If you’re a freelancer feeling that pang of worry because you don’t have a 401(k) through an employer, you’re far from alone. Without those automatic paycheck deductions and matching contributions, building a solid nest egg can feel daunting. But here’s the good news: retirement savings for freelancers don’t have to fall by the wayside. In fact, self-employed retirement plans like the Solo 401(k), SEP IRA, and Roth IRA for freelancers can actually give you powerful, tax-advantaged tools to grow your wealth on your own terms. Ready to learn exactly how to save for retirement without an employer plan? This guide breaks down your best options, contribution limits, and simple steps to start building lasting financial security — no confusing jargon, just straight-up strategies designed for your unique freelance lifestyle. Let’s get you set up to retire comfortably, even without a traditional 401(k).

Why Freelancers Often Fall Behind on Retirement Savings (and How to Flip the Script)

If you’re a freelancer, you’ve probably noticed how saving for retirement can quickly fall off your priority list. It’s easy to see why: irregular income, feast-or-famine cash flow, and the lack of automatic payroll deductions all create real challenges. Unlike traditional workers with steady paychecks and employer-sponsored plans, freelancers face unique hurdles that often lead to falling behind on retirement savings.

Common obstacles freelancers face:

- Irregular income: Some months are great, others dry. This unpredictability makes consistent saving tough.

- Feast-or-famine cash flow: When money flows in bursts, it’s tempting to focus only on immediate expenses rather than long-term goals.

- No automatic payroll deduction: Without an employer to withhold contributions automatically, it’s all on you to remember and prioritize saving.

But here’s the hard truth: waiting to save wastes the power of compound interest. For example, if you start saving $500 a month at age 30, you could end up with more than double the amount you’d have if you start at 40—simply because your money has more time to grow. Every year you delay is potentially thousands of dollars lost.

So, how do you flip the script? First, shift your mindset. Treat retirement savings like a non-negotiable business expense, just like paying for software or office rent. Consider it money you “owe” your future self.

By making retirement savings a fixed part of your freelance budget, you build security despite income ups and downs. It’s not just smart — it’s necessary to protect your financial future.

Ready to take control? Let’s explore the best retirement accounts designed specifically for freelancers and how to make your money work harder for you.

The Best Retirement Accounts for Freelancers & Self-Employed (2026 Rules)

Freelancers and self-employed professionals have several solid options for retirement savings without a traditional 401(k). Here’s a quick rundown of the top accounts in 2026:

Solo 401(k) / Individual 401(k)

Ideal if you’re a solo freelancer or independent contractor with no employees (other than a spouse). In 2026, you can contribute up to $22,500 as an employee, plus an employer contribution of 25% of your net self-employment income, maxing out at a total of $66,000. There’s also a Roth option if you want after-tax growth.

Pros: Highest contribution limits among self-employed plans, potential to take loans.

Cons: More paperwork and administrative steps than other options.

SEP IRA

The Simplified Employee Pension (SEP) IRA is easy to set up and perfect for those with irregular or high income. The 2026 contribution limit is 25% of your net self-employment earnings, up to $66,000. This plan suits freelancers who want flexibility without annual filing hassle.

SIMPLE IRA

This account works well if you have employees. The 2026 contribution limit is $15,500, plus a mandatory employer match of up to 3% of employee compensation. It has simpler administration than a Solo 401(k) but lower contribution limits.

Traditional & Roth IRA

Both IRAs let you contribute up to $6,500 in 2026. The Roth IRA has income phase-outs, meaning high earners might be excluded, but can still use a backdoor Roth strategy to get around this limit. These IRAs are great for supplementing your main retirement accounts or if you’re just starting to save. For a deep dive into types of IRAs and when to pick a Roth vs. Traditional option, check out this detailed guide on 401(k) vs. Roth IRA accounts.

Taxable Brokerage Accounts

If you’ve maxed out tax-advantaged accounts or want more flexible access to your money, a taxable brokerage account is the go-to. Use tax-efficient investments like ETFs and index funds to lower your tax bill. Also, tax-loss harvesting strategies can help offset gains and reduce taxes owed.

Health Savings Account (HSA) – The Triple Tax-Advantaged Wildcard

If eligible with a high-deductible health plan, an HSA lets you contribute pre-tax dollars, grow your savings tax-free, and withdraw funds tax-free for qualified medical expenses — even in retirement. This makes HSAs a powerful but often overlooked tool for freelancer retirement savings.

Choosing the right mix of these accounts depends on your income, goals, and whether you have employees. Combining accounts can help maximize tax benefits while growing your nest egg smarter and faster.

Step-by-Step Action Plan for Freelancers

Saving for retirement as a freelancer can feel overwhelming, but breaking it down into clear steps helps. Here’s a simple action plan to get your self-employed retirement savings on track:

1. Calculate Your Retirement Number

- Use the 25x rule: Multiply your expected yearly expenses in retirement by 25 to get your target savings.

- Or apply the 4% rule: Plan to withdraw 4% of your savings annually to cover expenses.

- Free online calculators can help you estimate this based on your personal goals.

2. Choose the Right Retirement Account(s)

Select accounts that fit your income and savings strategy:

| Account | Best For | 2026 Contribution Highlights |

|——————|——————————————|——————————————|

| Solo 401(k) | Freelancers with stable income | Up to $22,500 employee + employer match; Roth option available |

| SEP IRA | High earners with variable income | Up to 25% of net self-employment income |

| SIMPLE IRA | Freelancers with employees | $15,500 limit plus employer match |

| Traditional & Roth IRA | Lower earners or additional savings | $6,500/year, with income phase-outs for Roth IRA |

3. Set Up Automatic Monthly Transfers

Even small monthly contributions add up. Automate transfers to build consistent discipline, whether to a Solo 401(k), IRA, or taxable account. Automating your savings removes uncertainty and gets you saving without the hassle.

4. Prioritize Contribution Order

Stack your savings in this order for maximum tax benefit and growth potential:

- Max out employer-matched accounts (Solo 401(k) or SIMPLE IRA)

- Fund Roth or Traditional IRAs

- Add extra to taxable brokerage accounts if you’ve maxed out tax-advantaged plans

5. Review and Max Out Annually

Income varies, so revisit your contributions yearly, especially before tax deadlines. Increase amounts as your earnings grow to stay on track with your retirement goals.

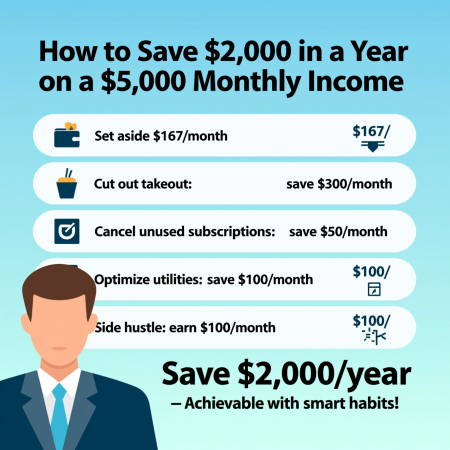

Following this plan helps independent contractors steadily build their nest egg without the structure of an employer plan. For more help on managing freelance income and expenses, check out how to save $2,000 in a year on a $5,000 monthly income.

Advanced Strategies for High-Earning Freelancers

If you’re a high earner freelancing without a traditional employer plan, there are some powerful strategies to boost your retirement savings beyond the basics.

-

Mega Backdoor Roth with a Solo 401(k): If your Solo 401(k) plan allows after-tax contributions, you can stash extra money beyond the standard limits and roll it into a Roth IRA. This is a smart way to maximize tax-free growth, especially if you expect to be in a higher tax bracket later.

-

Use Business Profits for Employer Contributions: As a self-employed individual, you can make employer contributions through your business profits, which can significantly increase your overall contributions to your Solo 401(k) or SEP IRA. This approach accelerates savings while lowering taxable income.

-

Combine Multiple Accounts Strategically: Having a mix of accounts—Solo 401(k), SEP IRA, Roth IRA, and even a taxable brokerage account—gives you flexibility in taxes and withdrawals. For instance, you can grow tax-deferred funds in retirement plans while using a taxable account for more accessible investments.

-

Tax-Loss Harvesting in Taxable Accounts: For taxable brokerage accounts, actively managing investments by selling losing positions to offset gains can reduce your tax bill. This technique can keep more money working for your retirement, especially if you’re regularly investing outside of tax-advantaged accounts. For beginner-friendly strategies on investment types suitable for taxable accounts, check out this guide to ETF vs. mutual fund investing.

Using these advanced tactics helps freelancers maximize retirement savings without relying on traditional employer plans, ensuring you’re making the most of your income and tax advantages.

Common Mistakes Freelancers Make (and How to Avoid Them)

Many freelancers fall behind on retirement savings because they wait for “a good year” to start putting money aside. The problem is, with irregular income and feast-or-famine cash flow, there’s rarely a perfect time. Starting small and consistent beats waiting for a windfall.

Another frequent mistake is ignoring the self-employment tax deduction. This can lead to overpaying taxes and leaving less cash available to fund your retirement accounts. Be sure to track deductible expenses carefully and use those savings to boost your contributions.

Not separating personal and business finances is also a big pitfall. Mixing these funds can confuse how much you’re truly earning and hinder accurate retirement savings calculations. Keeping accounts distinct helps you understand your actual net self-employment income, which is essential when planning how much to contribute to plans like the Solo 401(k) or SEP IRA.

Finally, many freelancers forget to increase their contributions as their income grows. It’s easy to stick with a fixed amount when starting out, but scaling your savings in line with income is crucial to ensure you’re maximizing tax-advantaged retirement accounts and avoiding falling behind on your goals.

To avoid these mistakes, treat your retirement savings like a non-negotiable business expense and review your contributions regularly. Doing so will keep you on track and help you build a secure financial future without relying on an employer plan.

For help with calculating your savings needs or tracking your finances, consider using free retirement calculators and bookkeeping apps designed for self-employed professionals. These tools make it easier to estimate your net income and plan contributions strategically.

Related reading: how starting investing early impacts your long-term wealth — it’s about the power of compound growth and smart timing.

Tools & Resources Recommended

When it comes to managing retirement savings for freelancers, having the right tools can make all the difference. Start with reputable, low-cost providers like Vanguard, Fidelity, and Schwab, as they offer a wide range of tax-advantaged retirement accounts with low fees—perfect for independent contractors looking to maximize their returns.

To plan effectively, use free retirement calculators to estimate your savings progress and retirement number. These calculators help you see how much to contribute regularly and the impact of compound interest over time.

Since freelancers often face irregular income and fluctuating expenses, bookkeeping apps that track your net self-employment income are invaluable. These apps simplify estimating your tax deductions and retirement contribution limits so you can stay on top of your finances. If you want tools that actually work for budgeting and saving, check out our detailed overview of 5 budgeting apps that actually work to keep your cash flow organized and ensure you’re consistently saving for retirement.

Combining these resources helps you commit to saving even when your income varies, making it easier to maximize contributions into your self-employed IRA options, Solo 401(k), or SEP IRA each year.