What Are ETFs? Explanation, Key Features, and Beginner Pros

ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges, much like individual stocks. They are collections of assets—like stocks, bonds, or commodities—bundled into one easy-to-buy-and-sell package.

Key Features of ETFs

| Feature | Description |

|---|---|

| Traded Like Stocks | Buy and sell ETFs anytime during market hours |

| Diversified Portfolio | Hold many assets in one fund |

| Low Expense Ratios | Typically cheaper than mutual funds |

| Passive Management | Many track indexes like the S&P 500 |

| Transparency | Holdings are updated daily |

| Tax Efficiency | Can minimize capital gains taxes |

Why Beginners Like ETFs

- Easy to trade: Just like stocks, ETFs can be bought or sold anytime the market is open.

- Low-cost investing: Expense ratios are generally low, making ETFs a cost-effective way to start.

- Instant diversification: Even with a small amount of money, you can invest in a whole index or sector.

- Flexible strategies: You can choose passive ETFs for long-term growth or active ETFs for more hands-on management.

Don’t worry if you’re new; understanding ETFs is easier than it seems. They provide a simple way to build a diversified and low-cost portfolio right from your brokerage account.

Next, we’ll compare ETFs with mutual funds, breaking down the ETF vs mutual fund differences to help you decide which fits your investing style.

What Are Mutual Funds? Explanation, Key Features, and Beginner Pros

Mutual funds pool money from many investors to buy a broad mix of stocks, bonds, or other assets. Managed by professional fund managers, they aim to grow your investment over time without you needing to pick individual stocks.

Key Features of Mutual Funds:

| Feature | Description |

|---|---|

| Active or Passive | Can be actively managed or track indexes like the S&P 500 index trackers |

| Net Asset Value (NAV) | Price per share, calculated at the end of each trading day |

| Minimum Investment | Often requires a minimum amount to start |

| Diversified | Offers instant diversification across various assets |

| Automatic Reinvestment | Dividends and capital gains can be automatically reinvested |

Why Mutual Funds Are Good for Beginners:

- Simple to use: No need to watch the market daily.

- Professional management: Fund managers handle investment decisions.

- Dollar-cost averaging friendly: You can invest regularly and build a diversified portfolio starters.

- Low entry barriers: Many mutual funds have affordable minimum investments.

- Tax-efficient options: Some funds optimize for taxes, reducing your yearly bill.

Mutual funds remain one of the best investments for beginners who prefer hands-off investing with broad market exposure. If you want to explore budget-friendly strategies for beginners, check out detailed budgeting methods for beginners that help make investing smoother.

Key Differences: A Side-by-Side Comparison of ETFs and Mutual Funds

Here’s a quick comparison to help you spot the key ETF vs mutual fund differences, especially important for beginners deciding where to start:

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Bought and sold like stocks throughout the day (intraday trading ETFs) | Purchased or redeemed only at end-of-day net asset value (NAV) |

| Expense Ratios | Generally lower, especially for index-based ETFs | Often higher due to active management and operating costs |

| Minimum Investment | Typically no minimum; you can buy as little as one share | Often requires minimum investments, sometimes $1,000 or more |

| Trading Fees | Pay brokerage commissions or bid-ask spreads (though many brokers now offer commission-free ETFs) | No trading fees, but some funds charge sales loads or redemption fees |

| Management Style | Mostly passive (index funds) but some active ETFs exist | Active and passive options available, with many actively managed funds |

| Tax Efficiency | More tax-efficient due to how shares are created/redeemed | Less tax-efficient, may generate capital gains distributions |

| Liquidity | High liquidity during market hours; prices fluctuate | Priced once daily, so liquidity depends on fund issuer |

| Accessibility | Requires a brokerage account | Can be bought directly from fund companies or through brokers |

| Investment Flexibility | Can be used for intraday strategies or long-term investing | Best suited for long-term investing and dollar-cost averaging |

Understanding these differences helps beginners pick the best investments for beginners, balancing cost, simplicity, and investment goals.

If you’re exploring more low-cost investing options or want to dig deeper into how index funds for new investors work, this side-by-side snapshot is your starting point.

For a practical guide on managing your brokerage account setup or understanding how to build a solid base, check out resources on managing your portfolio and emergency funds like this guide on why you need an emergency fund and how to build it efficiently.

Which Is Cheaper? Breaking Down Expense Ratios, Trading Fees, and Total Costs

When it comes to ETF vs mutual fund differences, cost is a big factor for beginners. Generally, ETFs tend to be cheaper overall, but the details matter.

Expense Ratios

ETFs usually have lower expense ratios than mutual funds, especially actively managed ones. This is because many ETFs track indexes like the S&P 500, making them passively managed and low-cost. Mutual funds, on the other hand, can be actively or passively managed, but active funds often have higher fees due to management costs.

Trading Fees

ETFs trade like stocks, so you pay a commission or trading fee each time you buy or sell. This can add up if you trade frequently, but many brokers now offer commission-free ETF trades, making this less of a concern. Mutual funds don’t have trading fees but may charge sales loads or redemption fees on certain funds.

Minimum Investment and Other Costs

Mutual funds often require a minimum investment amount, which can be several hundred or even thousands of dollars. ETFs, thanks to their stock-like nature, can be bought in single shares, allowing for smaller initial investments. Taxes can also differ, with ETFs generally being more tax-efficient due to how they’re structured.

Total Costs in Practice

- ETFs: Lower expense ratios + potential trading fees

- Mutual Funds: Possibly higher fees + no trading commissions but may include minimum investments and sales loads

For beginner investors seeking low-cost investing options and expense ratios comparison, ETFs might edge out mutual funds as the cheaper choice overall, especially if you’re building a diversified portfolio with index funds.

If you want a deeper look at how fees impact your investing journey, check out guides on best investments for beginners to get a clearer picture of low-cost options and fee structures.

Which Is Simpler for Beginners? Ease of Use, Learning Curve, and Common Pitfalls

When it comes to simplicity, mutual funds generally have the edge for beginners. That’s because mutual funds are bought and sold at the end-of-day net asset value (NAV), so you don’t need to worry about intraday price fluctuations or timing your trades. You simply pick a fund, invest your money, and let the fund manager handle the rest. This hands-off approach means less stress and a gentler learning curve, especially for those just starting to build a diversified portfolio.

ETFs, on the other hand, trade like stocks throughout the day. This offers flexibility but can complicate things for new investors, who might be tempted to time buys and sells based on price swings. ETFs require a brokerage account and often some basic knowledge of order types, which can trip up beginners. However, they align well with passive investing strategies like S&P 500 index trackers and allow intraday trading for those ready to take more control.

Common pitfalls with mutual funds involve sometimes higher minimum investment requirements and confusing expense structures, but these can be manageable with some initial research. ETFs tend to be more transparent with their fees, making it easier to spot low-cost investing options. Still, new investors should be cautious about trading fees and avoid frequent buying or selling that eats into returns.

In , mutual funds are typically simpler to use because of their straightforward pricing and set-it-and-forget-it nature. ETFs can be great for beginners once they get the hang of the trading basics, but the initial learning curve is steeper. For beginners focused on ease, starting with mutual funds might feel less overwhelming, while those interested in tax-efficient investments or lower costs might gradually explore ETFs.

For more on managing fees in your long-term investments, you may find this guide on long-term investing fees helpful.

Pros and Cons for Beginner Investors: ETFs vs Mutual Funds Practical Advantages and Drawbacks

Choosing between ETFs and mutual funds means weighing the pros and cons based on what fits your investing style as a beginner. Here’s a straightforward look at each:

ETFs: What Beginners Like and Should Watch Out For

Pros:

- Lower costs: ETFs often have lower expense ratios compared to many mutual funds, making them a more affordable choice for low-cost investing options.

- Intraday trading: You can buy and sell ETFs anytime during market hours, which adds flexibility.

- Tax efficiency: ETFs tend to be more tax-efficient, helping you keep more of your gains.

- No minimum investment: Many ETFs don’t require a minimum investment, perfect for those just starting.

Cons:

- Trading fees: Although many brokers now offer commission-free trades, some still charge fees. This can add up if you trade frequently.

- Price fluctuations: Since ETFs trade like stocks, their prices can swing during the day, which might be overwhelming for newbies.

- Requires a brokerage account: To buy ETFs, you’ll need to set up and manage a brokerage account.

Mutual Funds: Beginner Benefits and Drawbacks

Pros:

- Simpler investing: Mutual funds trade only once daily, at their net asset value (NAV), which removes intraday price uncertainty.

- Automatic investing options: Many mutual funds allow easy automatic monthly contributions, ideal for dollar-cost averaging beginners.

- Professional management: Active mutual funds often have managers picking stocks for you, which can be reassuring if you prefer hand-holding.

Cons:

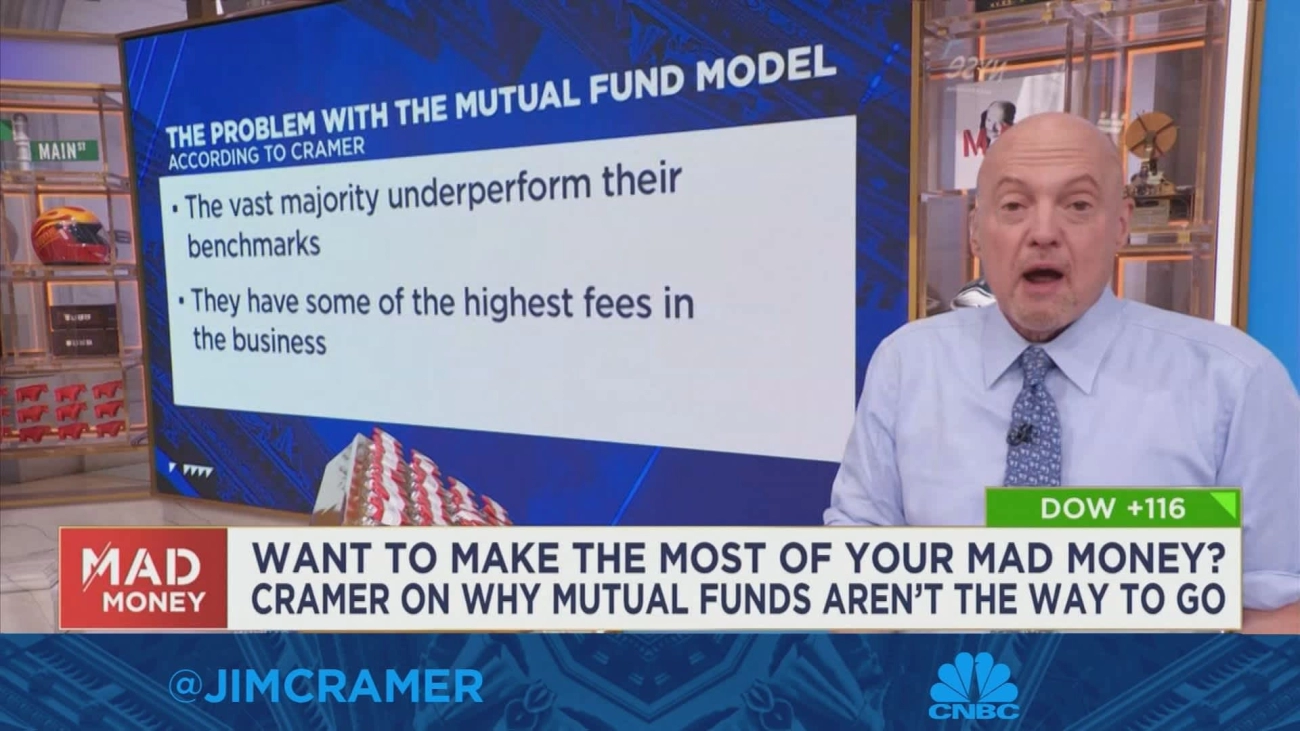

- Higher fees: Mutual funds usually come with higher expense ratios and sometimes sales loads (fees), which can eat into long-term returns.

- Minimum investment requirements: Some mutual funds require initial investments of $1,000 or more — a hurdle for new investors.

- Less tax-efficient: Mutual funds often generate capital gains distributions, leading to higher taxes compared to ETFs.

Bottom Line for Beginners

- ETFs are typically better if you want more control, lower costs, and tax efficiency.

- Mutual funds are simpler if you prefer a hands-off approach with professional management and easy automatic investing, despite potentially higher fees.

For more on making low-cost, diversified portfolio starters work for you, check out practical tips on should you get rid of your actively managed funds. This can help you decide whether to lean toward ETFs or mutual funds for your goals.

When to Choose ETFs Over Mutual Funds (and Vice Versa)

Choosing between ETFs vs mutual funds depends on your investment goals, style, and budget. Here’s a quick guide to help you decide when each makes sense, plus ideas for using both.

| Scenario | Pick ETFs If… | Pick Mutual Funds If… |

|---|---|---|

| You want low-cost investing options | You want to keep fees super low with expense ratios often below mutual funds | You’re okay paying slightly higher fees for active management or target-date funds |

| You prefer intraday trading | You want to buy and sell any time during market hours like stocks | You’re fine trading only once a day at the net asset value (NAV) price |

| You’re building a diversified portfolio starter | You want broad market exposure easily via index funds like S&P 500 trackers | You want access to specialized actively managed funds or automatic reinvestment |

| You want tax-efficient investments | You want to limit capital gains taxes with ETFs’ tax structure | You don’t mind possible higher tax events from active fund trading |

| You have a smaller budget to start | You can buy as little as one share, no minimum investment | You may face minimum investment requirements ($500+ usually) |

| You prefer simplicity and automation | You’re comfortable with a brokerage account and online trading | You prefer automatic investing plans or workplace retirement accounts |

Hybrid Strategies: Using Both Together

Many beginners benefit by mixing ETFs and mutual funds:

- Use low-cost ETFs for broad index exposure, keeping costs down.

- Add mutual funds for target-date or sector-specific goals.

- Dollar-cost average using mutual funds for steady investing.

- Take advantage of ETFs for tactical or intraday moves.

This balanced approach works well globally, especially for investors who want to keep it simple but flexible.

Choosing between ETFs and mutual funds isn’t about one or the other—it’s about matching your style and budget. Keep this guide handy when planning your next investment move!

How to Get Started as a Beginner: Step-by-Step Guide for ETFs and Mutual Funds

Starting your investment journey with ETFs or mutual funds doesn’t have to be confusing. Here’s a simple, step-by-step guide to get you going with these low-cost investing options:

1. Set Your Investment Goals

- Decide if you’re saving for the long term (like retirement) or short term.

- Think about how much risk you’re comfortable with.

2. Choose Between ETFs and Mutual Funds

- ETFs offer intraday trading and usually lower expense ratios.

- Mutual funds can be easier for beginners because of automatic investments and simpler buying at net asset value.

- Consider minimum investment requirements—some mutual funds require more money upfront.

3. Open a Brokerage Account

- Pick a platform that supports both ETFs and mutual funds.

- Look for low or no trading fees, since those costs add up.

- Set up your account with basic info and link your bank.

4. Research Funds

- Use the platform to search funds that fit your goals—look for broad market index funds like S&P 500 index trackers.

- Check passive vs active management styles.

- Compare expense ratios and tax efficiency (ETFs are often more tax-friendly).

5. Start Small & Use Dollar-Cost Averaging

- Begin with a manageable amount to reduce risk.

- Invest regularly, like monthly, to smooth out market ups and downs.

6. Monitor & Adjust

- Keep an eye on your investments but avoid overchecking.

- Rebalance your portfolio once or twice a year to stay diversified.

Quick Tips:

- ETFs can be traded like stocks anytime during market hours.

- Mutual funds generally trade once a day at the net asset value price.

- Both support building a diversified portfolio starter for beginners.

This approach helps you ease into investing without stress while growing your money steadily. By focusing on low-cost, tax-efficient investments, you set yourself up for long-term success.

FAQs: Common Questions About ETFs and Mutual Funds

1. What’s the main difference between ETFs and Mutual Funds?

ETFs trade like stocks on an exchange throughout the day, with prices changing constantly. Mutual funds trade only once per day after the market closes, priced at their Net Asset Value (NAV).

2. Which is cheaper for beginners: ETFs or mutual funds?

Generally, ETFs have lower expense ratios and no minimum investments, but you might pay a small trading fee. Mutual funds can have higher fees and minimum investments but often don’t charge trading fees.

3. Can I use dollar-cost averaging with ETFs?

Yes, but it can be trickier since ETFs trade like stocks. You’d need to set up regular purchases with your brokerage. Mutual funds often let you set up automatic investments easily, which can be great for beginners.

4. Are ETFs more tax-efficient than mutual funds?

Typically, yes. ETFs are structured to minimize capital gains taxes, making them more tax-efficient for long-term investors compared to many mutual funds.

5. Can I buy index funds as ETFs or mutual funds?

Absolutely. Many popular index funds, including S&P 500 trackers, are available both as ETFs and mutual funds, giving you options based on costs and convenience.

6. What about the minimum investment requirements?

ETFs usually don’t have minimum investments beyond the cost of one share, which could be affordable. Mutual funds sometimes require minimums, like $500 or $1,000, which might be a hurdle for new investors.

7. Are ETFs good for intraday trading?

Yes, ETFs allow intraday trading, letting you buy or sell anytime during market hours. Mutual funds don’t offer this because they only trade once daily.

8. Do I need a brokerage account for both ETFs and mutual funds?

Yes, a brokerage account is required to buy and sell ETFs. For mutual funds, you can buy through a brokerage or directly from the fund company.

9. Which is better for building a diversified portfolio?

Both are great for diversification, especially with index funds. ETFs and mutual funds hold many stocks or bonds in one investment, helping beginners spread risk easily.

10. How do I get started with ETFs or mutual funds?

Start by choosing a low-cost provider, open a brokerage account, and pick funds aligned with your goals. Consider your investment timeline, fees, and ease of use. Many beginners like starting with index ETFs or low-cost mutual funds.

If you have more questions about ETFs vs mutual fund differences or want tips on low-cost investing options, these answers should help you get started confidently. Remember, simplicity and cost-efficiency matter most when you’re new to investing!