Market Crash 2026 Buy the Dip or Wait Calm Proven Strategy

Discover a calm, evidence-based strategy for market crashes to decide when to buy the dip or wait amid 2026 volatility and investor uncertainty.

Browsing Category

Discover a calm, evidence-based strategy for market crashes to decide when to buy the dip or wait amid 2026 volatility and investor uncertainty.

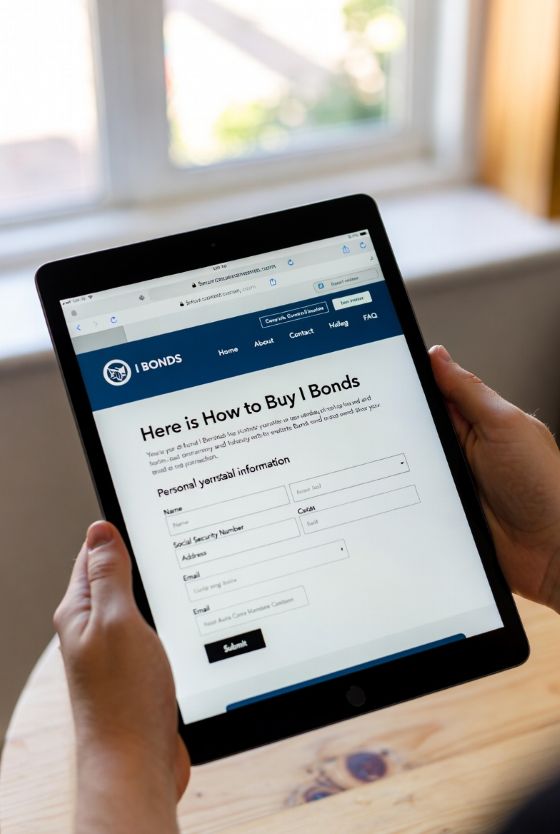

The buzz around I bonds in the personal finance community has been off the charts the last few years, with guaranteed interest rates not seen anywhere else in recent decades, and no risk-free comparable investment alternatives. I gave an in-depth I bond overview and covered how to buy I bonds previously to help readers take …

Discover 3 simple budgeting methods for beginners to stop living paycheck to paycheck and start saving with easy step-by-step guides.

Capital gains tax rules do not make for a particularly thrilling topic. But, seeing that this is a personal finance blog geared towards young professionals and we should all be investing as early as we possibly can, capital gains (and losses) related to investing are something I wanted to do a “101”-type overview on. And …

Discover the best high-yield savings accounts in 2026 offering top APYs 4-5% plus tips on safe, FDIC-insured options to maximize your cash returns.

PSA to readers who have had an interest in U.S. Treasury I Savings Bonds in recent years, as I have – you can purchase I bonds at treasurydirect.gov at the current new I bond rate of 4.03 APR%. If you’re not familiar with them, see my I bonds overview for a primer on what they …

Updates: the new I bond rate for November, 2025 to May, 2026 has been set at 4.03% APR for new purchases. If you find that appealing, here is how to buy I Bonds. For those who previously purchased, it may be a good time to close I bonds with variable rates and inflation having declined …

Explore if 0% APR offers on credit cards are smart tools for debt payoff or risky traps with fees high interest and repayment tips.

Learn how to save side hustle income with the Bucket Strategy to manage taxes reinvestments emergencies and build long-term wealth effectively

One of my very favorite personal finance metrics to calculate, monitor, and compete against is my personal inflation rate (as one half of a married couple, it could more rightfully be referred to as “household inflation rate” since my wife and I share all costs). Whatever you want to call it, I’d put it second …