Why Budgeting Matters If You’re Starting From Scratch

Starting from scratch with your finances can feel overwhelming, especially if you’re living paycheck-to-paycheck or constantly caught off guard by unexpected expenses. These are common signs that you’re ready to start budgeting:

- Struggling to cover bills before your next paycheck

- Surprise costs wrecking your plans

- No clear picture of where your money goes

Budgeting for beginners is not about strict rules or giving up everything you enjoy. Instead, it’s a smart way to take control, reduce stress, and build a better future. Here’s what budgeting can do for you:

| Benefits of Budgeting | What It Means for You |

|---|---|

| Reduced Stress | No more guessing if money will last |

| Faster Debt Payoff | Allocate cash to shrink what you owe |

| Emergency Fund Growth | Build a safety net for life’s surprises |

The biggest mindset shift? Budgeting isn’t a restriction—it’s empowerment. It shows you exactly where your money goes and helps you make it work for YOU. When you start budgeting, you’re not limiting freedom; you’re unlocking it.

Step 1: Get Clear on Your Current Finances

Before diving into any budgeting for beginners, it’s essential to get a clear picture of where your money is coming from and where it’s going. Start by calculating your monthly take-home income—this is the money you actually bring home after taxes and deductions.

Next, track your expenses for at least 1 to 3 months. Use bank statements, receipts, or budgeting apps to capture everything. This helps you spot exactly how much you spend and on what.

Once you have your spending data, categorize it into three simple groups:

- Needs: Essentials like rent, utilities, groceries, and transportation.

- Wants: Non-essentials such as dining out, entertainment, and shopping.

- Savings/Debt Payments: Money put toward emergency funds, investments, or paying off debt.

By sorting your spending this way, you’ll identify “leaks” — areas where you might be overspending — and quick wins you can tackle immediately. For example, cutting back on subscription services or cooking at home more often can free up cash right away.

Getting this clarity sets a solid foundation for your budgeting journey and helps you stop living paycheck to paycheck faster. Tracking expenses easily through apps or simple spreadsheets makes this step much less painful and more revealing.

Once you’re confident about your finances, you’re ready to apply one of the best budgeting methods for beginners and start building your financial freedom step by step.

The 3 Best Budgeting Methods for Beginners

Method 1: The 50/30/20 Rule – Simple and Flexible

One of the easiest budgeting methods for beginners is the 50/30/20 rule. It breaks your monthly take-home pay into three clear categories:

- 50% for needs: essentials like rent, utilities, groceries, and transportation

- 30% for wants: dining out, entertainment, hobbies, and non-essentials

- 20% for savings and debt payoff: building an emergency fund, investing, or paying off loans

This method is perfect for beginners because it keeps things simple and flexible without tracking every single expense. You don’t have to be a spreadsheet expert, and it’s easy to adjust according to your lifestyle.

How to Apply the 50/30/20 Rule Step-by-Step

- Calculate your monthly take-home income.

- Multiply by 50%, 30%, and 20% to find your spending limits in each category.

- Track your expenses over a month to see how they fit those percentages.

- Adjust by cutting back on wants or increasing savings as needed.

Real-Life Example

If you bring home $3,000 each month:

- $1,500 goes to needs

- $900 goes to wants

- $600 goes to savings and debt

If you notice needs are over 50%, maybe you can save by switching to cheaper utilities or negotiating bills, freeing up more for savings.

Pros and Cons

Pros:

- Easy to understand and follow

- Encourages a balanced approach to spending and saving

- Flexible enough to fit most lifestyles

Cons:

- May be hard to stick to if your income is very low or irregular

- Some expenses don’t fit neatly into one category

- Needs careful tracking if you want to optimize savings

Adjustments for Low Income

If your income is tight, prioritize essentials and savings first. The 50/30/20 rule is a guide, not a strict law—feel free to adjust to something like 60/20/20 or 70/10/20 temporarily. The key is building positive budgeting habits that grow with your financial situation.

This simple budgeting method is a great starting point for anyone looking to stop living paycheck to paycheck and start building financial freedom. For more on saving strategies and debt management, be sure to check out guides on low-risk investing alternatives to make your money work smarter.

Method 2: Pay Yourself First – Prioritize Savings From Day One

The Pay Yourself First method is all about making savings your top priority, before spending on anything else. Instead of seeing savings as what’s left over, you automate putting money aside as soon as you get paid. This simple shift in mindset can fast-track building an emergency fund and paying down debt, even if you’re starting from scratch.

How to Set It Up

- Decide on a fixed amount or a percentage of your monthly income to save or use for debt payments first.

- Set up automatic transfers to a savings account or debt repayment plan right when your paycheck hits.

- Treat this like a non-negotiable bill to make it stick.

Building Habits and Emergency Funds Quickly

This method works well for beginners, especially if your income varies month to month. For example, freelancers or gig workers can save a portion every time they get paid, turning irregular income into consistent progress. Over time, these small, automated savings build up faster than you’d expect.

Example Scenario

If you earn $2,000 irregularly one month, setting aside just 15% ($300) into savings immediately means you’re steadily growing your emergency fund without feeling the pinch afterward. This also builds discipline, so you avoid spending what you don’t have.

Pros and Cons

- Pros: Automates savings, easy to follow, builds fast momentum, great for irregular incomes.

- Cons: Requires discipline to not dip into savings, may feel tight starting out if budget is tight.

Tips for Staying Motivated

- Set clear savings goals (like an emergency fund or debt payoff).

- Track your progress visually with apps or charts.

- Celebrate milestones to keep momentum going.

For more on handling variable income and making every dollar count, check out practical personal finance advice tailored for beginners here.

Method 3: The Envelope System (Cash or Digital) – Control Impulse Spending

The Envelope System is a simple, hands-on budgeting method that helps control impulse spending. Traditionally, you use cash envelopes for different spending categories—like groceries, entertainment, and dining out. You put a set amount of cash in each envelope at the start of the month. When the money in an envelope runs out, that’s it—you stop spending in that category until the next budget cycle.

Today, there are also digital envelope budgeting apps that do the same thing without carrying cash. These apps let you assign money into virtual envelopes and track spending in real time, making it perfect for those who prefer managing money on their phone.

How It Works

- Set up envelopes for your main spending categories.

- Put a fixed amount of money into each envelope at the beginning of the month.

- Spend only what’s in the envelope for that category.

- When the envelope is empty, pause spending in that area.

This visual, practical method is especially great if you’re a visual learner or someone who tends to overspend without realizing it. It makes budgeting tangible and clearly shows where your cash is going.

Example: Grocery and Entertainment Envelopes

- You assign $300 to your grocery envelope and $100 to entertainment.

- Once you’ve spent the $300 on groceries, you stop buying anything else food-related until the next budget period.

- For entertainment, when the $100 is gone, no more outings or streaming extras until you refresh your envelopes again.

Pros and Cons

Pros:

- Easy to understand and follow.

- Helps prevent overspending by setting clear limits.

- Great for controlling impulse buys.

- Digital versions sync with bank accounts for easy tracking.

Cons:

- Using cash envelopes can be inconvenient in a cashless world.

- Digital envelopes require familiarity with apps and tracking.

- May need discipline to not borrow from other envelopes.

Whether you stick with physical cash envelopes or go digital, the envelope budgeting system is a powerful way to take control of your spending and stop living paycheck to paycheck. It’s a straightforward tool that fits well with other budgeting methods, helping beginners build solid habits fast.

Comparing the 3 Budgeting Methods: Which One Fits Your Situation?

Choosing the right budgeting method depends on your income, goals, and personality. Here’s a quick comparison to help you decide which simple budgeting method suits you best:

| Method | Ease of Use | Flexibility | Tracking Required | Best For |

|---|---|---|---|---|

| 50/30/20 Rule | Easy | High | Moderate (monthly check) | Beginners with steady income |

| Pay Yourself First | Moderate | Medium | Low (automation helps) | Those focused on saving first |

| Envelope System | Moderate | Low to Medium | High (daily/weekly) | Visual spenders, impulse buyers |

How to Pick the Best One for You

- Steady income? The 50/30/20 rule works well since your earnings are predictable and you can split your budget easily.

- Struggle to save? Pay Yourself First forces savings automatically, so it’s great if building an emergency fund or paying down debt matters most.

- Impulse spender or prefer cash? The Envelope System helps control spending right at the source, useful if you need strict limits on categories like groceries or entertainment.

Mix and Match for a Hybrid Approach

You don’t have to stick to one method. Many beginners combine parts:

- Automate saving (Pay Yourself First) while using the 50/30/20 split for the rest.

- Use envelopes for tricky spending areas while tracking basics digitally.

Trying a hybrid budget lets you customize and find what really keeps you on track.

The key is to pick a method that feels manageable and fits your lifestyle. Remember, budgeting for beginners is about making money work for you, not the other way around.

Essential Tools and Apps to Make Budgeting Easy

Starting budgeting for beginners is much simpler when you use the right tools. Whether you prefer free or paid options, tracking your money becomes less of a chore and more of a habit.

Free and Paid Budgeting Apps

- Free apps: Mint, EveryDollar, and Goodbudget are great for tracking expenses easily without spending a dime.

- Paid options: You Need A Budget (YNAB) and PocketGuard offer more features like goal-setting and personalized advice, perfect if you want extra support.

Automation Tips

Automate wherever you can to keep your budget on track without extra effort:

- Set up direct deposits so your paycheck goes straight into your checking or savings account.

- Use automatic bill pay for regular expenses like rent, utilities, or subscriptions to avoid late fees and stress.

- Automate transfers to your emergency fund or debt payments to pay yourself first without thinking about it.

Building and Protecting an Emergency Fund

An emergency fund is your safety net, so use budgeting apps to track your progress. Set a clear monthly savings goal and watch your fund grow automatically. Protect it by keeping the fund in a separate savings account to avoid the temptation to spend.

Using these essential tools and apps makes personal finance for beginners manageable, helping you build habits that lead from living paycheck to paycheck to true financial freedom.

Common Beginner Mistakes and How to Avoid Them

When you’re just starting with budgeting for beginners, it’s easy to slip into some common traps. Here’s what to watch out for and how to stay on track:

-

Setting Unrealistic Goals

Don’t aim for perfect savings or zero spending right away. Start with small, achievable targets. Realistic goals keep you motivated and prevent burnout.

-

Forgetting Irregular Expenses

Things like car repairs, birthdays, or annual subscriptions can throw your budget off. Track these irregular costs by estimating them monthly and setting aside a bit each paycheck.

-

Not Reviewing or Adjusting the Budget

Life changes, and so does your money situation. Make it a habit to review your budget monthly. Adjust your spending categories and savings to stay realistic and effective.

-

Giving Up After Setbacks

Unexpected expenses or slip-ups happen. Instead of quitting, tweak your budget and keep going. Persistence is key to moving from broke to banked.

Avoiding these beginner mistakes will help you build steady financial habits and make budgeting less stressful. Remember, budgeting apps and tracking tools can make this easier and keep you accountable.

Building Long-Term Habits: From Broke to Banked

Budgeting for beginners is just the start. To go from broke to banked, you need to build strong, long-term habits that stick. Here’s how to keep your progress steady and stress-free.

Track progress every month

Set a simple routine to check your budget and expenses monthly. This helps you see where your money goes, spot any leaks, and celebrate small wins. Tracking keeps you honest and motivated.

Celebrate wins, big and small

Did you pay off a bill? Add to your emergency fund? Treat yourself—even modest rewards boost your motivation and make budgeting feel less like a chore.

Adjust as life changes

Your income, expenses, and goals won’t stay the same forever. Update your budget when you get a raise, face new costs, or decide to save for something different. Flexibility is key.

Next steps for financial freedom

Once your budgeting habits are solid, it’s time to level up:

- Start focused debt payoff strategies like the snowball or avalanche method to chip away at what you owe.

- Look for ways to increase your income, whether it’s freelancing, asking for a raise, or starting a side gig.

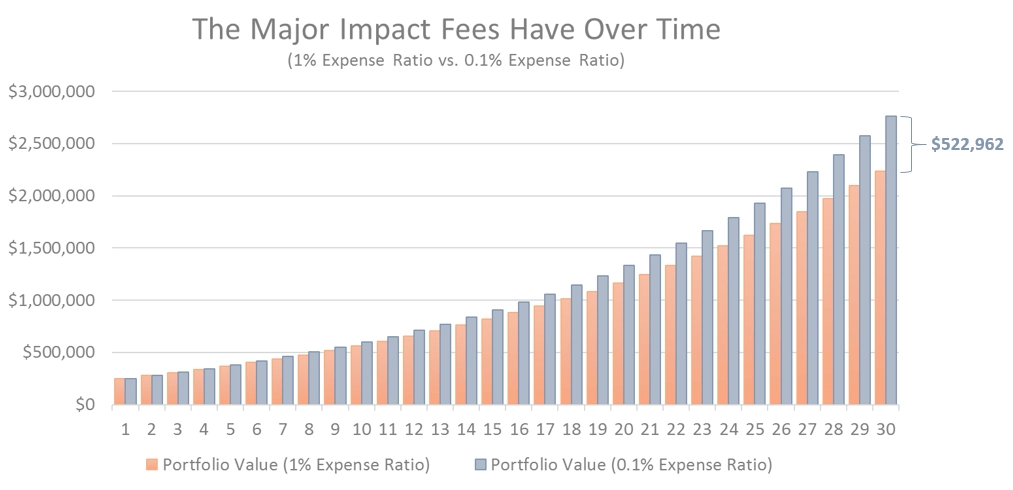

- Begin with investing basics to grow your money over time, even with small amounts. Use simple, low-cost options like index funds or retirement accounts.

By staying consistent with these habits, you’ll move from just getting by to building true financial freedom, one smart step at a time.