Understanding the Current High-Rate Landscape

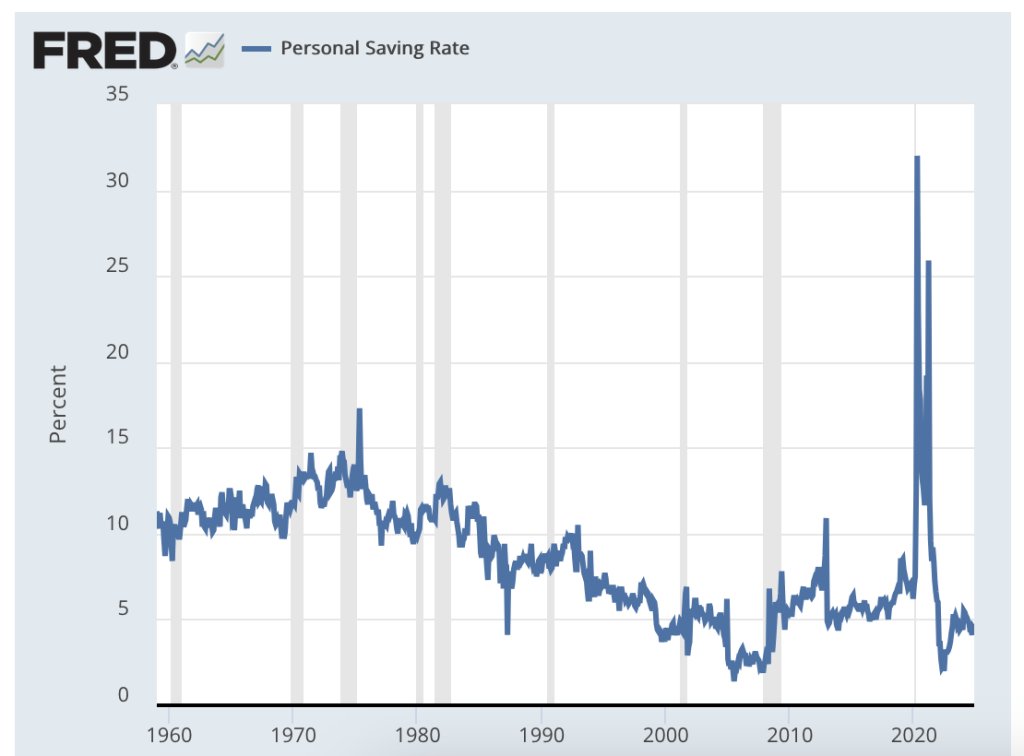

The Federal Reserve’s recent rate hikes have shaped a high-rate era unlike what we’ve seen in years. As of late 2026, the Fed’s policies suggest rates may hold steady or see modest changes, but the outlook remains uncertain. This environment means savers can now enjoy high-yield savings accounts offering impressive APYs around 4-5%, a huge jump compared to the national average of roughly 0.40%.

Elevated rates create a prime opportunity for anyone looking to grow their cash safely. High-yield savings accounts and other online high-interest savings options provide a way to earn meaningful returns with FDIC insured savings accounts, giving peace of mind alongside liquidity.

However, it’s essential to remember rates can fluctuate. The Fed might reduce rates if economic conditions shift, causing APYs to dip. That’s why acting now to lock in higher returns and moving cash into the best high-yield savings accounts 2026 is a smart move. By doing so, you maximize earnings while maintaining flexibility and safety.

What Is a High-Yield Savings Account?

A high-yield savings account (HYSA) is a savings account that offers much higher interest rates than traditional savings accounts. While regular savings accounts often have APYs around 0.40%, HYSAs can offer rates between 4-5%, making them a smart choice in today’s high-rate environment.

Key Features of High-Yield Savings Accounts:

- Variable Rates: HYSA rates can change based on market conditions and Federal Reserve moves.

- FDIC Insurance: Like traditional savings, funds are insured up to $250,000 per depositor, so your money is safe.

- Liquidity: You can access your money easily, usually without penalties, although federal rules limit certain withdrawals to six per month.

HYSA vs. Traditional Savings Account

| Feature | High-Yield Savings Account | Traditional Savings Account |

|---|---|---|

| Average APY | 4% – 5% (variable) | ~0.40% |

| FDIC Insurance | Yes, up to $250,000 | Yes, up to $250,000 |

| Minimum Deposit | Often $0 to $1,000 | Usually $0 or low minimum |

| Accessibility | Easy transfers and withdrawals (some limits) | Easy access with potentially fewer limits |

| Interest Compounding | Daily or monthly | Usually monthly |

Pros and Cons of HYSAs

Pros:

- Higher interest earnings boost your savings faster.

- FDIC insured, so your savings are safe.

- Flexible access to funds compared to CDs or bonds.

Cons:

- Interest rates can drop if the Fed lowers rates.

- Some accounts have minimum balance requirements to earn top APYs.

- Withdrawal limits may apply under federal regulations.

For those looking to maximize short-term cash growth safely, understanding these features is key to choosing the right place for parking your cash in 2026.

Top High-Yield Savings Accounts in December 2026

In this high-rate era, finding the best high-yield savings accounts in December 2026 can seriously boost your cash’s earning power. Here’s a curated list of top picks, focusing on current APYs, minimum deposits, and standout features to help you decide:

| Bank/Provider | APY (Dec 2026) | Minimum Deposit | Fees | Highlights |

|---|---|---|---|---|

| Ally Bank | 4.75% | $0 | No monthly fees | User-friendly app, 24/7 support |

| Marcus by Goldman Sachs | 4.70% | $1 | No fees | High APY, easy transfers |

| Discover Bank | 4.65% | $0 | No fees | Strong customer service, mobile app |

| Capital One 360 | 4.60% | $0 | No monthly fees | No minimum balance, solid app |

| Synchrony Bank | 4.55% | $0 | No fees | Competitive APY with ATM access |

What to Compare When Choosing

- APY and Compounding: Look for the highest APY and daily or monthly compounding to maximize interest.

- Fees: Avoid accounts with monthly maintenance or transfer fees that eat into earnings.

- Mobile App and Ease of Use: A smooth online and mobile experience matters for quick access and transfers.

- Customer Service: Reliable, accessible support helps if issues pop up.

- Bonuses: Some banks offer cash bonuses for new accounts—worth considering to bump your initial balance.

Tips for Switching Accounts Seamlessly

- Link your new HYSA to existing checking accounts for easy, automatic transfers.

- Set up automated monthly deposits to benefit from compound interest.

- Keep the old account open for a month to ensure pending transactions clear.

- Update any direct deposits or bill payments linked to the old account.

Switching to a top high-yield savings account can lock in excellent returns while keeping your cash liquid and safe. For a deeper dive into how to build your cash reserves, explore our guide on why you need an emergency fund and how to build it efficiently.

Key Factors to Consider When Choosing an Account

When selecting a high-yield savings account, several important factors can affect your overall returns and convenience. First off, APY (Annual Percentage Yield) is crucial—it tells you how much interest you’ll earn annually, including compound interest. Look for accounts with frequent compounding (daily or monthly) to maximize your gains.

Next, check the minimum deposit and balance requirements. Some accounts require a sizable initial deposit or maintaining a minimum balance; failing to do so can trigger fees that eat into your earnings. Speaking of fees, prioritize no-fee high-yield savings when possible to keep your returns fully intact.

Accessibility matters too. Consider how easy it is to make transfers, whether you can use an ATM for withdrawals, and the quality of the bank’s mobile app. Smooth, on-the-go access is a must in today’s fast-paced world.

Equally important is the bank’s reliability. Make sure the institution is FDIC insured, which guarantees your money up to $250,000 in case of bank failure. For credit unions, look for NCUA insurance. Also, review customer ratings and service quality—these influence your experience with account management.

Finally, be aware of the tax implications on interest earned. Interest from high-yield savings is typically taxed as ordinary income, so factor that into your after-tax returns when comparing accounts.

Taking these elements into account ensures you pick an account that not only offers one of the best high-yield savings rates but fits your needs in terms of fees, access, and safety. For a broader look at related investment options like Treasury-backed products, check out this detailed guide on how to buy I bonds.

Alternatives to High-Yield Savings Accounts

If you’re exploring options beyond traditional high-yield savings accounts, several alternatives offer different benefits depending on your goals and timeline.

Money Market Accounts

These accounts blend features of savings and checking accounts. They usually offer competitive interest rates, often close to HYSA rates, and provide easy access through checks or debit cards. Plus, they’re typically FDIC insured, making them a safe spot for your cash with added liquidity.

Certificates of Deposit (CDs)

CDs lock in a fixed interest rate for a set term, often yielding higher returns than HYSAs but with less flexibility. Early withdrawals can lead to penalties, so CDs work best if you don’t need immediate access. Laddering CDs—buying multiple CDs with different maturity dates—can balance access and maximize returns.

Treasury Bills and Bonds

Treasuries are government-backed and come with tax advantages, usually exempt from state and local taxes. Treasury bills are short-term instruments suitable for parking cash safely, while bonds offer longer durations with generally higher yields. They provide predictable income with minimal risk.

Money Market Funds

Unlike money market accounts, these are investment funds investing in short-term debt. They offer slightly higher returns but carry minimal risk since they’re not FDIC insured. These funds suit those comfortable with small fluctuations for better yields.

Choosing the Right Alternative

- Liquidity needs: If you want quick access, money market accounts or short-term Treasuries are better.

- Time horizon: For longer commitments, CDs or bonds can provide more attractive rates.

- Risk tolerance: Money market funds have slight risk, unlike FDIC insured accounts.

Balancing these factors ensures your cash works efficiently for you without compromising safety.

For more insight on low-risk ways to invest your cash, check out this guide on low-risk alternatives to stock investments.

Strategies for Maximizing Your Cash Returns

To make the most of your savings in today’s high-rate environment, it’s smart to combine several strategies tailored to your financial goals and liquidity needs.

Build an Emergency Fund in a High-Yield Savings Account

Start by parking 3 to 6 months’ worth of living expenses in a high-yield savings account (HYSA). This keeps your emergency cash safe, liquid, and earning competitive interest—far better than a traditional savings account.

Ladder CDs or Treasury Securities

Consider laddering certificates of deposit (CDs) or Treasury bills and bonds. By staggering the maturity dates, you get regular access to funds while capturing higher yields on longer terms. This strategy balances liquidity and returns effectively.

Automate Transfers and Monitor Rates

Set up automatic transfers to your HYSA to build savings consistently without effort. Also, keep an eye on changing interest rates—rates can move with the Federal Reserve’s decisions, so switching accounts or laddering can help sustain strong returns.

Diversify Accounts for Yield and Safety

Don’t put all your cash in one place. Spread your money across several FDIC-insured savings accounts and consider mixing in money market accounts or Treasuries. Diversifying helps maximize overall yield while keeping your funds safe and within insurance limits.

By combining these approaches, you can boost your cash returns in this high-rate era while preserving access and security. For detailed insights on managing your fixed income and cash options, check out this guide on whether you should get rid of your fixed income holdings.

Potential Risks and Future Outlook

While high-yield savings accounts offer attractive APYs now, it’s important to watch the Fed’s moves closely. If the Federal Reserve cuts rates in 2026, many high-yield savings account rates will likely drop too, lowering your returns. Since these accounts have variable rates, your earnings could shrink without warning.

Inflation is another factor eating into your real returns. Even with 4-5% APYs, if inflation stays high, the actual purchasing power of your saved cash may not grow much. It’s smart to keep an eye on inflation trends alongside your HYSA interest.

Also, avoid common traps like chasing teaser rates—some banks offer high rates for a short period before dropping them. Always check for hidden fees or minimum balance requirements that could reduce your overall gains.

To stay ahead:

- Monitor Fed announcements and adjust where you park your cash

- Compare no-fee high-yield savings accounts regularly

- Don’t ignore the fine print on fees and rate lock periods

Being cautious about these risks helps you make the most of the high-rate era while protecting your savings.

FAQs: Quick Answers on High-Yield Savings in 2026

Here are clear answers to common questions about high-yield savings accounts in this high-rate era.

| Question | Answer |

|---|---|

| Best rates now? | Look for HYSA APYs around 4-5% as of December 2026—far above the national average (~0.40%). Check sites regularly for updates. |

| Safe from bank failure? | Yes, if your bank is FDIC insured (or NCUA for credit unions), your deposits are protected up to $250,000 per account holder. |

| Differences from CDs? | HYSAs offer variable rates and easy access to funds. CDs lock your money with a fixed rate but usually pay higher yields. |

| Tax treatment on interest? | Interest earned is taxable as ordinary income. Keep records and report annually on your tax return. |

| Is switching banks worth it? | Often yes—especially if you find higher APYs, no fees, or better app/mobile features. Switching is mostly online and straightforward today. |

Remember, in this high-rate environment, acting now to lock in good rates on FDIC insured savings accounts can boost your cash returns while keeping money accessible.