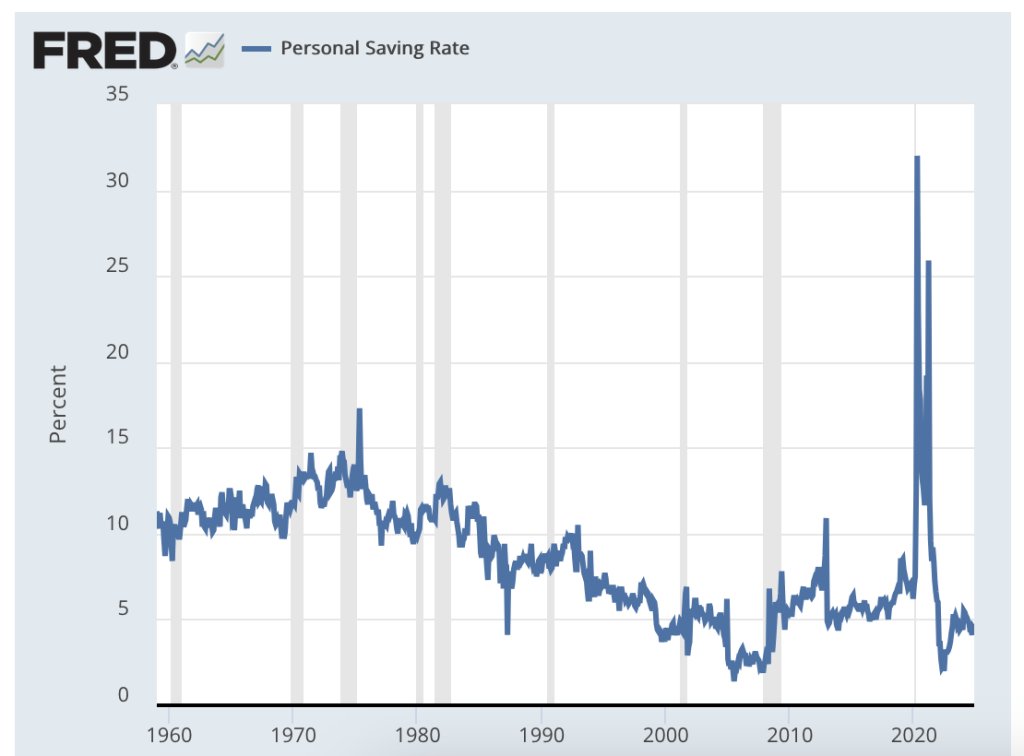

Long-time readers here know that personal savings rate is one of my favorite personal finance metrics (along with safe withdrawal rate, crossover point, net worth, and “usable net worth”, to name a few). No other metric is as apt at diagnosing your current “personal business” of household cash flow management. In its simplest form, Personal …