If you’re juggling high-interest credit card debt or planning a big purchase, those enticing 0% APR offers might seem like the perfect solution. But are these introductory APR promotions a genuine way to save money, or just a clever trap that leads to more debt? In this post, we’ll cut through the marketing noise and give you a clear, balanced look at how these zero interest credit cards work—and whether they’re the right move for your finances. Ready to find out if 0% APR offers are your smart debt strategy or a costly risk? Let’s dive in.

How 0% APR Offers Work

0% APR offers are introductory credit card promotions designed to attract new customers by waiving interest on certain transactions for a limited time. These offers typically come in three types:

- 0% APR on new purchases: No interest charged on purchases made during the promo period.

- 0% APR on balance transfers: Transfers from high-interest credit cards to the new card incur no interest for the promotion length.

- 0% APR on both purchases and balance transfers: Combines the above benefits on new spending and transferred balances.

These promotional periods usually last between 12 to 21 months, giving cardholders an interest-free window to manage debt or finance purchases. However, once the promotion ends, the regular APR applies, often ranging from 17% to 28%, significantly increasing the cost of carrying a balance.

Key terms to watch include:

- Balance transfer fees, typically ranging from 3% to 5% of the amount transferred—an upfront cost that impacts savings.

- Minimum payments that must be made monthly to keep the offer valid.

- Eligibility requirements, which usually demand a good-to-excellent credit score to qualify.

Understanding these details helps you navigate 0% intro APR credit cards more confidently and avoid surprises that can turn an attractive deal into costly credit card debt consolidation challenges.

The Benefits: Why 0% APR Offers Can Be a Smart Move

0% APR offers on credit cards can save you a bundle if used right. Here’s why these introductory APR promotions often make sense:

- Huge interest savings: You can avoid the high interest charges that grow quickly on new purchases or existing balances. For example, paying off a $6,000 balance during a 0% period beats racking up interest at 17–28% APR.

- Faster debt payoff: The interest-free window gives you a clear timeline to plan your payments, helping accelerate paying down what you owe.

- Clear savings example:

| Scenario | Interest Rate | Interest Paid Over 12 Months | Notes |

|---|---|---|---|

| Using 0% APR on $6,000 | 0% | $0 | Save $600+ in interest* |

| Regular 20% APR | 20% | ~$600 | Typical high-rate accrual |

*Estimated, assumes carrying full balance without payoff

- Extra perks: Many zero interest credit cards also hook you up with rewards or sign-up bonuses after the promotional period—adding value beyond just saving on interest.

Using a 0% APR offer strategically can be part of a solid credit card debt consolidation plan, especially if you combine it with a disciplined repayment schedule. Just make sure you understand the terms and stay on track so these benefits aren’t overshadowed by pitfalls.

For more ways to manage your finances effectively, check out this guide on how to save $2,000 in a year on a $5,000 monthly income.

The Risks: How 0% APR Offers Can Become a Debt Trap

While 0% APR offers seem like a lifesaver, they can quickly turn into a debt trap if you’re not careful. Once the introductory period ends—usually between 12 and 21 months—the regular APR kicks in, often ranging from 17% to 28%. Any remaining balance suddenly starts accruing interest at this high rate, which can balloon your debt fast.

Common pitfalls include paying only the minimum, which barely chips away at your balance and extends your debt timeline. Many also fall into the trap of new spending on the card during the promo, which may not be covered by the 0% APR and racks up interest immediately. Forgetting the promo end date or missing a payment can void the offer entirely, causing retroactive interest charges on the entire balance.

Balance transfer fees, typically 3–5%, add upfront costs and can cut into your savings. Psychologically, the interest-free “breathing room” might encourage overspending or postponing repayments, making it harder to clear the debt once the promo ends.

Finally, applying for these offers means hard credit inquiries. Plus, transferring large balances can spike your credit utilization ratio, temporarily dinging your credit score. Knowing these risks ahead lets you plan smarter and avoid falling into common promotional APR pitfalls.

Pros and Cons at a Glance

When considering 0% APR offers, it’s important to weigh the benefits against the drawbacks to decide if they fit your financial goals.

Pros:

- Interest-free period: You can make purchases or transfer balances without paying interest during the introductory APR promotions, which can save you a lot on high interest credit card debt.

- Debt consolidation: Balance transfer offers let you combine multiple debts into one card, making repayment simpler and often cheaper.

- Potential rewards: Some zero interest credit cards come with perks like sign-up bonuses or ongoing rewards, adding extra value beyond the no interest financing.

Cons:

- Fees: Balance transfer fees (usually 3–5%) add upfront costs and can eat into your savings.

- High ongoing APR: After the promo ends, regular APRs often jump to 17–28%, which can cause debt to balloon if you don’t pay off the balance in time.

- Strict terms: Minimum payments, eligibility requirements, and rules around promo use can be tough to navigate.

- Temptation to accumulate more debt: The “breathing room” of zero interest can encourage overspending or delaying repayment, turning what seemed like a smart move into a debt trap.

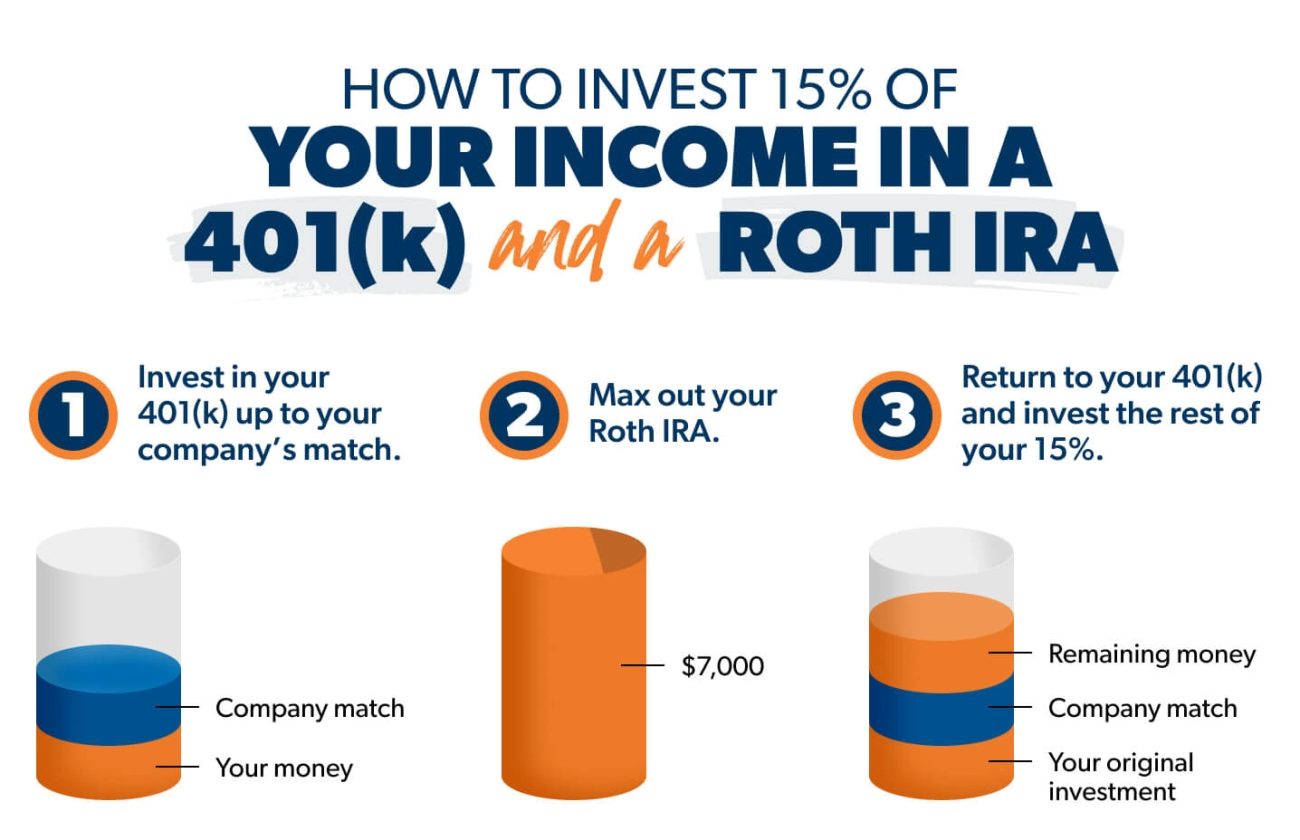

Understanding the pros and cons helps you use 0% intro APR credit cards wisely and avoid common promo APR pitfalls. For a more detailed look at managing your money mindset alongside such offers, check out these helpful psychology hacks for consistent investing.

Real-Life Examples and Scenarios

Using a 0% APR offer effectively often comes down to discipline and planning. For example, Sarah transferred a $6,000 balance from a high-interest card to a zero interest credit card with an 18-month introductory APR promotion. She created a budget to pay off $333 each month, clearing her debt before the promo ended. This smart move saved her hundreds in interest and boosted her credit score by reducing overall utilization.

On the flip side, consider Tom’s story. He transferred $5,000 but only paid the minimum payments during the 12-month promo. When the 0% period ended, the remaining balance was hit with retroactive interest at a high APR—turning his debt into a costly trap. This example highlights how quickly deferred interest traps can emerge if you don’t keep to a strict payoff plan.

Calculator Tip: How to Figure Out Monthly Payments

To avoid surprises, calculate your monthly payment to clear the balance before the promo ends:

- Divide the total balance by the number of months in the 0% introductory APR period.

- Add a small buffer for any unexpected expenses or fees.

- Stick to this amount or pay more to ensure full payoff and avoid interest charges.

Planning this way ensures you make the most of balance transfer offers without falling into common pitfalls.

For more on managing your finances and avoiding overspending, check out guides on stopping revenge spending and creating a credit card repayment plan.

When 0% APR Offers Are Worth It

0% APR offers can be a powerful tool when used right, but they’re not for everyone. They’re most worthwhile if you’re transferring high-interest debt and have a clear, realistic plan to pay it off before the promo ends. This could mean dividing your balance by the number of months in the introductory APR period, ensuring you won’t get hit by the steep regular APR later. They’re also a smart choice for financing planned essential purchases that you’d otherwise pay interest on.

However, watch out for red flags. If you don’t have a solid repayment strategy or struggle with controlling your spending habits, a zero interest credit card can quickly turn into a debt trap. Likewise, qualifying only for short introductory APR promotions or cards with high balance transfer fees often chips away at the potential savings. Without a well-thought-out plan, the costs and backlash can outweigh the benefits.

For those looking to build better financial habits alongside using 0% APR offers, combining this strategy with tools like budgeting apps or learning money management can make a big difference. Check out some effective methods in this guide to budgeting apps that actually work.

Tips for Using 0% APR Offers Successfully

To make the most of 0% APR offers, having a clear strategy is key. Start by creating a strict payoff plan: divide your total balance by the number of months in the promotional period. This gives you a target monthly payment to avoid interest once the regular APR kicks in.

Avoid using the card for new purchases unless the 0% APR applies to those too. Mixing new spending with transferred balances can complicate payments and lead to unexpected interest charges.

Set calendar reminders well before the promo ends—missing the deadline can mean a sudden jump to high ongoing APRs, often between 17% and 28%. Paying more than the minimum due each month helps accelerate debt payoff and reduces the risk of leftover balances accruing interest. Using autopay is a simple way to never miss a payment and maintain the offer’s benefits.

Finally, don’t settle for the first offer you find. Compare multiple 0% intro APR credit cards to choose those with the longest interest-free period and the lowest balance transfer fees, typically ranging from 3% to 5%. This comparison ensures you get the best deal tailored to your credit card debt consolidation needs.

For a deeper dive into smart financial moves like these, check out how building an effective credit card repayment plan fits into overall personal finance strategies.

Alternatives to 0% APR Cards

If 0% intro APR credit cards don’t seem like the right fit, there are solid alternatives to consider for managing or avoiding credit card debt.

Personal loans for debt consolidation can be a good option if you want a fixed payment plan and a potentially lower interest rate than your credit cards. Unlike balance transfer offers, personal loans often don’t come with balance transfer fees and may help simplify repayment by combining multiple debts into one monthly bill.

Debt management plans or credit counseling provide professional guidance aimed at reducing interest rates and creating a realistic payoff schedule. These services can help you avoid the common pitfalls of promo APR traps and keep you accountable with your credit card repayment plan.

Lastly, building an emergency fund is a proactive way to steer clear of needing any no interest financing or zero interest credit cards altogether. Having savings on hand means fewer surprises and less temptation to rely on credit when unexpected expenses pop up.

If you want to explore more ways to manage money wisely, the principles of being paid and broke by Friday and trying the pay-yourself-first strategy can really help build a solid financial foundation.

Current Top 0% APR Offers (2026 Overview)

Right now, some of the best 0% intro APR credit cards on the market offer promotional periods lasting up to 21 months on new purchases and balance transfers. These long zero interest credit cards provide a valuable chance to consolidate high-interest debt and pay it down without added interest.

Many of these balance transfer offers come with reasonable balance transfer fees around 3–5%, which is worth considering against the potential interest savings. Keep in mind that these deals can change frequently, so it’s important to check directly with card issuers for the latest terms and eligibility requirements.

For those looking to maximize the interest-free period and minimize fees, comparing multiple cards and offers is a smart move. This comparison ensures you find the best fit for your credit card debt consolidation or no interest financing goals. For a better grasp of how to make the most of such financial tools, explore detailed strategies on building an effective credit card repayment plan and avoiding common promo APR pitfalls.

Checking up-to-date offers regularly can help you spot the best 0% APR deals that suit your situation as the market fluctuates throughout the year.

FAQs About 0% APR Offers

Do balance transfer fees outweigh the benefits?

It depends on your situation. Balance transfer fees typically range from 3–5% of the transferred amount, which adds upfront costs. However, if you’re moving high-interest debt to a zero interest credit card with a long interest-free period, the savings on interest usually outweigh these fees. Just crunch the numbers to be sure.

What happens if I miss a payment?

Missing a payment often voids the introductory APR promotion, meaning your balance starts accruing regular APR immediately, which can be 17–28% or higher. Plus, you might face late fees and a hit to your credit score. Staying on top of payments, ideally with autopay, is key to avoid this pitfall.

Can I transfer multiple balances to one card?

Yes, many 0% intro APR credit cards allow transferring multiple balances, but there might be a maximum limit and fees apply on the total amount transferred. Also, each transfer adds to your card’s utilization rate, which could impact your credit score if you’re not careful.

Is a 0% APR offer worth it for small debts?

For small balances, the fees and risk might outweigh the benefits. If the balance transfer fee approaches or exceeds the interest you’d pay on the current balance, or if you can pay off the debt quickly anyway, it might not be worth it. In such cases, a strong repayment plan without a new card might be better.

For more tips on managing debt and budgeting, consider checking out proven budgeting methods for beginners to complement your repayment strategy.