Unexpected expenses can hit at the worst times—car repairs, medical bills, or sudden job loss. That’s why having an emergency fund isn’t just smart; it’s essential for your financial security. In this guide, you’ll discover why you need an emergency fund and a simple, powerful way to build it in 3 steps—breaking down savings into easy actions that anyone can follow. Ready to stop worrying about money emergencies and start saving with confidence? Let’s get to it.

What Is an Emergency Fund?

An emergency fund is your personal financial safety net—money set aside specifically for unexpected expenses that you didn’t plan for. Unlike regular savings for vacations or planned purchases, this fund is strictly for real emergencies. Think of situations like sudden job loss, unexpected medical bills, urgent car repairs, or critical home maintenance. These are times when having emergency savings can make a huge difference.

It’s important to understand what an emergency fund is not. It’s not meant to cover everyday living costs like groceries or routine bills, nor is it for discretionary spending such as dining out or shopping sprees. The goal is to have a reliable cushion ready to protect you during true financial storms, offering peace of mind when life throws curveballs your way.

Why You Need an Emergency Fund

An emergency fund is your personal financial safety net. It provides peace of mind savings that help reduce stress during unexpected expenses like job loss, medical bills, or urgent home repairs. Without this buffer, you might rely on high-interest credit cards or loans, which can quickly spiral out of control.

Beyond avoiding debt, an emergency fund protects your long-term goals—such as retirement savings—from being raided when money gets tight. According to recent studies, nearly 4 in 10 Americans can’t cover a $400 emergency without borrowing or selling something, showing just how crucial a rainy day fund really is.

| Benefit | Life Stage Example | Why It Matters |

|---|---|---|

| Financial Security | Singles | Supports living expenses alone |

| Debt Avoidance | Families | Helps avoid expensive loans |

| Income Stability Backup | Self-employed | Covers income gaps during slow months |

| Stress Reduction | Those with unstable income | Provides peace of mind during uncertainty |

No matter your situation, an emergency savings account helps keep you on stable ground when life throws curveballs, giving you control and confidence.

For building a solid foundation, consider strategies on how to save more effectively with a proven budgeting system, like those explained in 3 budgeting methods for beginners.

How Much Should You Save in Your Emergency Fund?

A good rule of thumb is to save enough to cover 3-6 months of essential living expenses. This amount acts as a solid financial safety net to handle unexpected expenses like job loss, medical bills, or urgent home repairs without needing to rely on credit cards or loans.

Your personal target depends on several factors:

- Income stability: If your job or income is unpredictable, aim for the higher end of the range.

- Dependents: More people relying on you means more expenses to cover.

- Health: Medical needs or insurance costs should be factored in.

- Job market: Tough job markets call for bigger savings.

If you’re just starting out, set a starter emergency fund goal of $1,000. This smaller buffer is enough to cover minor emergencies while giving you peace of mind and a foundation to build on.

To calculate your personalized emergency fund amount, add up your monthly essentials:

- Housing (rent or mortgage)

- Utilities (electricity, water, internet)

- Food and groceries

- Insurance premiums

- Transportation costs (car payments, fuel, public transit)

Multiply this total by the number of months you want to cover. For freelancers or single-income households, lean toward saving more since income interruptions can be longer or less predictable.

Keeping your emergency fund in a liquid and low-risk account like a high-yield savings account or a money market account ensures quick access when it’s needed. For details on safe places to keep your fund, check out our guide on what is a money market fund.

Where to Keep Your Emergency Fund

When it comes to your emergency fund, liquidity and safety are key. The goal is to have quick access to your money when unexpected expenses arise, without risking loss. High-yield savings accounts and money market accounts are ideal places to keep your emergency savings because they offer both safety and decent interest rates, helping your money grow a bit while staying easily accessible.

Avoid putting your emergency fund in risky options like stocks or retirement accounts. Stocks can fluctuate a lot, and tapping into retirement funds early often means penalties and taxes, which defeats the purpose of having a financial safety net.

To strike the right balance between accessibility and discipline, keep your emergency fund separate from your everyday checking account. This helps reduce the temptation to spend it on non-emergencies while still allowing for easy transfers when needed. Automating transfers to your high-yield savings can also help you steadily build your personal finance buffer without thinking twice.

If you’re interested in safer places to park your savings beyond regular savings accounts, you might want to explore low-risk alternatives to stocks that can offer better liquidity and protection.

For reliable, easy-to-access emergency savings, always prioritize an emergency savings account that keeps your rainy day fund liquid and ready when life throws a curveball.

How to Build Your Emergency Fund in 3 Steps

Building an emergency fund doesn’t have to be overwhelming. Here’s a simple 3-step plan to get you started and keep you on track.

Step 1: Assess Your Situation and Set a Realistic Goal

Start by reviewing your current budget and monthly expenses. Calculate how much you need to cover essentials like housing, utilities, food, and insurance—this helps you define your personal emergency fund target. If aiming for 3-6 months of expenses feels too big right now, set a smaller starter emergency fund goal, such as $500 to $1,000, to provide a basic financial safety net.

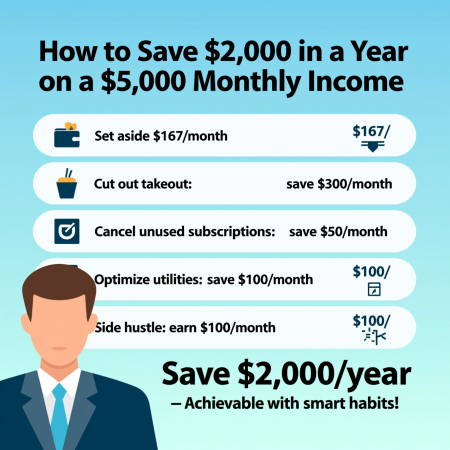

Step 2: Create a Savings Plan and Cut Expenses

Automate your savings by setting up regular transfers from your paycheck or checking account directly into a high-yield savings account dedicated to emergencies. To free up cash, look for ways to cut back on non-essential spending—cancel unused subscriptions, avoid impulse buys, or sell items you no longer need. You can also boost your emergency savings faster by directing tax refunds, work bonuses, or income from side gigs straight into this fund.

Step 3: Build Consistency and Monitor Progress

Make saving a habit by “paying yourself first”—treat your emergency fund contribution like a regular bill. Track how your fund grows each month and celebrate milestones to stay motivated. If you ever need to dip into your emergency savings, prioritize replenishing it as soon as possible. Also, revisit your goals regularly and adjust your target amount when your income or expenses change.

Following these steps creates a reliable emergency savings account that acts as your personal finance buffer against unexpected expenses. For more on managing your finances during changing economic conditions, check out insights on Fed rate cuts and what they mean.

Common Mistakes to Avoid When Building an Emergency Fund

When building your emergency fund, it’s easy to slip up if you’re not careful. Here are some common mistakes to watch out for:

-

Dipping into your fund for non-emergencies: Your emergency savings account is a financial safety net, not extra cash for everyday expenses or small wants. Using it for non-urgent spending defeats its purpose and leaves you vulnerable when a real emergency hits.

-

Keeping it in low-access or risky places: Your emergency fund needs to be liquid and safe. Avoid putting it in stocks or retirement accounts where you can face penalties or delays accessing money. High-yield savings accounts or money market accounts are better options for easy access and steady growth.

-

Ignoring inflation and not earning interest: Letting your emergency fund sit in a low-interest checking account can erode your buying power over time. Choose options that earn interest so your savings grow and keep pace with inflation.

-

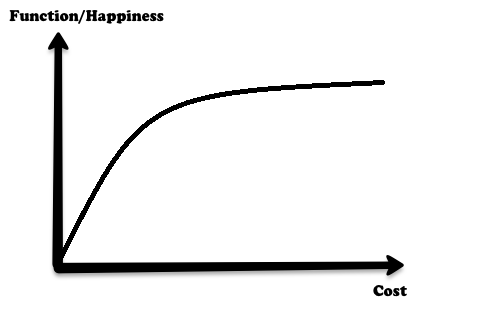

Giving up if progress feels slow: Building a solid personal finance buffer takes time. Don’t get discouraged if it feels like you’re saving too slowly. Consistency and small, steady contributions will add up and give you peace of mind savings in the long run.

Avoiding these mistakes will keep your emergency fund strong and ready for whatever life throws your way.

Maintaining and Using Your Emergency Fund Wisely

Your emergency fund is a financial safety net meant for true emergencies only. Use it strictly for unexpected expenses like job loss, sudden medical bills, or urgent home repairs—not for everyday spending or non-essential purchases.

After you tap into your emergency savings account, make rebuilding it a priority. Set a plan to replenish the fund as soon as possible to keep your personal finance buffer strong. This helps avoid falling back on credit card debt or loans with high interest.

Over time, review your emergency fund regularly. As your income grows or your expenses change, adjust the amount you save. Increasing your rainy day fund ensures it keeps pace with your life and provides ongoing peace of mind savings.

Remember, keeping liquidity for emergencies means the fund should be easily accessible but separate from your daily accounts—to help resist the urge to spend it casually. This way, your emergency fund stays ready when you actually need it most.