If you’re serious about maximizing your investment returns, understanding tax-efficient investing and knowing where to hold what—IRA vs brokerage—can make a huge difference. Taxes quietly erode your gains every year, but smart asset location strategies help you keep more of what you earn by placing the right assets in the right accounts. Whether it’s sheltering high-tax bonds inside IRAs or enjoying long-term capital gains in a taxable brokerage, this isn’t just theory—it’s a practical way to boost your after-tax wealth. Ready to learn how to optimize your portfolio for tax efficiency and keep more money working for you? Let’s dive into the essentials of tax-efficient investing and discover the best home for each of your investments.

Understanding Account Types and Their Tax Treatment

When planning your tax-efficient investing strategy, it’s essential to understand the main account types and how they’re taxed. Each has unique benefits and implications for where you hold your assets.

Taxable Brokerage Accounts

- No contribution limits: You can invest as much as you want anytime.

- Flexible withdrawals: There are no penalties or restrictions when you take money out.

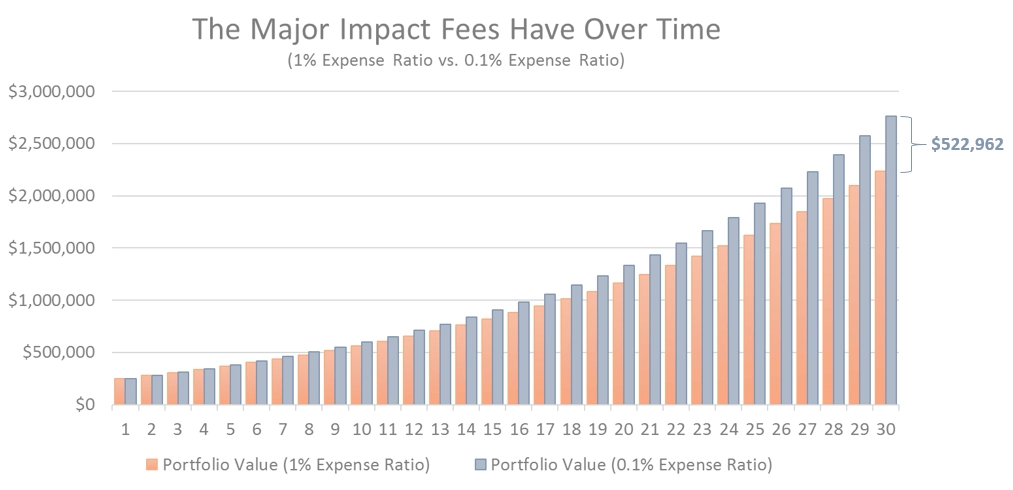

- Taxed on income and gains: Dividends, interest, and realized capital gains are subject to taxes yearly. This creates a tax drag that can slow your portfolio growth over time.

Traditional IRA

- Tax-deferred growth: Investments grow without annual taxes.

- Potentially tax-deductible contributions: You may reduce your taxable income when contributing.

- Withdrawals taxed as ordinary income: When you take money out in retirement, it’s taxed at your current income tax rate.

Roth IRA

- After-tax contributions: You invest with money that’s already taxed.

- Tax-free qualified withdrawals: Withdrawals in retirement are tax-free if certain conditions are met.

- No required minimum distributions (RMDs) for the original account owner, meaning your money can grow longer tax-free.

Key Differences: Tax Drag vs. Tax Shelter

- Taxable brokerage accounts face ongoing taxes on dividends, interest, and gains, which can reduce returns annually—this is the tax drag effect.

- IRAs shelter investments from yearly taxes, allowing your money to grow faster through compounding without interruption.

Understanding these differences helps you decide where to hold what—a core step toward optimizing your portfolio for tax efficiency.

The Core Principles of Tax-Efficient Asset Location

When it comes to tax-efficient asset placement, the main idea is to minimise tax drag and maximise growth over time by choosing the right account for each asset. Here’s the simple rule: place high-tax-burden assets—those producing ordinary income like interest or non-qualified dividends—in tax-advantaged accounts such as Traditional or Roth IRAs. These accounts shield you from paying taxes annually on income that would otherwise be taxed at a higher rate.

On the flip side, keep tax-efficient assets with low turnover, qualified dividends, and long-term capital gains in your taxable brokerage accounts. These investments typically face lower tax rates and benefit from strategies like the step-up in basis at inheritance.

Expect higher-growth assets to thrive best in Roth IRAs or other accounts offering tax-free growth. Since their gains may be substantial, sheltering them from taxes on withdrawal can make a big difference.

Finally, factor in your time horizon and current versus expected future tax bracket. If you expect to be in a higher tax bracket during retirement, placing growth stocks in a Roth IRA may be more beneficial. Also, consider how often you rebalance, since moving assets between accounts can trigger taxes if done improperly. Balancing all these elements gives you a solid foundation for effective tax-efficient investing and optimising your asset location.

Recommended Placement by Asset Class

To maximize tax-efficient asset placement, it’s important to know where each type of investment fits best between your IRA and taxable brokerage accounts.

-

Bonds and Fixed Income: These generate ordinary income taxed at your regular rate, so they’re usually best held in a Traditional IRA where that interest income grows tax-deferred, delaying taxes until withdrawal.

-

High-Dividend Stocks and Actively Managed Funds: Since these produce regular taxable dividends, placing them in a Traditional or Roth IRA helps avoid the annual tax hit on dividends.

-

REITs and Commodity Funds: Because these investments often pay out non-qualified distributions taxed at higher rates, it’s wise to shelter them inside IRAs, where taxes can be deferred or avoided.

-

Broad Market Index ETFs and Buy-and-Hold Stocks: These tend to be more tax-efficient due to low turnover and qualified dividends that benefit from favorable long-term capital gains rates. They’re best placed in taxable brokerage accounts.

-

Growth Stocks (Low or No Dividends): Since these investments rely on price appreciation rather than income, holding them in a Roth IRA takes advantage of tax-free growth and withdrawals.

-

Municipal Bonds: With interest that’s usually tax-exempt at the federal level, these fit best in a taxable brokerage account to preserve their tax advantage.

-

International Stocks: Often better held in taxable accounts because you can potentially claim foreign tax credits, reducing your overall tax bill.

Strategically placing your assets across accounts helps reduce tax drag and improve long-term after-tax returns. For a detailed approach to managing your portfolio’s risk while balancing taxes, consider exploring low-risk alternatives to stocks that can complement your tax-efficient investment plan.

Sample Portfolio Examples

Choosing where to hold what depends a lot on your portfolio style and tax situation. Here are a few common setups to illustrate tax-efficient asset location across IRAs and taxable brokerage accounts.

Balanced 60/40 Portfolio

- Stocks (60%): Place broad market index ETFs and buy-and-hold stocks in your taxable brokerage account to benefit from qualified dividends and long-term capital gains tax rates.

- Bonds (40%): Hold bonds and fixed income in your Traditional IRA to defer ordinary income taxes on interest.

- This setup balances tax cost and diversification, leveraging tax-efficient asset placement to reduce portfolio tax drag.

Aggressive Growth-Focused Portfolio

- Growth Stocks (low or no dividends): Best in Roth IRA for tax-free appreciation and no required minimum distributions (RMDs), maximizing long-term growth.

- Dividend Stocks & REITs: Put these in Traditional or Roth IRAs to avoid annual tax on non-qualified dividends.

- High return assets in Roth can be especially advantageous if you expect to be in a higher tax bracket later.

Income-Oriented Retirement Portfolio

- High-Dividend Stocks and REITs: Shielded inside IRAs to escape ordinary income tax on distributions.

- Municipal Bonds: Kept in taxable accounts since their interest is generally tax-exempt, reducing tax drag.

- Cash and Short-Term Bonds: Traditional IRA for tax deferral on interest income.

Tax Bracket and Account Balance Scenarios

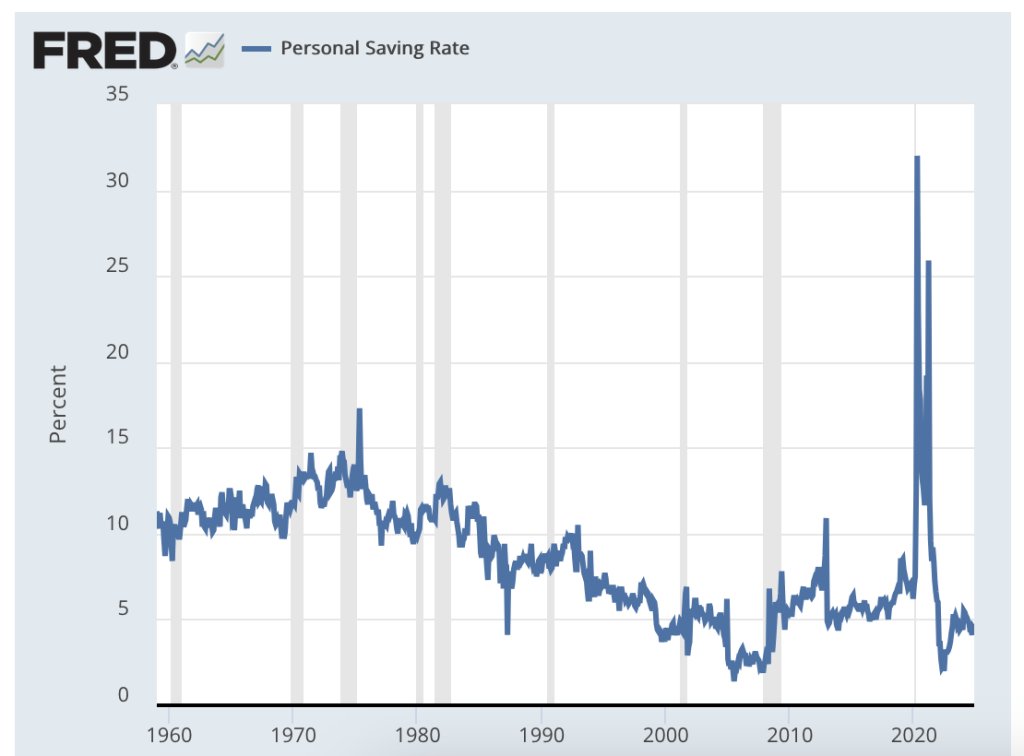

- If you’re in a higher current tax bracket, prioritize tax-deferred accounts for higher-income-generating assets.

- Lower brackets might benefit by holding assets in taxable accounts to enjoy capital gains advantages.

- Large account balances may require careful planning around RMDs and tax consequences, especially involving Traditional IRAs.

Using these examples as a guide can help you arrange your portfolio for tax efficiency based on your goals and tax situation. For more tailored ideas, tools like tax-efficient asset location calculators can assist you in optimizing your strategy.

(For further strategies on managing savings automatically and growing wealth, see this guide on automate your savings.)

Advanced Considerations and Strategies

When deciding between Roth vs. Traditional IRA prioritization, consider placing high-return assets in Roth accounts to maximize tax-free growth. Since Roth IRAs allow tax-free qualified withdrawals, growth stocks or aggressive investments benefit the most here, while Traditional IRAs work well for steady, income-generating assets due to the tax-deferral on ordinary income.

Tax-loss harvesting is a powerful tool available in taxable brokerage accounts. By selling investments at a loss, you can offset capital gains and reduce your tax bill. This strategy helps lower the overall tax drag on your taxable brokerage investments and complements your broader tax-efficient asset placement.

Rebalancing your portfolio is essential but can trigger capital gains taxes in taxable accounts. To minimize this, rebalance within your IRAs or use new contributions and dividends to adjust allocations without selling taxed assets. This keeps your overall fund placement strategy tax-efficient.

Required Minimum Distributions (RMDs) from Traditional IRAs can affect your tax situation significantly by forcing withdrawals taxed as ordinary income after age 73. Planning around RMDs—using Roth conversions or coordinating with existing 401(k)s—can help manage future tax impacts.

Speaking of coordination, optimize your overall retirement savings by considering 401(k)s and HSAs alongside your IRAs and taxable brokerage. HSAs provide triple tax advantages, making them ideal for certain assets, while 401(k)s typically resemble Traditional IRAs in tax treatment, influencing your asset location strategy.

For a practical breakdown of fixed income investing options, including I Bonds which can fit into tax-efficient strategies, check out this detailed guide on how to buy I Bonds.

By combining these strategies—Roth vs. Traditional prioritization, tax-loss harvesting, smart rebalancing, planning for RMDs, and syncing accounts—you’ll enhance your tax-efficient investing and improve your retirement portfolio’s after-tax performance.

Common Mistakes to Avoid

When it comes to tax-efficient investing and deciding between IRA vs taxable accounts, some pitfalls can cost you more in taxes over time if overlooked.

-

Holding tax-inefficient assets in brokerage accounts: Placing assets that generate ordinary income, like bonds or REITs, in taxable brokerage accounts can lead to unnecessary tax drag because interest and non-qualified dividends get taxed yearly. Instead, keep these in tax-deferred IRAs or Roth IRAs to shelter that income.

-

Ignoring overall asset allocation for location perfection: Focusing too much on perfect asset location without considering your total portfolio balance can backfire. It’s important to maintain your target allocation first and then optimize asset placement within those limits.

-

Overlooking changes in tax laws or personal circumstances: Tax rules change, and so can your income or retirement plans. Regularly review your asset location strategy to adapt to new tax brackets, RMD rules, or legislation shifts.

-

Forgetting the step-up in basis on inherited brokerage assets: Assets inherited in a taxable brokerage account get a stepped-up cost basis, which can reduce capital gains tax if sold. This makes holding some assets in taxable accounts more advantageous for estate planning purposes.

Avoiding these common mistakes helps you make the most of your tax-efficient asset placement and ensures your portfolio works smarter over time. For guidance on keeping the right assets in the right accounts, check out this detailed guide on optimizing your fund placement strategy.

How to Implement Asset Location in Your Portfolio

Implementing tax-efficient asset location starts with a clear plan. Here’s a simple step-by-step guide to help you get started:

- Assess Current Holdings: Take stock of your investments across your IRAs and taxable brokerage accounts. Identify which assets generate the most taxable income or gains.

- Calculate Tax Drag: Estimate the annual tax impact on your taxable accounts by looking at dividends, interest, and realized capital gains. This step reveals where tax-efficient asset placement can make the most difference.

- Transition Gradually: Don’t rush to move everything at once. Gradually reposition your assets to better match tax treatment—putting tax-inefficient assets in tax-advantaged accounts like Traditional or Roth IRAs, and tax-efficient assets in brokerage accounts.

Leverage online tools and resources such as tax drag calculators or brokerage platforms with built-in asset location suggestions. These tools simplify comparing different placement scenarios to boost tax savings over time.

It’s also a good idea to consult a financial advisor or tax professional if you have complex portfolios, uncertain tax implications, or need personalized retirement account optimization strategies. Their guidance can ensure you avoid common pitfalls and stay updated with changes in tax laws that affect your strategy.

For more on managing tax-efficient investments and optimizing your retirement planning, check out resources like Financial Firme’s retirement account optimization guides.