Paying More Interest Over Time Due to Extended Loan Terms

One common risk of consolidating debt that many guides don’t mention is paying more interest over the long haul because of extended loan terms. When you consolidate, your monthly payments often drop, which feels like a relief. But this lower payment usually comes from stretching your repayment period from, say, a few years on credit cards to 5–7 years on the consolidation loan.

How Longer Terms Increase Interest Costs

For example, imagine you have $10,000 in credit card debt at 18% interest, and you make aggressive payments aiming to clear it in 2 years. You’d pay roughly $2,000 in interest over that time. Now, suppose you consolidate that debt into a personal loan at 12% interest but spread payments over 6 years to lower your monthly bill.

- Credit cards: $10,000 balance, 18% APR, 2-year payoff

- Total interest paid: ~$2,000

- Consolidation loan: $10,000 balance, 12% APR, 6-year payoff

- Total interest paid: ~$3,900

Even though the rate is lower, paying over 6 years means almost double the interest. This extended repayment risk often flies under the radar because guides focus on monthly payment relief, not total cost.

Why This Risk Is Overlooked

Most debt consolidation guides highlight the benefit of lower monthly payments but gloss over how much longer terms can add to your total debt cost. This can lead you to underestimate the true cost of consolidating your debt, making it a hidden fee debt consolidation in disguise.

Before consolidating, always ask: “How much interest will I pay overall?” and compare it to your current repayment plan. This simple step can save you from paying significantly more in the end.

Risk 2: Hidden Fees That Reduce or Eliminate Savings

One of the biggest debt consolidation disadvantages you might not expect are the hidden fees that chip away at your potential savings. Common fees include origination fees, which typically range from 1% to 6% of the loan amount. For example, on a $10,000 consolidation loan, a 4% origination fee means you owe an extra $400 upfront. Then there are balance transfer fees, often 3% to 5%, which apply if you’re consolidating credit card debt through a transfer card. These costs can quickly add up.

If you’re using a home equity loan or HELOC for consolidation, be ready for closing costs similar to what you’d pay when buying a house—these can be several hundred to a few thousand dollars. In some cases, these fees alone can offset the interest savings you were hoping to gain by consolidating debt.

It’s also important to watch out for prepayment penalties. Some loans charge a fee if you pay off your debt early, which can make refinancing or aggressively paying down your balance more expensive than expected. These fees and costs are rarely highlighted in basic debt consolidation guides but can significantly impact the overall value of consolidating your debt.

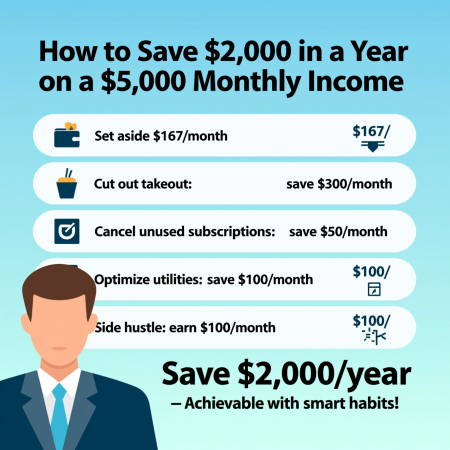

Being aware of these hidden fees upfront helps you avoid falling into debt consolidation traps that leave you paying more in the long run. For a better handle on managing expenses and saving, you might find tips in how to save $2000 in a year on a $5000 monthly income useful to improve your overall financial strategy.

Risk 3: Temptation to Accumulate New Debt and Fall Deeper in the Hole

One major risk of debt consolidation is the false sense of relief it creates after paying off credit cards. When people see their balances wiped clean, it’s tempting to start spending again, thinking they have more financial freedom. This often leads to accumulating new debt on top of the consolidation loan, trapping them deeper in the debt cycle after consolidation.

Studies show many borrowers end up with both a consolidated loan and fresh credit card debt, sometimes worse than before. This happens because debt consolidation doesn’t fix the root problem—poor spending habits and lack of budgeting. Ignoring this leads to a recurring cycle where people use consolidation as a quick fix but fall back into high-interest debt.

If you want to avoid this, focus on managing your spending and building healthy financial habits. Otherwise, the risks of consolidating debt multiply, turning what seemed like a smart move into a debt consolidation trap. For insights on how to control spending, consider checking out practical guides on emotional money management, which can be a key part of avoiding this pitfall.

Risk 4: Risk of Losing Assets with Secured Consolidation Options

One of the biggest hidden risks in debt consolidation is using secured loans like home equity loans, HELOCs (Home Equity Lines of Credit), or auto-secured loans. These loans require collateral — your house, car, or other assets. If you fall behind on payments, you risk foreclosure or repossession. This can be devastating since you might lose what you’ve worked hard to earn.

| Loan Type | Collateral | Risk if Payments Missed |

|---|---|---|

| Home Equity Loan/HELOC | Home equity | Foreclosure, losing your home |

| Auto-Secured Loan | Your vehicle | Repossession of the car |

| Unsecured Loan | None | No asset loss, but credit damage |

Despite these high stakes, lenders often push secured consolidation loans because they offer lower interest rates or larger approval amounts. Borrowers may be tempted, but the cost of default is much higher with secured debt.

Another downside: using home equity for consolidation can drain the safety net you might need for emergencies. It reduces the amount of home equity available, which is usually one of your last financial reserves.

If you want to avoid these risks, unsecured loans or other debt relief options might make more sense, even if the rates are slightly higher.

For more on protecting yourself financially, check out tips on building an emergency fund in three simple steps. This can keep you from relying on collateral-based loans in a crunch.

This section emphasizes the secured debt consolidation risks clearly and briefly. It includes a table for quick comparison and links naturally to relevant advice, maintaining SEO-friendly use of the keyword “secured consolidation options.”

Risk 5: Potential Damage to Your Credit Score and Qualification Challenges

One risk of debt consolidation that often goes unnoticed is the impact on your credit score, both short-term and long-term. When you apply for a consolidation loan or a balance transfer card, lenders will perform hard inquiries on your credit report. These inquiries can cause a small but immediate dip in your credit score. Additionally, closing old credit card accounts after consolidation can reduce your overall available credit, pushing up your credit utilization ratio—a key factor in credit scoring. Using balance transfers may also temporarily raise your utilization if the new credit line is smaller than the combined credit limits you had before.

Over time, if you don’t change spending habits or miss payments on the new loan, your credit score can take a bigger hit. Missed payments and higher debt levels make you a riskier borrower, which often results in higher interest rates on future loans. This situation can trap you in a cycle of debt consolidation disadvantages, where the higher rates ultimately reduce or eliminate the initial benefit of consolidating debt.

Keep in mind, poor credit not only makes qualifying for the best consolidation offers harder but also limits your options for future financial moves. This is why understanding the debt consolidation credit score impact is crucial before proceeding. It pays to be cautious and make sure you have a solid repayment plan to mitigate these risks.

For more on managing your finances effectively while paying down debt, consider strategies like building an emergency fund or following disciplined spending habits, as explained in these practical saving tips for young adults.

Other Overlooked Considerations

When thinking about debt consolidation, it’s important to remember that not all debts qualify for consolidation. For example, many student loans—especially federal ones—and certain medical bills often can’t be included in a consolidation loan. This limitation might mean you still have multiple payments to handle, reducing the simplicity you’re hoping for.

Another factor to watch is the impact on cosigners or family members if they guarantee your consolidation loan. If you miss payments, it’s not just your credit on the line; your cosigners could face damage too, which can create tension and financial strain within families.

Also, keep an eye on promotional rates that may expire, such as 0% balance transfer offers. While these low or no-interest deals can seem attractive, they often jump to a much higher APR after the promo period ends, potentially increasing your costs unexpectedly. This traps some borrowers in renewed cycles of debt if they aren’t prepared.

Considering these hidden traps is crucial before taking the plunge, as these debt consolidation disadvantages often don’t get enough attention in basic guides. For a broader view on managing money and financial planning alongside your debt strategy, exploring lifestyle finance articles like portfolio rebalancing tips could also help.

When Debt Consolidation Might Still Be Worth It

Despite the risks of consolidating debt, it can be a smart move if your situation fits certain criteria. Debt consolidation works best when you have strong credit, a disciplined spending habit, and a clear payoff plan. Good credit usually means you can qualify for lower interest rates, which helps you avoid paying more interest consolidation traps often lead to over the long term.

If you’re someone who can stick to a budget and resist the temptation to accumulate more debt after consolidation, you’ll likely get more out of the process. Having a clear plan to pay off the consolidated loan within a reasonable timeframe—without extending repayment terms unnecessarily—also keeps interest costs down.

Quick Pros Recap:

- Simplifies multiple payments into one manageable monthly amount

- Potentially lowers your interest rate if you qualify

- Can improve cash flow with lower monthly payments (if done carefully)

- Helps break free from high-interest credit card cycles

Of course, success depends on maintaining good financial habits and avoiding hidden fees or collateral risks seen in some secured debt consolidation options. If you’re confident in your plan, debt consolidation could be a useful tool. For ongoing budgeting help to support your payoff strategy, exploring reliable tools like these 5 budgeting apps that actually work can be a great step.

Alternatives to Debt Consolidation

If debt consolidation’s risks feel like too much, there are several alternatives worth considering that might suit your situation better.

-

Debt Management Plans through Credit Counseling: Many non-profit credit counseling agencies offer debt management plans (DMPs). These plans help you negotiate lower interest rates and set up a structured repayment timeline without the risks of a new loan. It’s a practical approach if you want help controlling debt without adding new obligations.

-

Balance Transfer Cards (With Caveats): Balance transfer credit cards can provide a 0% APR promotional period, allowing you to pay down debt interest-free for several months. However, watch out for balance transfer pitfalls like fees of 3–5%, high rates after the promo ends, and the risk of increasing your credit utilization, which can negatively impact your credit score.

-

Debt Snowball/Avalanche Methods: These self-managed strategies focus on paying off debts either by smallest balance first (snowball) or highest interest rate first (avalanche). While it requires discipline and patience, these methods avoid added fees or credit risk and help rebuild healthy financial habits.

-

Debt Settlement or Bankruptcy as Last Resorts: If debt becomes unmanageable, options like debt settlement or bankruptcy might be necessary. These come with serious credit score damage and long-term consequences, so they should only be considered when other options fail.

Each alternative carries its own benefits and challenges, so understanding what fits your financial goals and habits is key. If you want to improve your money management alongside debt reduction, exploring budgeting methods for beginners can give you solid ground to avoid falling back into debt.

How to Avoid These Risks If You Proceed

If you decide debt consolidation is the right path, it’s crucial to steer clear of common pitfalls by taking smart steps. First, shop multiple lenders and get a clear picture of all costs involved—not just the interest rate but also any hidden fees like origination or balance transfer fees. Calculating the total cost over the life of the loan helps you avoid surprises and pay less interest consolidation traps often hide.

Next, create a realistic budget and track your spending closely. Debt consolidation doesn’t fix poor spending habits, so knowing where your money goes is key to staying on track and avoiding accumulating more debt after consolidation. Be disciplined and avoid the temptation to use any freed-up credit lines because that can quickly put you back in the debt cycle after consolidation.

Finally, build an emergency fund before or alongside your consolidation plan. This fund protects you from relying on credit if unexpected expenses arise, especially important if you choose secured debt consolidation options that risk your home or assets. Staying financially prepared reduces the risk of missed payments and credit score impact down the road.

By carefully managing these steps, you can dodge many risks of consolidating debt and make your payoff plan more effective.

For a better grasp on budgeting that supports debt repayment, check out strategies like 7 ways to budget for travel without going broke.