Choosing between a 401(k) vs Roth IRA can feel overwhelming—especially when considering which fits best at your current life stage. The truth is, your age, income, and retirement goals play a huge role in deciding the ideal retirement account. Whether you’re just starting out, climbing the career ladder, or nearing retirement, understanding the tax benefits, contribution limits, and withdrawal rules of each option can set you up for long-term success. In this post, you’ll discover the key differences and practical advice to help you pick—or even combine—the right accounts for your unique financial journey. Let’s jump in!

Understanding the Basics: Traditional 401(k), Roth 401(k), and Roth IRA

When planning for retirement, it’s important to understand the key differences between a Traditional 401(k), Roth 401(k), and Roth IRA. Each of these accounts offers unique benefits depending on your current tax situation, income, and life stage.

What are they?

- Traditional 401(k): An employer-sponsored retirement plan allowing pre-tax contributions. This means the money you put in reduces your taxable income now, and taxes are paid when you withdraw funds in retirement.

- Roth 401(k): Also employer-sponsored, but contributions are made with after-tax dollars. You don’t get a tax break today, but qualified withdrawals in retirement are tax-free.

- Roth IRA: An individual retirement account funded with after-tax money, available regardless of employer. Like the Roth 401(k), qualified withdrawals grow tax-free.

Tax advantages explained

- Traditional 401(k) contributions are pre-tax, lowering your current taxable income, and grow tax-deferred—you pay taxes upon withdrawal.

- Roth 401(k) and Roth IRA contributions are after-tax, meaning you pay taxes upfront, but your investments grow tax-free, and withdrawals in retirement are completely tax-free.

Who can open these accounts?

- Traditional and Roth 401(k)s are employer-sponsored, available only if your job offers these plans.

- Roth IRAs are individual accounts you open yourself, giving you more control and flexibility regardless of your employment situation.

Understanding these basics is the first step to choosing the best retirement account for your needs. The good news is, you can start small and adjust your strategy as your career and life evolve!

Key Differences Between 401(k) Plans and Roth IRAs

When comparing a 401(k) and a Roth IRA, several important differences stand out:

| Feature | 401(k) | Roth IRA |

|---|---|---|

| Contribution Limits (2026) | Up to $23,500 + catch-up ($7,500) for age 50+ | $7,000 + $1,000 catch-up for 50+ |

| Employer Match | Yes, many employers offer matching contributions | No employer match |

| Income Limits | None for Roth 401(k); Traditional 401(k) allows all incomes | Roth IRA phases out starting at $138,000 (single) and $218,000 (married) |

| Investment Options | Limited to employer’s plan offerings, often lower fees | Wide range of investments, subject to brokerage fees |

| Withdrawal Rules | Penalties for early withdrawal before 59½; Required Minimum Distributions (RMDs) start at age 73 | Contributions can be withdrawn anytime penalty-free; No RMDs during lifetime |

| Tax Treatment | Pre-tax contributions (Traditional 401(k)); Roth 401(k) offers after-tax | After-tax contributions; tax-free growth and withdrawals |

One major advantage of Roth IRAs is flexibility: you can withdraw your contributions anytime without penalties, which is not the case with most 401(k) plans. Meanwhile, 401(k)s often benefit from employer matching—a critical boost to savings that IRAs don’t offer.

Understanding these differences helps tailor your retirement strategy, especially when considering tax diversification and maximizing your savings through various life stages. For more on saving tactics, check out this guide on how to save $2,000 in a year on a $5,000 monthly income.

Pros and Cons of Each Account

When comparing the traditional 401(k), Roth 401(k), and Roth IRA, each account has its own advantages and drawbacks to consider.

Traditional 401(k)

- Pros: Contributions reduce your taxable income today, giving you an immediate tax break. Plus, many employers offer matching contributions, which is essentially free money toward your retirement.

- Cons: Withdrawals in retirement are taxed as ordinary income, and you must start taking required minimum distributions (RMDs) at age 73, which can limit flexibility.

Roth 401(k)

- Pros: Contributions are made with after-tax dollars, so withdrawals—including earnings—are tax-free in retirement. The higher contribution limits compared to Roth IRAs let you save more, and there are no income restrictions to qualify.

- Cons: You don’t get an upfront tax deduction, meaning no immediate tax relief. Also, investment options are often limited to what your employer’s plan offers.

Roth IRA

- Pros: Offers tax-free growth and withdrawals, and unlike 401(k)s, Roth IRAs don’t require RMDs during your lifetime, providing more control over your money. You can also withdraw your contributions anytime without penalty, which adds flexibility.

- Cons: Contribution limits are lower, and income limits restrict who can contribute directly. This can limit how much high earners can invest.

Understanding these pros and cons helps you tailor your retirement savings strategy to your current financial situation and goals. For detailed tax benefits and how to leverage savings, check out this guide on why you need an emergency fund and how to build it.

How Life Stage Influences Your Choice

Your age and career stage play a big role in deciding between a 401(k) vs Roth IRA or blending both smartly.

Early Career (20s-30s):

You’re likely in a lower tax bracket now, so Roth options shine here—with tax-free retirement withdrawals looking attractive later. Focus on snagging your employer match through a 401(k) first, since it’s essentially free money. After that, topping up a Roth IRA can boost your tax diversification early on.

Mid-Career (40s-50s):

With income typically higher, it makes sense to max out your 401(k) contributions to take full advantage of employer matching and the higher 2026 limit ($23,500 plus catch-ups). If eligible, a Roth IRA can complement this by offering tax-free growth and withdrawal, giving you more control over future tax bills.

Pre-Retirement (50s-60s):

This is the time to use catch-up contributions (additional $7,500 for 401(k)s, $1,000 for Roth IRAs) to supercharge your savings. A shift toward Roth accounts can help ensure some tax-free income when you retire. It also helps mitigate required minimum distributions (RMDs) you’ll face in traditional accounts.

Approaching Retirement (60s+):

Focus shifts to smart withdrawal strategies, managing RMDs, and legacy planning. Roth IRAs stand out here because they have no RMDs and offer tax-free withdrawals, which can be a big advantage for leaving assets to heirs.

For those navigating these life stages, understanding how your retirement savings fit your current and future tax situation is key. You can explore more tailored strategies in retirement planning for beginners and how to balance employer match 401(k) benefits with Roth IRA flexibility.

Recommendations by Life Stage

Young professionals: If you’re just starting out, focus on your 401(k) first to capture any employer match—that’s free money you don’t want to miss. After locking that in, consider funding a Roth IRA for tax-free growth and more flexible withdrawal options down the road. This combo helps build a solid retirement foundation early in your career.

High earners: If your income exceeds Roth IRA limits, a Roth 401(k) is a smart choice. It lets you bypass those income restrictions while still enjoying tax-free retirement withdrawals. Plus, you can contribute more each year compared to a Roth IRA, giving you greater savings power.

Self-employed or no employer plan: Without access to a 401(k), your best bet is to prioritize a Roth IRA. It offers flexibility, tax-free growth, and no required minimum distributions, making it ideal if you manage your own retirement savings.

When to use both: Combining a 401(k) and Roth IRA provides valuable tax diversification for retirement. Start by maximizing your employer match in the 401(k), then fund your Roth IRA to balance tax-deferred and tax-free accounts. This strategy gives you greater flexibility with withdrawals and tax management as your needs evolve.

For more on getting started with retirement savings, check out these budgeting methods for beginners that can help you free up money to invest wisely.

Contribution Limits and Rules for 2026

When planning your retirement savings, knowing the contribution limits for 2026 is key to maximizing your benefits. Here’s a quick breakdown:

- 401(k) limits: You can put in up to $23,500 this year. If you’re 50 or older, you get a catch-up contribution of $7,500, plus an additional “super catch-up” of $5,000 if you’re between 60 and 63 and your plan allows it.

- Roth IRA limits: You can contribute up to $7,000 annually, with a $1,000 catch-up for those aged 50 and above.

- Income phase-outs: Roth IRA contributions start phasing out at certain income levels — so if you earn too much, you might not qualify to contribute directly. However, Roth 401(k)s don’t have income limits, which is good news for high earners.

Tips for maximizing contributions

- Capture your employer match first in your 401(k). This is free money you don’t want to miss.

- Hit the Roth IRA limit if eligible. It offers tax-free growth and no required minimum distributions (RMDs), which is great for flexibility.

- Use catch-up contributions once you hit 50. This can seriously boost your retirement savings.

- Consider the super catch-up if you’re 60-63, especially for your 401(k) — not many know about this bonus.

- Keep track of income rules to avoid accidentally exceeding Roth IRA limits.

Understanding and using these retirement savings life stages rules can help you get the most out of your 401(k) and Roth IRA in 2026.

Strategies for Combining 401(k) and Roth IRA

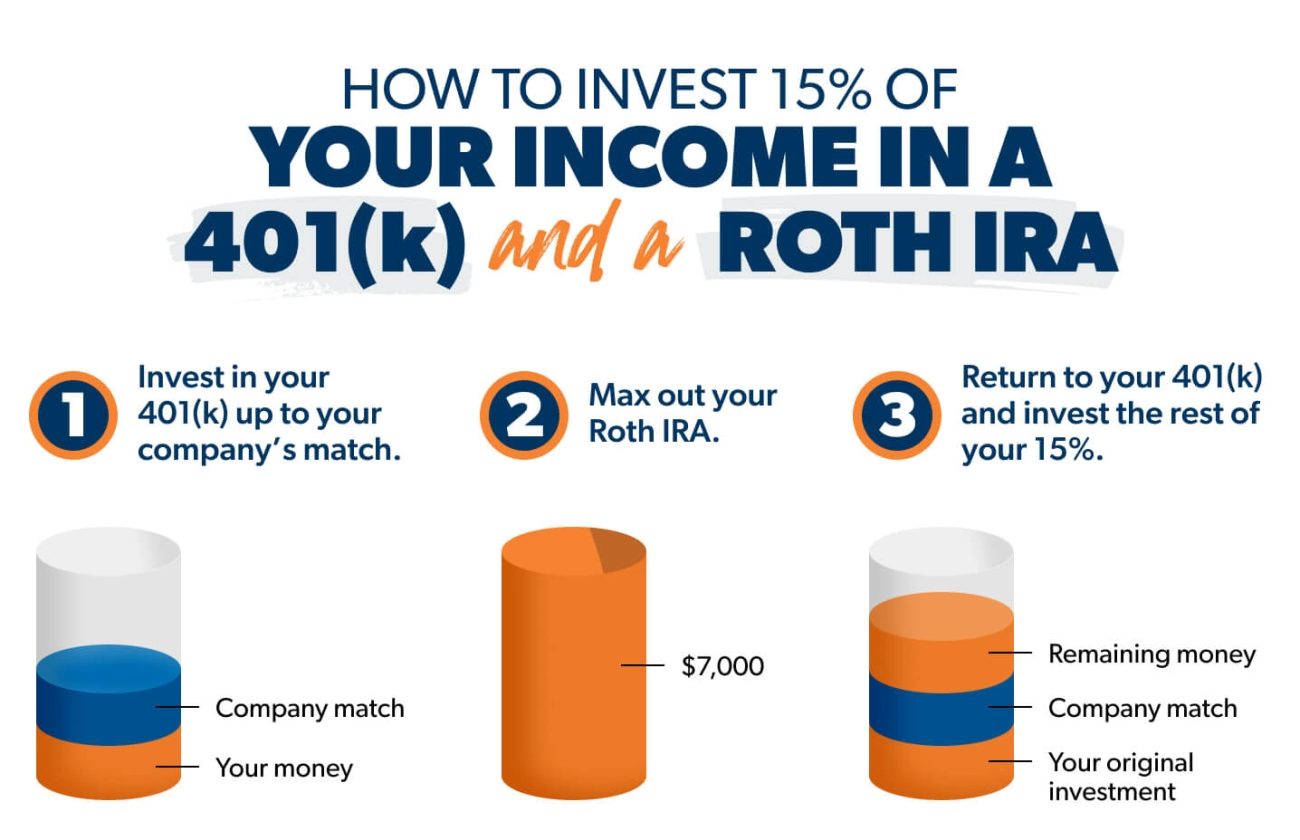

Combining a 401(k) and Roth IRA is a smart move to get the best of both worlds in retirement savings. Here’s how I usually approach it:

-

Prioritize Employer Match First

If your employer offers a 401(k) match, don’t miss out. Contribute enough to get the full match—it’s free money and a solid boost to your retirement nest egg.

-

Fund Your Roth IRA Next

Once you secure the employer match, I recommend maxing out your Roth IRA. You benefit from tax-free growth and withdrawals later, plus Roth IRAs have more flexible withdrawal options and no required minimum distributions (RMDs).

-

Max Out Your 401(k) Last

After your Roth IRA, if you still have extra to save, aim to max out your 401(k) contributions. This helps you save more overall and might reduce your taxable income if you’re contributing to a traditional 401(k).

Rollovers and Conversions to Optimize Savings

If you switch jobs or want to simplify accounts, consider rolling over an old 401(k) into a Roth IRA. This can trigger taxes upfront but sets you up for tax-free withdrawals later. Also, converting traditional 401(k) balances to a Roth 401(k) or Roth IRA can help with tax diversification, especially if you expect higher taxes down the road.

Tax Diversification Benefits

Tax diversification is key. By having both pre-tax (traditional 401(k)) and after-tax (Roth IRA or Roth 401(k)) accounts, you gain flexibility to manage your taxable income in retirement. This strategy helps hedge against future tax rate changes and lets you withdraw from the account that best fits your tax situation each year.

In short: grab your employer match, invest in a Roth IRA, then top off your 401(k). Use rollovers and conversions wisely to keep your retirement savings balanced and tax-smart.

Common Mistakes to Avoid

When choosing between a 401(k) vs Roth IRA, there are some common pitfalls that can cost you in the long run.

Ignoring employer matches

One of the biggest mistakes is passing up on employer matches in your 401(k). That free money is crucial—it’s like a guaranteed return on your savings. Always contribute enough to get the full match before funding other accounts.

Overlooking income limits or early withdrawal penalties

Roth IRA income limits can sneak up on you, especially if your salary grows. Make sure you stay within eligibility to avoid disallowed contributions. Also, be careful with early withdrawals; penalties can chip away at your savings if you take out funds before the rules allow, particularly in traditional 401(k)s.

Not adjusting strategy as life stage changes

Your retirement plan shouldn’t be “set it and forget it.” What works in your 20s might not be ideal in your 50s or 60s. Updating your approach based on your career stage helps you maximize tax benefits, contribution limits, and withdrawal strategies.

Avoiding these mistakes helps you get the most from your retirement savings and ensures that the right retirement account fits your life stage.