What Is an Expense Ratio?

An expense ratio is the annual cost you pay to invest in a mutual fund or ETF, expressed as a percentage of the fund’s total assets. Simply put, it shows how much of your investment goes toward the fund’s operating expenses every year.

How It’s Calculated

The formula is straightforward:

Expense Ratio = (Total Operating Expenses ÷ Average Fund Assets) × 100

For example, if a fund charges $970 in fees annually and manages $100,000 in assets, the expense ratio would be:

$970 ÷ $100,000 = 0.0097, or 0.97%

This means you pay $970 annually for every $100,000 invested.

What’s Included in the Expense Ratio?

The expense ratio covers several costs that keep the fund running smoothly:

- Management fees: Payments to the fund manager overseeing investments.

- Administrative expenses: Day-to-day operational costs like recordkeeping.

- 12b-1 fees: Marketing and distribution fees.

- Other costs: Custodian fees, legal fees, and sometimes shareholder services.

Gross vs. Net Expense Ratio

- Gross expense ratio represents the total operating costs before any fee waivers or reimbursements.

- Net expense ratio reflects the fees charged after discounts and waivers, which is often lower.

Knowing the difference helps you understand the true cost of your investment.

Understanding your fund’s expense ratio is crucial because these fees directly reduce your returns. Even seemingly small percentages like 0.97% can add up over time, quietly eating into your gains. Keeping an eye on these fund operating expenses ensures better control over your investment’s long-term growth.

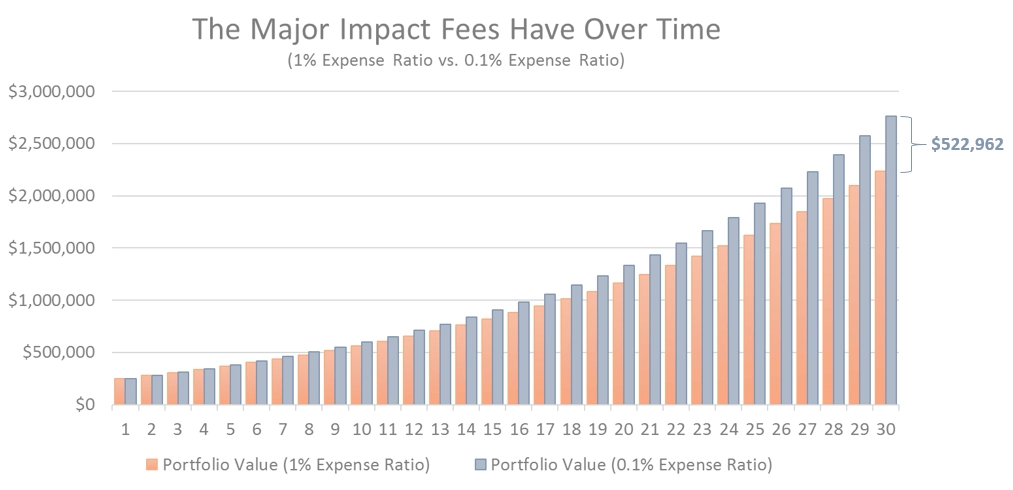

Why Expense Ratios Matter: The Power of Compounding

Expense ratios aren’t just small numbers on your fund statement—they have a big effect over time thanks to compounding. Think of compounding in reverse: every year, the fees you pay reduce your fund’s returns. This means the money lost to fees isn’t just gone; it also misses out on growing in future years, shrinking your overall investment growth.

For example, if your fund returns 7% annually but has a 0.97% expense ratio, your real return is closer to 6.03%. That might sound small, but over decades, this fee drag on returns can seriously cut into your retirement savings or long-term investments. The cost of mutual fund fees like these can quietly chip away at the power of compounding, leaving you with substantially less than you might expect after 20 or 30 years.

Understanding how expense ratios affect long-term investment fees is crucial, especially when planning for retirement. Even a seemingly minor difference in percentage points can mean tens of thousands of dollars lost in the end. This hidden investment cost emphasizes why keeping fees low is a smart move for building wealth steadily and efficiently. For example, automating your savings with the right low-cost investments can help avoid these unnecessary costs and maximize your nest egg growth over time.

The Hidden Cost: How 0.97% Can Cost You $100,000 (or More)

Let’s break down why a seemingly small expense ratio like 0.97% can quietly drain your investment over time. Imagine you start with $100,000 in a mutual fund that charges this high fee. Assuming a 7% average annual return before fees and you invest for 30 years, here’s what the difference looks like compared to a low-cost index fund with an expense ratio around 0.07%.

- High-fee fund (0.97%) after 30 years: About $550,000

- Low-fee index fund (0.07%) after 30 years: About $650,000

That’s a $100,000 difference just from fees eating into your compound returns!

Now, if you add realistic monthly contributions, say $500 each month for 30 years, the impact grows even larger. The higher fees could cost you upwards of $300,000 to $400,000 or more in lost retirement savings, due to the compounding cost of fees year after year.

| Investment Scenario | Expense Ratio | Ending Value (30 yrs) | Difference vs. Low-Cost Fund |

|---|---|---|---|

| Initial $100,000, no monthly add | 0.97% | $550,000 | -$100,000 |

| Initial $100,000 + $500/month | 0.97% | $1,100,000 | -$350,000 |

| Initial $100,000 + $500/month | 0.07% | $1,450,000 | — |

This example highlights the importance of keeping an eye on expense ratios. Over decades, what looks like less than 1% becomes a big hidden investment cost that can seriously hurt your retirement savings.

To get a better handle on how fees affect your portfolio growth, consider using free online calculators or tools found on websites like Morningstar or Vanguard. These resources make it easy to project the fee drag on returns and compare potential outcomes clearly.

For more practical tips on managing your money and savings, check out how to build an emergency fund in 3 steps or simple ways to save money on a moderate income. These strategies complement cutting down your mutual fund fees for a stronger financial future.

Active vs. Passive Funds: Where Expense Ratios Differ Most

Expense ratios vary significantly between active and passive funds, and this difference can have a big impact on your returns over time.

| Fund Type | Typical Expense Ratio Range |

|---|---|

| Active Funds | 0.67% – 1.00%+ |

| Passive/Index ETFs | 0.03% – 0.20% |

Why Do Active Funds Cost More?

Active funds charge higher expense ratios mainly because they involve:

- Research: Analysts and portfolio managers spend time selecting stocks or bonds.

- Trading Costs: Frequent buying and selling to try and beat the market.

- Management Fees: More hands-on management requires higher pay.

However, studies consistently show that most active funds fail to outperform the market after fees are taken into account. This fee drag on returns eats into your gains, especially over long periods.

Benefits of Low-Cost Passive Investing

- Lower Fees: Passive funds track an index, so they don’t need costly research or frequent trades.

- Better Long-Term Returns: By minimizing operating expenses, passive funds capture more of the market’s growth.

- Simplicity: Easier to understand and manage, ideal for everyday investors focused on retirement savings or long-term goals.

For those serious about minimizing mutual fund fees and maximizing returns, choosing low-cost index funds or ETFs is often the smarter route. This strategy leverages passive investing benefits without the hidden investment costs active funds rack up.

To explore more on fee impacts and index funds, check out our detailed low-risk alternatives to stock investing.

What’s a Good Expense Ratio? Benchmarks and Red Flags

When it comes to expense ratios, knowing the right benchmarks can help you avoid costly fund fees. For passive funds like index funds and ETFs, an expense ratio under 0.20% is generally considered ideal. These low-cost options tend to minimize the fee drag on returns, making them perfect for long-term investors focused on steady growth.

For active funds, a bit more leeway is acceptable, typically up to 0.75%, but only if the fund consistently delivers strong performance that justifies those higher costs. Many active funds charge more due to increased research and trading expenses, but keep in mind that most fail to outperform their benchmarks after fees are taken out.

Expense ratios over 1% are usually a red flag. Such high fees can eat away your retirement savings and significantly hurt long-term investment returns thanks to the compounding cost of fees over time.

The good news is industry competition is driving expense ratios down across the board, particularly for passive funds. Platforms like Vanguard and Schwab have pushed average costs lower, making it easier for everyday investors to find affordable funds. To check current trends and compare fees, resources like Morningstar or the FINRA Fund Analyzer can be very helpful.

By sticking to these benchmarks and carefully watching for red flags, you can minimize hidden investment costs and keep more of your money working for you.

How to Find and Compare Expense Ratios

Finding and comparing expense ratios is easier than you might think. Start by checking the fund prospectus or fact sheets, which clearly list the expense ratio and other mutual fund fees like 12b-1 fees and administrative costs. These documents are mandatory and easily accessible on the fund’s official website.

You can also use trusted websites like Morningstar, Vanguard, or the FINRA Fund Analyzer to quickly compare ETF expense ratios and mutual fund fees side-by-side. These platforms offer detailed breakdowns of fund operating expenses and highlight any hidden investment costs that could affect your returns long term.

To really understand how fees impact your investments, explore free online calculators that project the compounding cost of fees over time. By plugging in your initial investment, expected return, and different expense ratios, these tools show how much fee drag on returns can lower your final balance.

Here’s a simple step-by-step process to compare expense ratios:

- Identify funds you’re interested in and download their prospectuses or fact sheets.

- Note the gross and net expense ratios along with any additional fees.

- Use sites like Morningstar or FINRA to cross-reference these numbers.

- Input your investment details into an online fee impact calculator.

- Evaluate how fee differences affect your potential returns, especially for long-term goals like retirement.

This approach helps you make informed choices and avoid costly surprises, ensuring your retirement savings impact isn’t eroded by high fees. For practical budgeting tips to align your investments with your savings goals, check out useful strategies like those in 3 budgeting methods for beginners from broke to banked.

Strategies to Minimize Expense Ratios and Maximize Returns

Keeping your expense ratios low is one of the smartest moves you can make to grow your money faster. Here’s how to do it without breaking a sweat:

- Choose low-cost index funds and ETFs: These tend to have the lowest expense ratios, often below 0.20%. They track the market and avoid the heavy costs of active management, so more of your money stays invested.

- Switch from high-fee active funds when possible: Active funds usually charge between 0.67% and over 1%, eating into your returns. If you find a similar low-cost passive option, moving your money can save you thousands over time.

- Consider target-date funds or robo-advisors: These options balance your portfolio and offer low expense ratios, usually under 0.50%. They’re great for hands-off investors who want a simple, cost-effective solution.

- Rebalance periodically without extra costs: Keep your investments on track by rebalancing, but avoid triggering extra fees like trading costs or tax penalties. Look for platforms or funds that offer free or low-cost rebalancing.

By focusing on low-cost investing and avoiding hidden fees like 12b-1 fees and excessive fund operating expenses, you can reduce fee drag on returns and keep more of your money working for you in the long run. Remember, even a small difference in expense ratios can have a big impact on retirement savings or any long-term investment goals.