Understanding Behavioral Finance: The Science Behind the Gap

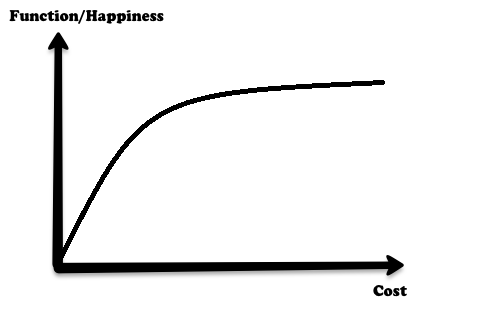

Behavioral finance helps explain why you often know better but don’t do better with your money. Unlike traditional finance, which assumes people are perfectly rational and make decisions logically, behavioral finance recognizes that our choices are heavily influenced by emotions and cognitive biases.

At its core, traditional finance relies on the idea that investors act solely to maximize returns based on all available information. Behavioral finance challenges this by showing how real people often act irrationally, swayed by feelings and mental shortcuts. This is where Kahneman and Tversky’s prospect theory plays a crucial role. They revealed that people don’t value gains and losses equally – losses typically hurt more than equivalent gains feel good. This insight into loss aversion psychology highlights why emotional reactions can lead to poor financial decisions.

Our brains use two types of thinking: System 1, which is fast, instinctive, and emotional, and System 2, which is slow, deliberate, and logical. Most financial errors happen because System 1 takes over, triggering biases like overconfidence or herd mentality. These emotional shortcuts can directly cause investor underperformance—like panic selling during market dips or chasing hot stocks impulsively.

Studies repeatedly show that these behavioral biases in investing create a persistent gap between what you know is smart and what you actually do. Recognizing this gap is the first step towards making decisions that better align your actions with your financial knowledge.

Common Behavioral Biases That Cause the Knowing-Doing Disconnect

Many of us know better but don’t always act on that knowledge because of deep-rooted behavioral biases. These mental shortcuts influence financial decisions and create a gap between what we know and what we actually do. Here are the main biases that cause this disconnect:

-

Loss Aversion: We tend to fear losses more than we value equivalent gains. This fear often leads to avoidance or stubborn holding onto losing investments, hurting long-term performance.

-

Overconfidence Bias: Overestimating our own knowledge or control causes risky bets and poor timing. This bias can make investors believe they can beat the market more easily than they actually can.

-

Confirmation Bias: Instead of objectively assessing information, we seek data that supports our existing beliefs and ignore opposing facts. This keeps us stuck in unhelpful patterns.

-

Herd Mentality: Following the crowd during market bubbles or crashes feels safe, but it often results in buying high and selling low, driven by emotional investing mistakes rather than logic.

-

Present Bias: Prioritizing immediate rewards or comforts over future gains leads to procrastination, especially with saving or investing for retirement.

-

Anchoring Bias: Relying too much on initial information—like a stock’s purchase price—skews later decisions, making it harder to adjust strategies objectively.

-

Endowment Effect: We overvalue assets simply because we own them. This can prevent us from selling poor-performing stocks or reallocating our portfolio efficiently.

-

Availability Bias: Recent or vivid market events disproportionately affect our decisions. For example, seeing media coverage of a crash can lead to panic selling, despite long-term trends suggesting otherwise.

Understanding these biases is the first step to bridging the gap between knowing and doing. For those battling procrastination, particularly in managing finances, tools like budgeting apps can provide useful nudges to form better habits—see practical tips on managing your money with 5 budgeting apps that actually work.

Real-World Examples of Biases in Action

Behavioral biases show up everywhere—in how we invest, spend, and even save. Take investing: panic selling during market dips is a classic result of loss aversion, where fear pushes us to dump stocks at a low price. On the flip side, chasing hot stocks or trends reflects overconfidence bias and herd mentality, often leading to buying high and selling low.

In personal finance, these biases emerge too. Impulse buying is a perfect example of present bias—valuing immediate gratification over long-term financial goals. Meanwhile, procrastinating on savings often results from the same bias and can seriously delay wealth building.

Historical market events highlight these biases on a broader scale. The dot-com bubble burst was fueled by overconfidence and herd mentality, with investors overly optimistic about new tech stocks. Similarly, the 2008 financial crisis was deepened by confirmation bias and emotional investing mistakes, as many ignored warning signs and stuck to flawed beliefs.

Recognizing these patterns helps us understand the real cost of behavioral biases in investing and everyday money decisions. If you want to curb impulse buys, start with clear money goals and checklists like those suggested in 5 money questions to ask before buying a car, new or used, which guide disciplined spending.

Practical Fixes: Strategies to Overcome Biases and Align Actions with Knowledge

Bridging the gap between knowing better and doing better starts with practical steps to counter behavioral biases in investing and personal finance. Here’s how you can turn awareness into action:

Build Awareness

Start by identifying your own biases. Use self-reflection tools and bias checklists to catch tendencies like loss aversion or overconfidence before they sabotage your decisions. Awareness is the first key to change.

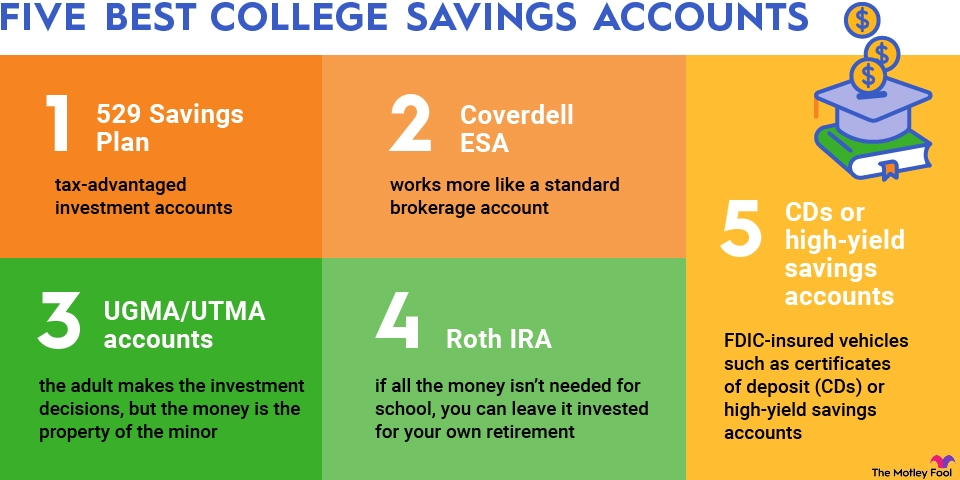

Automate Good Habits

Set up automatic savings, investments, and portfolio rebalancing. Automating these processes helps bypass present bias and procrastination, ensuring you stay consistent without relying solely on willpower.

Use Rules-Based Systems

Incorporate rules like dollar-cost averaging and stop-loss orders to remove emotional decision-making from the equation. These systems help manage risk and avoid panic selling during market swings.

Diversify and Plan Long-Term

Create written investment policies reflecting your goals and risk tolerance. Diversification reduces the impact of biases like the endowment effect or anchoring, while a long-term plan keeps you focused beyond short-term market noise.

Seek External Perspectives

Working with a financial advisor or an accountability partner provides fresh perspectives and counters confirmation bias. They can challenge your assumptions and keep you on course during volatile times.

Reframe Decisions

Use premortem analysis—imagining potential failures before they happen—to balance your view of risks and rewards. Also, consider symmetrical loss views to reduce fear-driven decisions caused by loss aversion.

Mindfulness and Education

Ongoing learning, journaling your financial decisions, and mindfulness practices help you stay in touch with your emotional triggers. This continuous education improves your grasp of behavioral finance and builds resilience against emotional investing mistakes.

Nudges and Environment Design

Modify your environment to reduce temptations—app blockers for impulse purchases or disabling notifications that push you to check volatile markets repeatedly. Small nudges like these help maintain discipline.

For those starting out, strategies like automatic savings can be particularly effective, and you can learn about different ways to save side hustle income with structured methods like the bucket strategy. Explore practical options in saving and investing to boost your financial habits for the long haul.

(Read more about effective saving techniques in a high-rate environment here.)

Implementing Fixes for Long-Term Success

Closing the gap between knowing and doing means putting practical steps in place and sticking with them over time. Here’s a simple action plan to help you tackle behavioral biases and improve your financial habits for the long haul:

-

Assess Your Biases: Start by identifying which biases affect your decisions most. Use self-reflection tools or bias checklists to get clear on areas like loss aversion, overconfidence bias, or present bias.

-

Prioritize Fixes: Focus on the biases that hurt your portfolio or savings the most. For example, if you tend to panic sell during market dips, prioritize building automated investment habits or rules-based systems like dollar-cost averaging.

-

Track Progress: Regularly review your financial actions and results. Measuring your portfolio’s performance against benchmarks helps you see if you’re overcoming emotional investing mistakes or just falling into the same traps.

To support your journey, there are plenty of tools and resources you can use:

- Financial apps that automate savings and investments

- Books on behavioral finance and psychology of money decisions

- Professional advisors who provide external perspective and accountability

For example, learning about portfolio rebalancing can keep your asset allocation on track without emotional interference. Using these resources consistently helps turn knowledge into action.

Finally, measuring improvement isn’t just about numbers—it’s about tracking your decision-making quality too. Journaling your choices or using apps that highlight emotional patterns can guide you to smarter, less biased investing. Consistency here is key to beating common behavioral biases in investing and truly doing better with what you know.