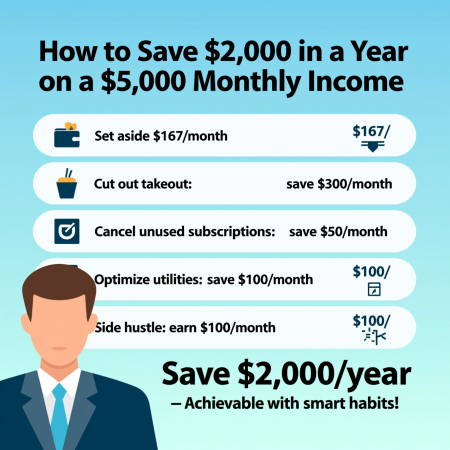

If you’re wondering how to save $2,000 in a year on a $5,000 monthly income, you’re in the right place. Saving that amount breaks down to just about $167 a month—totally doable without giving up everything you enjoy. Whether you want to build a solid emergency fund, pay off small debts, or just boost your financial confidence, I’ll show you smart, practical steps to stretch your paycheck, trim unnecessary expenses, and set up automated savings that work for you. Ready to make saving simple and stress-free? Let’s get started.

Assess Your Current Financial Picture

Before you can save $2,000 in a year on a $5,000 monthly income, start by understanding your true take-home pay. After taxes and benefits, your actual monthly income is often less than your gross salary. Calculate this net amount so you know exactly what you’re working with.

Next, track your spending for 1 to 2 months. Write down every dollar spent, whether it’s big or small, to spot where your money really goes. Many of us have “money leaks” — areas where overspending drains funds without us noticing. Common culprits include:

- Dining out frequently

- Unused or forgotten subscriptions

- Impulse purchases

To simplify this process, use free budgeting apps or spreadsheets to categorize and analyze your expenses. These tools help you clearly see which categories need trimming, making it easier to plan your monthly savings plan effectively.

Knowing your spending habits and take-home pay lays the foundation for better budgeting, so you can confidently move forward with saving smartly on your $5,000 salary.

Create a Realistic Budget Using the 50/30/20 Rule

A simple way to manage your money and save $2,000 in a year on a $5,000 monthly income is by using the 50/30/20 budget rule. This rule divides your take-home pay into three parts:

- 50% on needs: These are essentials like housing, utilities, groceries, transportation, and any minimum debt payments.

- 30% on wants: Things like dining out, entertainment, hobbies, and non-essential shopping.

- 20% on savings and extra debt payoff: This is where you build your savings and pay down debt aggressively.

On a typical take-home pay of about $3,800 to $4,200 (after taxes and benefits), allocate at least $167 to $200 each month toward your $2,000 savings goal. This fits nicely within the 20% savings guideline and makes the target manageable without drastic lifestyle changes.

Here’s a sample breakdown for $4,000 take-home income:

| Category | Amount |

|---|---|

| Needs (50%) | $2,000 |

| Wants (30%) | $1,200 |

| Savings (20%) | $800 |

You don’t need to stick rigidly to these numbers but use them as a starting point. Adjust your budget depending on your actual expenses and priorities. Remember, tracking your spending habits regularly will help you fine-tune your budget and find more room for savings.

Using budgeting apps or spreadsheets can keep your plan organized and provide a clear view of your monthly savings plan. For more tips on managing your money smartly, you might find insights from experts discussing high-yield savings accounts and personal finance budgeting useful.

Set Up Automatic Savings to Pay Yourself First

One of the easiest ways to save $2,000 in a year on a $5,000 monthly income is to pay yourself first by setting up automatic savings. Start by opening a high-yield savings account—this helps your money grow faster with better interest rates compared to regular checking accounts. Then, automate transfers to move about $167 each month or split it up into biweekly amounts right after payday to make saving feel seamless and stress-free.

To keep your progress clear and motivating, set up a separate savings account dedicated solely to your $2,000 goal. Watching that balance grow over time can boost your commitment and help you track your monthly savings plan without mixing it with your everyday spending. Automating this process removes the guesswork and builds a consistent habit, increasing your chance of success.

For more details on smart saving options, consider exploring resources on money market funds which can be another place to park your savings efficiently.

Cut Expenses in Key Categories Without Feeling Deprived

Saving money doesn’t mean you have to give up everything. You can trim your budget in smart ways that don’t leave you feeling deprived. Here are some straightforward tips for key areas:

| Category | Ways to Save | Estimated Monthly Savings |

|---|---|---|

| Groceries & Food | Meal plan, cook at home, buy sales items | $100–$200 |

| Housing & Utilities | Negotiate bills, use energy-efficient habits, consider roommates | Varies, potentially $50+ |

| Transportation | Carpool, use public transit, maintain your vehicle to avoid costly repairs | $30–$100 |

| Entertainment & Subscriptions | Cancel unused services, choose free or low-cost alternatives | $20–$50 |

| Shopping | Wait 30 days before buying non-essentials, buy generic or secondhand | $25–$75 |

Practical Tips to Cut Costs

- Groceries and food: Plan meals each week, cook more at home, and shop sales or bulk deals. This can save you $100–$200 monthly while improving your diet.

- Housing and utilities: Don’t hesitate to call service providers to negotiate lower rates. Small energy-efficient habits like turning off lights or reducing heating can lower bills. If possible, a roommate can cut housing costs significantly.

- Transportation: Carpooling or using public transit cuts gas and maintenance expenses. Regular vehicle maintenance avoids expensive repairs down the line.

- Entertainment and subscriptions: Review all your subscriptions—streaming, apps, magazines—and cancel those you rarely use. Look for free entertainment like community events or online content.

- Shopping habits: Before buying something non-essential, apply the 30-day waiting rule to avoid impulse buys. Switching to generic brands or shopping secondhand can deliver big savings without sacrificing quality.

These simple yet effective cuts can help you save more without tight sacrifices, fitting perfectly into your monthly savings plan. For more on negotiating bills or managing finances, check out advice on negotiating recurring bills to get better rates.

Find Small Ways to Reduce Daily Spending

Cutting small daily costs can add up fast when you’re trying to save $2,000 in a year on a $5,000 monthly income. Here are some easy ways to trim expenses without feeling pinched:

-

Coffee and Lunches: Brewing your own coffee at home or packing your lunch can save approximately $50–$100 a month. It’s a simple habit that reduces the usual daily spending and fits perfectly into any monthly savings plan.

-

No-Spend Challenges: Try setting specific days, weekends, or even a full week where you only spend on essentials. These challenges help break the cycle of impulse buys and put your frugal living strategies into action.

-

Negotiate Recurring Bills: Take time to review your insurance, internet, and phone plans. Often, you can get lower rates by calling providers and asking for discounts or switching to more affordable options.

By focusing on these small, daily adjustments, you boost your monthly savings without drastic lifestyle changes, making your goal to save money on a $60k salary much more doable.

Boost Your Income Slightly for Faster Progress

If saving $2,000 in a year feels slow, try boosting your monthly income a bit. Even adding an extra $100 to $300 each month can speed things up and make your savings plan easier.

Here are some simple ways to increase your income:

- Side gigs: Look into flexible options like delivery driving, freelancing, or doing online surveys. These can fit around your schedule and add steady cash.

- Sell unused items: Declutter your home and sell things you no longer need online. This one-time boost can jumpstart your savings.

- Take overtime: If your job offers extra hours, consider taking them to earn more without changing your routine.

- Direct windfalls to savings: When you get tax refunds, bonuses, or gifts, put that money straight into your high-yield savings account to keep your $2,000 goal on track.

By combining a slight income boost with your monthly savings plan, you’ll reach your target faster without stressing your budget too much.

Track Progress and Stay Motivated

Keeping an eye on your savings journey is key to hitting that $2,000 goal on a $5,000 monthly income. Set up monthly check-ins where you review your budget and spending. This helps spot any leaks or opportunities to tweak your plan. If you find expenses creeping up, adjust your monthly savings plan or cut back on wants.

Celebrate small wins to stay on track. Mark milestones like hitting $500 or $1,000 saved with simple, low-cost rewards—this keeps motivation high without breaking your budget. Use visual trackers like charts or budgeting apps to watch your savings grow. Seeing progress in black and white makes saving feel more real and encourages sticking to your 50/30/20 budget rule.

Consistency and visibility are your best tools—automate savings transfers and track spending habits to keep you focused. When saving money on a moderate salary, these habits help make frugal living strategies stick and keep your high-yield savings account growing steadily.

Avoid Pitfalls and Plan for the Long Term

Saving $2,000 in a year on a $5,000 monthly income is doable, but watch out for common mistakes that can slow you down. Lifestyle inflation is a big one—when your income grows, it’s tempting to spend more instead of saving more. Don’t skip automating your savings; if you rely on willpower alone, it’s easy to miss your goals.

Once you hit your $2,000 target, think bigger. Use that momentum to build a solid emergency fund covering 3 to 6 months of expenses. This gives you real financial security. Also, start socking money away for retirement, even if it’s a small amount.

If debt is holding you back, don’t hesitate to get help. Free credit counseling services can guide you through managing or paying down debt, which will help free up more money to save.

By avoiding these pitfalls and focusing on long-term goals, you’ll turn your $2,000 savings plan into a strong financial foundation.