What Counts as Side Income?

Side income covers any extra money you earn outside your regular job. Common sources include freelancing gigs, ridesharing (like Uber or Lyft), delivery apps (DoorDash, Instacart), online sales on platforms such as Etsy or eBay, renting out property or a spare room, consulting work, and crafting or handmade sales. Even cash payments count, whether you get paid in person or through apps like Venmo, PayPal, or other digital wallets.

It’s important to know that the IRS treats all these earnings as taxable income, so side hustle taxes apply. But not all income is treated the same. There’s a key difference between hobby income and business income. The IRS uses a “profit motive” test to decide if your side gig is a business — meaning you intend to make a profit — or just a hobby. This distinction matters because it affects how you report side job income and what deductions you can claim.

In simple terms: if you’re regularly trying to make money and treat your side job like a business, you’ll report it as such. If it’s more casual and mainly for fun, it may be hobby income — you still report it but with different tax rules. Understanding what counts as side income is the first step toward handling your gig economy tax obligations the right way.

Do You Always Need to Report Side Income?

Yes, the IRS requires you to report all taxable income, no matter the amount. There’s no minimum threshold when it comes to side hustle taxes – every dollar earned from gigs, freelancing, or selling online needs to be declared. This includes cash payments and earnings through payment apps like Venmo or PayPal.

That said, there are some exceptions. Gifts and personal reimbursements aren’t considered taxable income, so you don’t report those. Also, if your side income comes from a true hobby rather than a business, you still report the income, but deductions related to expenses are limited.

Failing to report side job income can lead to serious consequences. The IRS may charge penalties and interest, and it can trigger audits, which can be stressful and time-consuming. To avoid trouble, it’s best to accurately report all your taxable side income every year.

Key Tax Thresholds Explained

When it comes to reporting side income, understanding key tax thresholds is crucial. For self-employment tax, if your net earnings reach $400 or more, you must file Schedule SE to calculate and pay Social Security and Medicare taxes. The IRS also requires businesses to send Form 1099-NEC if they pay you $600 or more in nonemployee compensation, such as freelance or gig work.

For payment apps and online platforms like Venmo or PayPal, a recent legislative change effective in 2026 lowers the reporting threshold for Form 1099-K to $20,000 in gross payments and 200+ transactions. This change means more side hustlers will receive these forms, so tracking income carefully is important.

Beyond these thresholds, your overall filing requirement depends on whether your total income exceeds the standard deduction for your filing status or if your self-employment income hits the $400 mark. Even if your side income is considered a hobby, you must still report all earnings, but unlike business income, hobby income generally does not allow you to deduct related expenses without a profit motive.

Keeping these tax rules in mind will help you stay compliant with the IRS and avoid penalties. For more on managing expenses and deductions related to your side hustle, check out helpful budgeting tools like these 5 budgeting apps that actually work.

Side Hustle vs. Hobby: How the IRS Decides

The IRS uses nine factors to determine if your side income is a business or just a hobby. These factors focus on your profit motive—meaning if you’re trying to make a consistent profit or just earning money occasionally without a real business plan. Some key considerations include:

- Whether you run your side hustle in a businesslike manner

- Your level of expertise or knowledge in what you do

- How much time and effort you invest

- Whether you depend on the income for your living expenses

- Your history of making a profit from similar activities

- How the activity’s losses and profits compare over time

If you meet enough of these factors, the IRS treats your side hustle as a business. That means you can deduct expenses and claim losses, which lowers your taxable income. But if it’s classified as a hobby, you still report the income, though you can’t deduct expenses beyond your income for that activity.

For example, a freelance graphic designer who regularly takes clients, advertises services, and invests time and money clearly runs a business. In contrast, occasional crafting sales at a local fair, done sporadically without intent to profit, would more likely be considered a hobby.

Knowing this distinction can save you money and stress on your taxes. It also highlights why keeping good records and tracking your effort matters when trying to grow your side hustle. For more on managing your side income and tax rules, check out our gig economy tax guide.

How to Report Side Income on Your Taxes

When it comes to reporting side hustle taxes, knowing the right forms to use makes a big difference. For most business-related side income, you’ll start with Schedule C, which reports your profit or loss from freelancing, consulting, or selling goods. If your net earnings hit the $400 self-employment tax threshold, you’ll also need to file Schedule SE to calculate the Social Security and Medicare taxes you owe.

For income from hobbies or activities not seen as a business, report it on Schedule 1 as “Other Income.” Keep in mind, hobby income is taxable but doesn’t allow for business expense deductions like Schedule C does.

Even if you have a full-time job with a W-2, your side income reports flow into your main Form 1040 tax return. If you juggle multiple gigs or platforms (say freelancing plus selling on Etsy), you’ll still combine all earnings and expenses on Schedule C or Schedule 1 accordingly. Accurate tracking across all your side jobs helps avoid mistakes and keeps your filings clean.

Properly reporting side income ensures you stay compliant with IRS rules and avoid issues like audits or penalties. For more about organizing earnings and deductions, you might find tips on managing your overall finances useful alongside this gig economy tax guide.

Self-Employment Taxes: What You Owe Extra

If you’re earning side income from freelancing, consulting, or gig work, you need to understand self-employment taxes. The key rate here is 15.3% — this covers both Social Security (12.4%) and Medicare (2.9%) taxes on your net earnings.

How It Works:

- You pay the full 15.3% on net earnings over $400 (the self-employment tax threshold).

- Unlike W-2 employees, who split this cost with their employer, you cover the entire amount yourself.

- The good news: you can deduct half of the self-employment tax as an adjustment when filing your tax return. This reduces your taxable income and helps lower your overall tax bill.

| Tax Component | Rate | Who Pays? |

|---|---|---|

| Social Security Tax | 12.4% | Employee + Employer (split) |

| Medicare Tax | 2.9% | Employee + Employer (split) |

| Self-Employment Tax | 15.3% | Solely you (both parts) |

Keep in mind, this tax is in addition to income tax on your side income. Understanding these obligations can help you avoid surprises come tax time. For more on taxes related to gig economy income, stay updated on changes in reporting rules like the evolving 1099-K thresholds.

This information fits into the broader topic of the gig economy tax guide if you want to explore how different side hustles affect your tax situation.

Estimated Quarterly Taxes: Avoiding Surprises

If your side hustle or gig income means you owe $1,000 or more in taxes annually, the IRS expects you to make estimated quarterly tax payments. This helps you avoid a big tax bill — and penalties — when you file your return. These payments cover both income tax and self-employment tax, which includes Social Security and Medicare.

To calculate your quarterly estimated taxes, use Form 1040-ES, which provides worksheets to estimate your expected income, deductions, and credits for the year. You’ll then divide that amount into four payments due throughout the year (usually April, June, September, and January).

The IRS also offers safe harbor rules if you meet certain conditions, so you can avoid penalties even if you underpay. For example, if you pay at least 90% of your current year’s tax bill or 100% of last year’s tax liability through withholding and estimated payments, you’re generally in the clear.

Staying on top of quarterly estimated taxes is crucial for anyone with side income to avoid surprises and keep your tax situation smooth — especially if your freelance tax obligations or gig economy earnings fluctuate. For practical budgeting tips related to managing your money and side hustle taxes, check out this helpful guide on smart financial management.

Deductions and Credits to Lower Your Tax Bill

When it comes to side hustle taxes, knowing which deductions you can claim is key to keeping more of your earnings. Common business expenses include mileage for work-related travel, a home office if used exclusively for your gig, supplies, marketing costs, and any fees you pay to platforms or services. Tracking these expenses carefully can significantly reduce your taxable income.

Good recordkeeping is essential—keep receipts, use apps, or maintain a dedicated spreadsheet to separate personal and business transactions. This makes filing easier and helps if you ever face an audit. Don’t forget about the Qualified Business Income (QBI) deduction, which allows eligible self-employed individuals to deduct up to 20% of their net business income, potentially lowering your tax bill even more.

By staying organized and taking advantage of these deductions, you can manage your freelance tax obligations more effectively and avoid paying more than necessary. For more tips on managing your money and automating savings alongside your side hustle income, check out strategies like the set-and-forget way to grow wealth.

Common Mistakes and How to Avoid Them

When dealing with side hustle taxes, it’s easy to slip up if you’re not careful. Here are some frequent mistakes and simple ways to avoid them:

-

Mixing personal and business transactions: Many people use payment apps like Venmo or PayPal for both personal and side gig income. Misclassifying these can lead to inaccurate reporting and headaches during audits. Keep your business payments separate to stay clear.

-

Ignoring cash income or small amounts: Even small cash jobs or occasional earnings count as taxable side income. Skipping reporting because it feels minor can trigger penalties later. Always track all earnings, no matter how small.

-

Overclaiming deductions: Trying to deduct personal expenses or inflating business costs can flag your return for an IRS audit. Stick closely to legitimate Schedule C deductions related to your side gig.

-

Forgetting state taxes: Your side hustle income might be taxable at the state level too. Don’t overlook filing requirements beyond federal taxes; each state has its own rules and thresholds.

By avoiding these mistakes and keeping detailed records, you can confidently manage your freelance tax obligations and stay on the IRS’s good side.

For tips on keeping personal finances in order alongside side income, check out this guide on how to negotiate medical bills.

Special Considerations for Gig Workers and Online Sellers

If you’re a gig worker using platforms like Uber, DoorDash, or Lyft, there are a few special tax points to keep in mind. These apps usually send you a Form 1099-NEC or 1099-K, depending on how much you earn, so make sure to track your income carefully. Remember, even if you don’t get a 1099 form, you still need to report gig income to the IRS because all taxable income counts.

For online sellers on sites like Etsy or eBay, marketplace rules affect reporting too. Since 2026, platforms must issue a Form 1099-K if you exceed the $600 threshold, regardless of the number of transactions. This update lowers the previous $20,000 and 200 transaction rule, so many more sellers have to report income from payment apps like Venmo or PayPal. Always keep good records of sales and expenses for your freelance tax obligations and potential deductions.

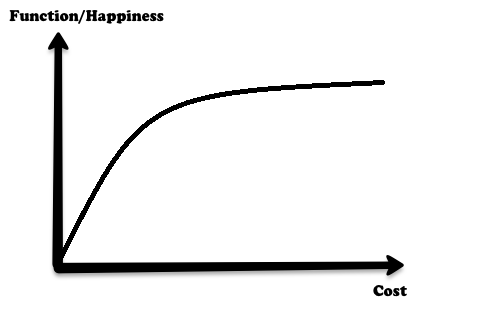

Finally, if your side income pushes your total earnings into a higher tax bracket, be aware that your tax rate on some income may increase. This can impact how much you owe in taxes and potentially your quarterly estimated tax payments. It’s wise to monitor your earnings throughout the year to avoid surprises, especially if you juggle multiple gigs or side hustles.

For practical tips on managing your money alongside working a side hustle, check out this guide on emotional money management and stopping revenge spending. This can help keep your finances balanced as your side income grows.