Subscription Overload? How to Audit & Cancel in 30 Minutes

Feeling like your bank statement is quietly leaking money every month? You’re not alone—most people are unknowingly paying for subscriptions they don’t use, wasting hundreds each year. The good news? You can take back control fast. In just 30 minutes, you’ll learn how to quickly audit your recurring payments, spot those forgotten subscriptions, and cancel the clutter that’s draining your budget. No fluff, no hours wasted—just practical steps that save you money and hassle right now. Ready to reclaim your cash and sanity? Let’s dive in!

Why Subscription Overload Happens

Ever feel like your bank statement is a never-ending list of charges you barely recognize? You’re not alone. Subscription overload is a common problem, sneaking up on many of us without warning. Why does this happen? Let’s break down the main culprits:

-

Free trials that auto-renew: Those tempting free trials can quickly turn into paid subscriptions if you forget to cancel in time. It’s easy to lose track when the clock is ticking and the payments start rolling in.

-

Auto-renewals everywhere: Services like streaming platforms, software, and fitness apps often auto-renew by default. Without regular audits, these recurring payments quietly drain your bank account month after month.

-

Impulse sign-ups: We all get caught up in the excitement of signing up for new apps, exclusive content, or special offers. Before you know it, you’ve added several subscriptions that you barely use.

-

Hidden costs and charges: Some subscriptions hide fees in the fine print or tack on extras you didn’t anticipate. These sneaky hidden subscription charges make it even harder to spot how much you’re really spending.

Understanding these common subscription traps is the first step to mastering how to manage recurring payments, cancel unused subscriptions, and avoid subscription creep in the future. Ready to take control? Let’s dive into your 30-minute subscription audit!

Your 30-Minute Subscription Audit Checklist

Tackling subscription overload doesn’t have to take all day. Here’s a simple 30-minute plan to help you cancel unused subscriptions and manage recurring payments like a pro.

Minutes 1-5: Gather Your Tools

Start by collecting everything you need: bank and credit card statements, email receipts, and any subscription tracker apps you use. Don’t forget to check your app store subscriptions too. Having this info on hand makes hunting down hidden subscription charges easier.

Minutes 6-15: Spot the Subscriptions and Categorize Them

Scan your statements and emails to spot every subscription—streaming services, software, gym memberships, and free trial auto-renewals. Create a quick list or spreadsheet to categorize them by type and note renewal dates. This forgotten subscriptions list helps you see where your money really goes.

Minutes 16-20: Evaluate What’s Worth Keeping

Ask yourself how often you’re actually using each service and if the cost justifies the value. Flag duplicate or overlapping subscriptions and take note of cheaper bundle options. This quick budget audit will highlight what’s draining your funds unnecessarily.

Minutes 21-30: Cancel the Clutter

Time to act. Use in-app settings, web portals, or your app store to cancel unwanted subscriptions. For tough cancellations, a direct call or knowledge of consumer laws can help. Look out for tools that speed up cancellations and don’t hesitate to request refunds on recently renewed services.

Following this checklist regularly helps you avoid subscription creep and save money on subscriptions. For extra tips on managing your recurring bills efficiently, check out our guide on plugging common money leaks for young adults.

Pro Tips to Avoid Future Overload

Avoiding subscription overload means staying proactive. Here are some easy yet effective ways to keep your recurring payments in check:

-

Set Calendar Reminders for Audits: Schedule a quick subscription audit every few months. Regular check-ins help catch forgotten subscriptions before they drain your budget.

-

Use Virtual Cards for Free Trials: Many banks offer virtual or temporary cards. Use these when signing up for free trial auto-renewals to prevent unexpected charges if you forget to cancel.

-

Opt for Bundles: Bundling services like streaming, software, or digital tools can cut costs and reduce the number of individual subscriptions you manage.

-

Use Subscription Tracking Apps: Apps designed to track monthly expenses and manage recurring bills make it simple to spot when subscriptions renew and suggest cancellations. For a reliable selection, check out our guide to budgeting apps that actually work.

By applying these tips, you’ll save money and avoid the stress of hidden subscription fees or free trial cancellations gone unnoticed. Regularly managing your subscriptions is key to preventing subscription creep and keeping your finances in control.

Real Savings Stories and Next Steps

Many people are shocked at how much they save once they tackle their subscription overload. Take Sarah, who discovered she was paying for three streaming services she barely used. After a quick subscription audit, she canceled two and saved over $40 a month—money she redirected toward paying off credit card debt. Then there’s Tom, who cut back on forgotten app store subscriptions and saved nearly $200 a year by bundling services instead.

These wins show how managing recurring payments with a simple subscription audit guide can quickly boost your budget. Ready to take control of your expenses? Start your 30-minute subscription audit today and stop those hidden subscription charges from eating away your money. Don’t forget to share your savings story—your experience might inspire others to save big too.

For more real-life saving tips and habits, check out these inspiring success stories of turning small changes into big financial wins.

Step 1: Gather Your Subscription Data (5 Minutes)

Start by collecting all your subscription information in one place. Quickly review your bank and credit card statements for recurring charges—these often reveal forgotten subscriptions or hidden subscription charges. Next, scan your email for receipts or renewal reminders from services you’ve signed up for, including those free trial auto-renewals that sneak up on you.

Don’t forget to log into your app stores (like Google Play or Apple’s App Store) where many subscriptions are managed directly. Some banks and apps even offer built-in tools to help track recurring payments, so use those if available. Exporting your statements into spreadsheets or using simple search functions can speed up identifying subscriptions before you dive into your audit.

This step sets the foundation for a thorough subscription audit guide by uncovering every recurring payment you might have missed. Staying organized early helps you save money on subscriptions and avoid surprise charges later on.

Step 2: Build a Quick Inventory List (5 Minutes)

Now that you’ve gathered your subscription data, it’s time to organize it fast. Open a simple spreadsheet or use a notes app to list each subscription. For every service, jot down:

- Service name (e.g., Netflix, Spotify)

- Monthly or yearly cost

- Last date you used it

- Next renewal date

Next, categorize them by type—streaming, software, fitness, hobby, etc.—to get a clear view of where your money goes. Calculate your total monthly and yearly spend to see the full impact on your budget. Don’t forget to highlight duplicates or overlapping services, like having multiple streaming platforms you rarely watch. This quick inventory acts as your personalized forgotten subscriptions list, making it easier to spot unnecessary recurring payments and hidden subscription charges.

By building this clear overview, you’re setting yourself up for a smooth subscription audit and cancellation process ahead. For more budgeting tips and ways to track monthly expenses effectively, check out this lifestyle finance guide for practical advice.

Step 3: Evaluate Value and Decide What Stays (10 Minutes)

Now that you have your subscription list ready, it’s time to evaluate each service’s value. Ask yourself some key questions: How often do I use this? Does it provide enough benefit for the cost? Are there similar subscriptions overlapping? If the answer is rarely or no, flag those subscriptions as unused or redundant.

Focus on cutting down on duplicates and overlapping subscriptions—like having more than one video streaming service you barely watch. This step helps you spot where you can save the most by canceling extras or switching to bundle deals, which often lower your overall spend significantly.

Prioritize keeping subscriptions that offer the best mix of value and usage, especially those that support your goals, such as budgeting or investing wisely. You might want to read up on smart money strategies like diversification to put your saved subscription fees to good use for financial growth. For instance, learning about diversification and owning multiple stocks could inspire where to direct your savings next.

By the end of these 10 minutes, you should have a clear sense of which subscriptions are truly worth keeping and which ones are just draining your wallet without much benefit.

Step 4: Cancel Unwanted Subscriptions Swiftly (10 Minutes)

Once you’ve decided which subscriptions to cut, act fast to stop recurring charges. Most services let you cancel directly through app settings, web portals, or your app store subscriptions page—this is usually the quickest way. For streaming service cancellations or other digital services, check their cancellation policy to avoid auto-renewal traps or hidden charges.

If a subscription is tricky to cancel online, don’t hesitate to call customer support—sometimes a quick phone call solves what the website can’t. In certain cases, consumer protection laws might help you get refunds for unwanted renewals, so look into your rights if needed.

To speed up the process, use subscription tracking apps or cancellation tools that provide direct links and reminders, streamlining your unsubscribe tasks. These tools help avoid unnecessary delays and ensure you stay on top of all subscription cancellations without the hassle.

By cancelling unwanted subscriptions quickly, you’re not just cutting costs but also taking control over your financial wellness and reducing subscription overload effectively.

Potential Savings and Real-Life Examples

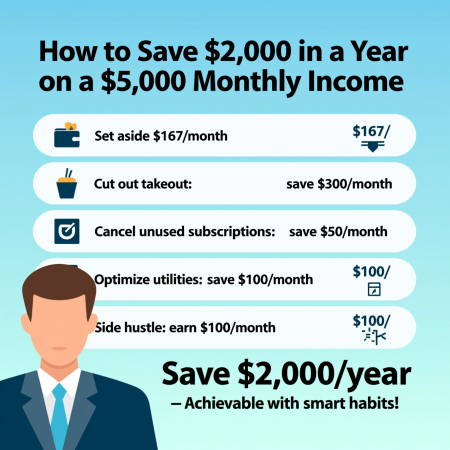

Tackling subscription overload can lead to surprisingly big savings, both monthly and yearly. Many people discover forgotten subscriptions to streaming services, apps, or digital tools they barely use—or don’t even remember signing up for. For example, one user cut $50 a month by canceling three underused streaming services and two fitness apps. Another saved over $300 annually by switching to bundled plans and stopping auto-renewals on free trials they never cancelled.

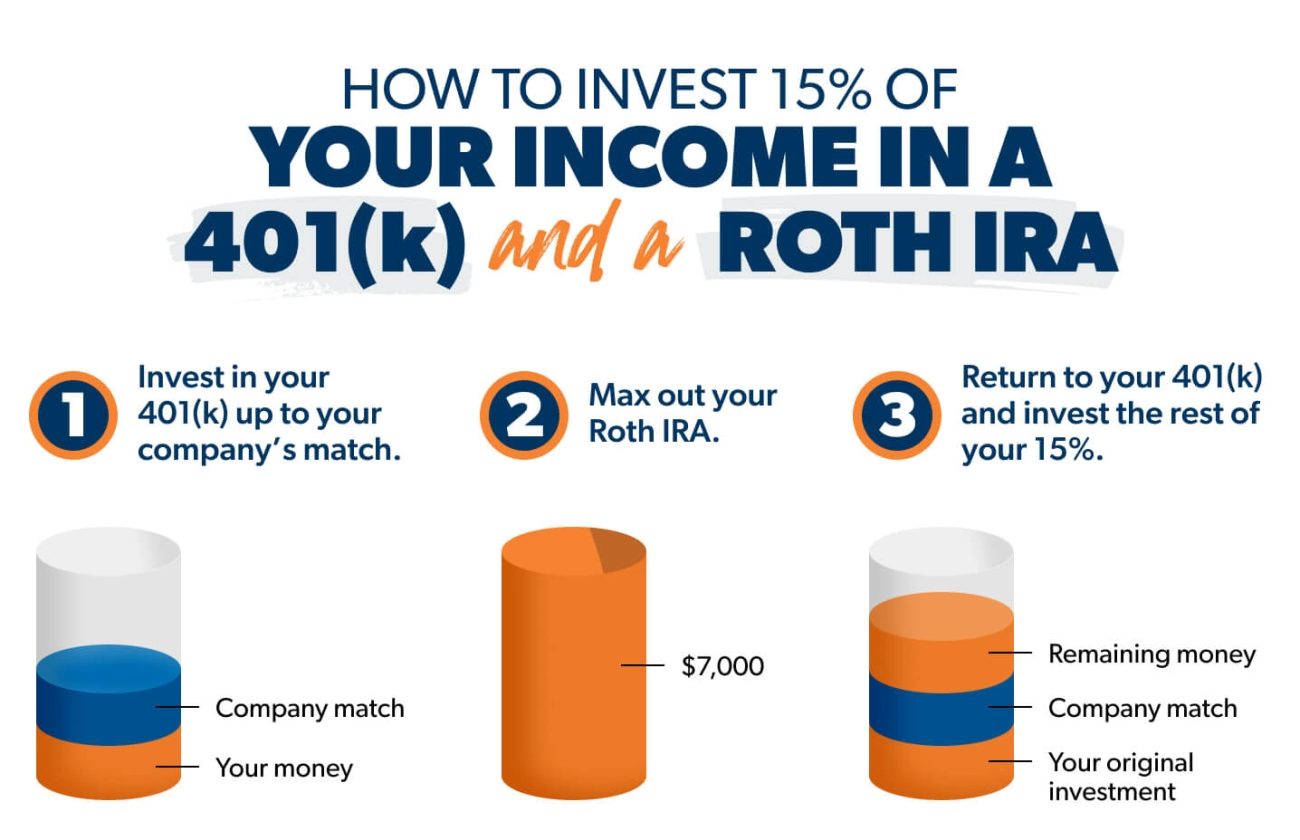

Redirecting these saved funds can make a real difference. You might choose to pay down debt faster, invest in retirement, or build an emergency fund. A quick subscription audit doesn’t just trim costs—it frees up cash for your financial goals. Plus, avoiding hidden subscription charges means you’re not leaking money without realizing it.

If you’re ready to save, start your audit today and share your wins. Small changes add up, and you can avoid subscription creep with smart tracking habits. For more ways to manage your finances and stick with savings, check out strategies on why the debt avalanche feels harder and how to stick with it and explore ideas on escaping broke but chic minimalist money in a high-spend era.

Prevention Strategies to Avoid Future Overload

Keeping subscription overload in check starts with smart habits. Here are key prevention strategies to manage recurring payments without stress:

- Set a subscription budget cap: Decide how much you want to spend monthly or yearly on services, and stick to it. Knowing your limit helps avoid creeping costs.

- Use renewal reminders: Set up calendar alerts or use subscription tracking apps to notify you before free trial auto-renewal or billing dates. This lets you review subscriptions before they renew and cancel if needed.

- Follow the ‘one in, one out’ rule: For every new subscription you add, cancel an old or less-used one. This keeps your managing list clean and your expenses steady.

- Schedule bi-annual audits: Mark your calendar to conduct subscription audits twice a year. Regular check-ups prevent forgotten subscriptions from draining your wallet over time.

By integrating these simple steps, you can significantly reduce hidden subscription charges and keep your monthly expense tracker accurate and lean. For more budgeting insights related to managing your finances, consider exploring practical strategies like the 3 budgeting methods for beginners that help control your spending overall.

Recommended Tools and Apps for Subscription Management

To effectively manage recurring payments and avoid subscription overload, using the right tools can make all the difference. Here are some popular subscription tracking apps and services, both free and paid, that help you spot forgotten subscriptions, monitor costs, and streamline cancellations:

Free Options:

- Truebill (now Rocket Money): Tracks subscriptions linked to your bank accounts and alerts you to upcoming renewals. It also helps cancel unused services quickly.

- Bobby: A simple app focused on tracking monthly expenses by subscription type, ideal for a quick budget audit.

- TrackMySubs: Designed for freelancers and small businesses, it monitors recurring payments and sends renewal reminders.

Paid Options:

- Trim: Beyond tracking, Trim negotiates bills on your behalf and offers personalized saving recommendations.

- Subby: With features for categorizing subscriptions, tracking usage, and detailed reports, it fits well if you handle many services.

- YNAB (You Need A Budget): While primarily a budgeting app, it excels at managing recurring bills and setting subscription budget caps.

What to Look for in Subscription Tracking Apps

- Ease of use: Simple interfaces save time during your quarterly subscription review.

- Automatic detection: Apps that link with your bank accounts catch hidden subscription charges without manual input.

- Renewal reminders: Alerts before free trial auto-renewal dates help avoid surprise charges.

- Cancellation assistance: Direct links and guidance to cancel services reduce friction in subscription detox efforts.

- Cost: Free plans work well for light users; paid services often offer better integrations and customer support.

Using dedicated subscription tracking apps alongside built-in banking tools gives you a clearer picture to reduce subscription costs and avoid streaming service overload.

For more on managing recurring bills and optimizing your expenses, check out this detailed guide on expense ratios and how they can cost you to keep an eye on where your money truly goes.