Money anxiety in your 20s is something nearly everyone faces but rarely talks about openly. Whether it’s juggling student loan anxiety, entry-level pay that barely covers rent, or the stress of watching others’ highlight reels on social media, these money worries can feel overwhelming. The good news? This kind of financial stress is completely normal—and there are practical ways to cope, regain control, and build confidence in your financial future. If you’ve been feeling stuck, uncertain, or constantly anxious about money, you’re in the right place. Let’s unpack why it’s so common and, most importantly, how you can take meaningful steps to ease that pressure today.

What Is Money Anxiety?

Money anxiety is more than just occasional stress about bills or budgets—it’s a persistent worry that can take over your thoughts and affect your everyday life. You might notice symptoms like constant worry about finances, avoiding opening bank statements or checking your account balance, trouble sleeping because your mind is racing about money, or even feeling physical tension like headaches or tightness in your chest. These signs go beyond typical stress; they linger and disrupt your mental well-being.

Unlike general stress, which comes and goes with daily challenges, money anxiety often feels like a constant weight. It doesn’t just pop up before payday but can impact your mood, focus, and energy throughout the day. This ongoing worry can make it hard to concentrate at work, affect your relationships, and contribute to feelings of overwhelm or low self-esteem. Recognizing money anxiety for what it is—something real and common, especially financial stress in your 20s—is the first step toward managing it and taking control of your financial future.

Why Money Anxiety Is So Common in Your 20s

Money anxiety in your 20s is super common because this decade is full of major life changes. You’re likely entering the workforce, moving out on your own, and trying to manage your new financial independence all at once. These big steps bring new responsibilities that can feel overwhelming.

Economic realities add to the stress. Many young adults face student loan anxiety on top of stagnant entry-level wages that don’t keep up with rising costs like rent, groceries, and healthcare. It’s tough to feel secure when your paycheck doesn’t stretch as far as it needs to.

Generational factors also play a role. Growing up after the recession, facing an uncertain job market, and constantly seeing social media comparisons about others’ lifestyles can increase feelings of financial insecurity and make you doubt your own progress.

Your upbringing and money mindset matter too. If you didn’t get much financial education in school or if your family had money struggles, it’s easy to adopt worries or habits that fuel money anxiety. This mix of personal history and economic pressure can make financial stress in 20s feel especially intense.

To navigate this, you can start by learning simple budgeting tips tailored for beginners and exploring ways to plug common money leaks young adults face, helping you build financial independence without burnout. For example, check out practical advice on identifying and stopping the biggest money leaks for young adults to improve your money mindset in twenties.

The Emotional and Physical Toll of Financial Worry

Financial stress in your 20s can take a heavy emotional and physical toll. Constant money anxiety often leads to mental health issues like anxiety, depression, and low self-esteem. When you’re constantly worried about bills, debt, or student loans, it’s hard to feel confident or at peace.

Physically, financial anxiety can cause insomnia, headaches, and chronic fatigue. These symptoms don’t just zap your energy—they also affect your ability to focus and perform daily tasks. Over time, if money worries go unaddressed, the stress can lead to burnout and even strain your relationships with friends, family, or partners.

Recognizing these signs early on can help you take steps to manage both your mental health and financial situation before they spiral. For a deeper look at emotional money management, consider exploring strategies beyond budgeting, like those found in guides on emotional money management.

How to Cope: Emotional Strategies for Immediate Relief

Feeling money anxiety in your 20s is totally normal, but there are simple emotional strategies that can help you manage it right away. First, acknowledge and normalize your feelings—remember, you’re not alone in dealing with financial stress in your 20s. Accepting these worries instead of fighting them can ease the pressure a lot.

Next, practicing mindfulness and stress-reduction techniques can make a big difference. Try breathing exercises or journaling to clear your mind and reduce tension. These methods help you stay present instead of spiraling into money fears. Also, limit social media comparisons—seeing others’ highlight reels can fuel money anxiety, so focus on your own progress and steps forward instead.

Building a support network is crucial too. Talk openly to friends, family, or even a therapist if you can. Sharing your concerns helps lighten the load and gives you practical advice or emotional reassurance. If your financial anxiety feels overwhelming, professional support through financial therapy can also be a game changer.

By combining these emotional coping strategies, you create a strong foundation to handle money worries more calmly and confidently.

Practical Financial Steps to Reduce Anxiety

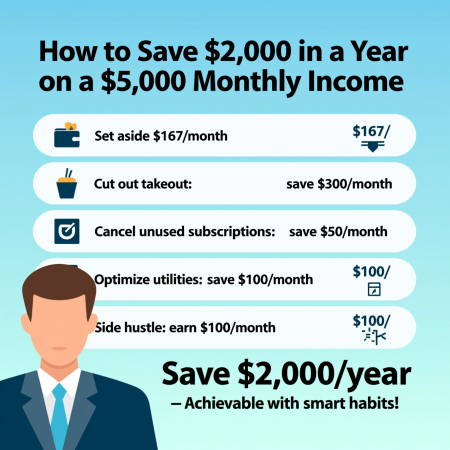

Taking control of your finances can significantly ease money anxiety in your 20s. Start by creating a simple budget: track your income and expenses so you can set realistic goals without feeling overwhelmed. Even a basic budget helps turn vague worries into clear, manageable tasks.

Building an emergency fund is another crucial step. Starting small, with around $500 to $1,000, can provide a surprising amount of peace of mind during unexpected expenses. For tips on how to build this safety net efficiently, check out practical advice on why you need an emergency fund and how to build it in 3 steps.

If debt is part of your financial stress, tackle it strategically. Focus on paying off high-interest debt first, and explore refinancing options if possible to reduce your payments. This approach makes your debt stress more manageable over time without feeling like a mountain that never shrinks. For guidance, the article on why the debt avalanche feels harder and how to stick with it is a great resource.

Boosting your financial literacy also helps reduce money worries. Use free resources, apps, and beginner-friendly books to understand personal finance basics better. This builds your confidence in managing money and helps you avoid pitfalls that add unnecessary stress.

Lastly, consider side hustles or ways to increase your income, but keep burnout in mind. Pick options that suit your lifestyle and energy levels so you can boost your finances without sacrificing your well-being. Balancing income growth with self-care is key to long-term financial confidence.

Long-Term Habits for Financial Confidence

Building financial confidence in your 20s means setting achievable goals that keep you motivated without feeling overwhelmed. Start with short-term savings targets or clear debt payoff milestones—small wins add up and help shift your money mindset from scarcity to abundance. Automating your savings and bill payments is another smart move; this reduces decision fatigue and keeps your finances on track without stress.

When planning for bigger milestones like buying a home or retirement, break these down into manageable steps. This approach prevents overwhelm and keeps your financial independence goals realistic and steady. For ongoing support, you might find helpful tips on creating strong credit habits that support long-term security in resources like this guide on daily habits of people with 700 credit scores.

By embedding these simple yet effective habits, you’ll reduce financial stress in your 20s and build the confidence needed to handle future money challenges.

When to Seek Professional Help

Sometimes, money anxiety goes beyond manageable stress. If you notice persistent overwhelm that affects your work, sleep, or overall health, it’s time to get help. Don’t wait until the worry starts controlling your life.

Signs You Need Professional Support:

| Sign | What It Means |

|---|---|

| Constant, intrusive worry | Anxiety is impacting daily focus |

| Trouble sleeping or eating | Physical health is suffering |

| Avoiding financial tasks | Fear is leading to harmful habits |

| Feeling isolated or hopeless | Mental health is at risk |

| Work or relationships suffer | Stress affects other life areas |

Where to Turn for Help:

- Financial advisors can help you create realistic budgets, manage debt, and plan ahead confidently.

- Therapists specializing in money issues offer financial therapy to tackle the emotional side of money anxiety.

- Many communities provide free counseling resources or online support groups focused on young adult money worries.

If you feel stuck, these experts can guide you beyond simple tips into effective solutions that improve both your financial health and mental well-being. For practical budgeting tools that can ease financial stress, check out our recommendations for budgeting apps that actually work.