You’re probably familiar with the debt avalanche method—paying off debts starting with the highest interest rate to save thousands over time. Sounds straightforward and smart, right? But if you’ve tried it, you know it often feels tougher than expected. The progress on those large, high-interest balances can seem painfully slow, and motivation quickly fades. Why does the debt avalanche feel harder, and how can you stick with it long enough to actually see the payoff? In this post, we’ll uncover the psychological hurdles behind the struggle and share actionable strategies to keep you on track—so you can minimize interest, avoid burnout, and finally conquer your debt for good.

What Is the Debt Avalanche Method?

The debt avalanche method is a smart way to tackle your debts by focusing on paying off those with the highest interest rates first. Here’s how it works, step-by-step:

- List all your debts from highest to lowest interest rate. For example, a credit card at 24% would go before a student loan at 6%.

- Make minimum payments on every debt to avoid fees and penalties.

- Put any extra money toward the debt with the highest interest rate.

- Once the top debt is paid off, roll that payment amount into the next highest-interest debt, creating a snowball effect—but focused on interest savings rather than balance size.

For example, imagine you have a $5,000 credit card debt at 24% and a $10,000 student loan at 6%. Using the avalanche method, you’d pay extra on the credit card first. This strategy cuts down your total interest paid and shortens your payoff timeline significantly compared to spreading out extra payments or focusing on smaller balances first.

The key advantage of the debt avalanche method is that it maximizes long-term savings by minimizing interest payments, especially on high-rate debts like credit cards. Over time, this means you keep more money in your pocket and get out of debt faster.

Debt Avalanche vs. Debt Snowball: Why the Avalanche Often Feels Harder

When comparing the debt avalanche method to the debt snowball, the key difference is how they impact motivation. The snowball approach offers quick wins by paying off the smallest debts first, creating early momentum. In contrast, the avalanche prioritizes paying off debts with the highest interest rates first—which often means tackling large balances that take longer to clear, making progress less visible at the start.

| Feature | Debt Avalanche | Debt Snowball |

|---|---|---|

| Focus | Highest interest rate debts | Smallest balance debts |

| Early wins | Slow, delayed gratification | Fast, visible progress |

| Psychological impact | Requires more discipline | Provides motivation boost |

| Total interest paid | Minimizes long-term interest | Often pays more interest |

The avalanche method feels tougher because it lacks early momentum and quick emotional rewards. Watching a big credit card balance slowly shrink is less satisfying than celebrating a fully paid-off small loan or store card. This slow visible progress can lead to frustration and burnout, requiring stronger discipline to stay the course.

Research confirms these psychological hurdles. Numerous studies and expert insights reveal that many people abandon the debt avalanche strategy due to motivation dips, even though sticking with it saves the most money over time. This makes understanding the emotional toll key to maintaining progress and ultimately minimizing interest payments.

If you find yourself struggling with this, exploring strategies that boost motivation can help you stick with the avalanche for the long haul. For more on managing emotional spending habits during debt repayment, check out this helpful guide on emotional money management.

The Psychology Behind the Struggle

One of the biggest reasons the debt avalanche method feels harder is simply how our brains are wired. Behavioral finance shows that humans naturally crave quick rewards—those little dopamine hits that come from seeing progress fast. That’s why the debt snowball’s quick wins feel so satisfying; paying off a small debt offers instant motivation, while the avalanche demands patience with bigger balances and slower visible gains.

The struggle hits hardest in common scenarios where your highest-interest debt also happens to be the largest balance. When that happens, progress can seem painfully slow because even after months of payments, the principal barely shrinks. Add multiple debts to the mix, and it’s easy to feel overwhelmed and burnt out before you hit key milestones. Without visible progress or quick payoffs, sticking to the debt avalanche plan can feel like an uphill battle.

Many real readers share how their initial enthusiasm fades into frustration when the payoff seems out of reach. Without regular milestones or reminders of long-term wins — like minimizing interest payments and getting closer to debt freedom — motivation dips, leading some to abandon the method entirely. To stay on track, it’s vital to understand these psychological barriers and build strategies around them.

For more about managing the psychology of money habits and staying motivated, resources like consistent investing psychology hacks offer useful insights to keep you steady on your financial journey.

Proven Strategies to Stick With the Debt Avalanche

Sticking to the debt avalanche method can be tough, but these strategies make it easier to stay on track and motivated.

Set micro-milestones

Break down your big debt goals into smaller wins. Celebrate every $1,000 you pay off on your highest-interest debt or when you see a noticeable drop in your interest rate. These small moments keep your motivation alive.

Track progress visually

Use spreadsheets, apps, or charts that display how much interest you’ve saved and when you’re projected to be debt-free. Seeing your progress in black and white makes those slow-moving payments feel more rewarding. Debt payoff planners or apps designed for avalanche tracking can be a huge help here.

Build accountability

Join online communities focused on debt repayment or find an accountability partner who will check in on your progress. Reward systems, even if it’s something simple like treating yourself after a tough month, keep the momentum going.

Gamify the process

Turn your debt payments into a challenge with levels or points, rewarding consistent payments or hitting mini-goals. Making debt repayment feel more like a game can boost your emotional drive and reduce burnout.

Try hybrid approaches

If the avalanche feels too slow at first, pay off one small debt completely for a quick win to get a psychological boost, then switch back to focusing fully on the highest-interest debts. This mix blends the best of the debt snowball’s quick wins with avalanche’s financial benefits.

Mindset shifts

Constantly remind yourself of the ‘why’ behind the method: financial freedom and minimizing interest wasted. Visualize life after debt—more money in your pocket, less stress, and stronger savings.

Practical tips to accelerate extras:

- Automate your payments to avoid missed deadlines and build consistency.

- Ruthlessly cut expenses where you can to free up more payments toward debt.

- Boost your income with side hustles or extra shifts to add to your avalanche payments. For ideas on increasing side hustle income efficiently, check out effective strategies like the bucket method.

By combining these strategies with the core principles of the debt avalanche method, you can power through those tough stages and get out of debt faster with confidence.

Tools and Resources to Make It Easier

Sticking to the debt avalanche method can feel smoother with the right tools. There are several apps and trackers designed specifically for debt payoff that help you monitor progress and stay motivated. Popular debt payoff planners let you input your debts, interest rates, and payments to visualize how your avalanche strategy cuts down interest and speeds up your debt freedom journey.

If you’re torn between debt avalanche vs snowball, using online calculators can show side-by-side comparisons for your specific debts. This helps you see which method saves more money or pays off debt faster, so you can make an informed choice.

Sometimes, despite your best efforts, the debt avalanche might not feel sustainable. Signs it may not be working include persistent burnout, missing payments, or losing motivation completely. In these moments, it’s okay to pivot your strategy without guilt. You might switch to a hybrid approach or start with a small quick win before diving back into avalanche payments. The key is to keep forward momentum, not get stuck.

For help managing finances across the board while accelerating debt repayments, consider budgeting apps that actually work and cut through the fluff—they can free up more cash flow for those extra avalanche payments. You can explore some highly effective budgeting tools here.

Using these tools and resources sharpens your debt repayment strategy, minimizes interest payments, and boosts your debt payoff motivation every step of the way.

Real-Life Success Stories and Potential Savings

Sticking with the debt avalanche method pays off—not just in theory but in real numbers. Many borrowers who focus on paying off high interest debt first have saved thousands in interest. For example, a common case shows individuals cutting $5,000 to $10,000 or more off their total interest by prioritizing debts with the highest rates, like credit cards at 20%+ APR, over lower-rate loans. This kind of saving can shave years off your debt freedom journey and keeps more money in your pocket long term.

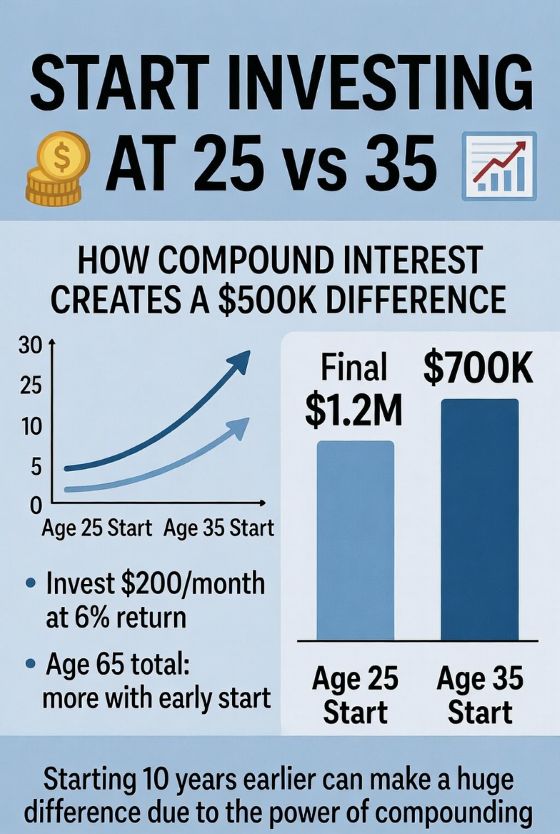

Beyond immediate savings, the debt avalanche sets you up for faster wealth building. Once high-interest debts are cleared, you reduce your monthly financial burden and free up cash flow to invest or save. The accelerated payoff not only minimizes interest payments but also helps you break free sooner to focus on your financial goals.

If you want a clearer idea of how much you can save by sticking with the avalanche plan—or how long it might take—there are solid calculator tools and planners available to track progress and compare strategies. And as you stick with it, celebrating each milestone brings you closer to that debt-free life and wealth-building phase.

For insights on maintaining motivation and positive habits on your money journey, check out real stories of young savers who succeeded early on their financial paths. These examples can inspire your own commitment to the debt avalanche method and beyond.

(Here’s a useful resource on 5 habits of 25-year-olds who saved $10k, illustrating how discipline and smart choices work together.)