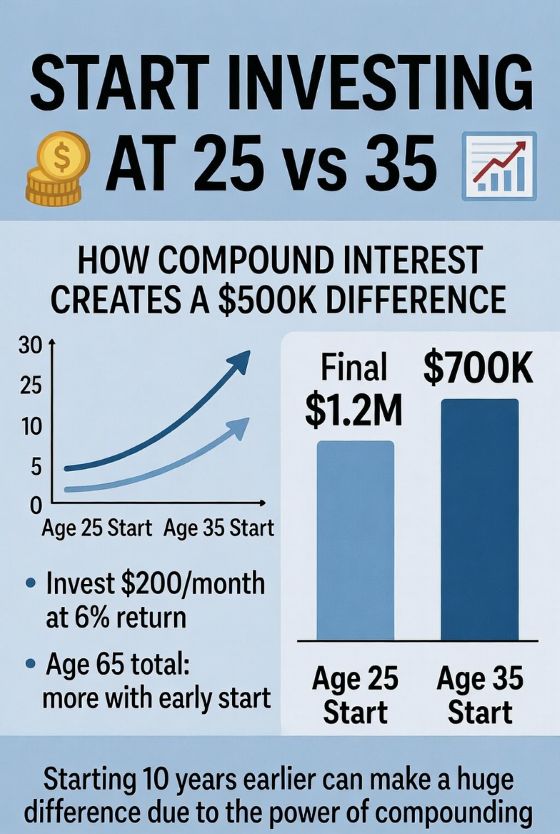

Imagine this: by starting to invest at 25 instead of 35, you could walk away with over $500K more by the time you retire—all thanks to the magic of compound interest. It’s not just about how much you put in; it’s about how long your money has to grow. In this post, you’re going to discover why time in the market beats timing the market, how a single decade can create a six-figure difference, and what that means for your financial future. Ready to see how powerful starting early really is? Let’s dive in.

The Power of Compound Interest

Compound interest is simply earning interest on your initial money (the principal) plus all the interest it has already earned. Think of it as a snowball effect where your investment grows faster with time because each new gain adds to the base that earns the next round of interest.

The magic formula behind compound interest is:

A = P(1 + r/n)^(nt) + contributions

Where:

- A = the amount of money accumulated after time (including interest)

- P = the principal or starting amount

- r = annual interest rate (decimal form, e.g., 0.07 for 7%)

- n = number of times interest compounding happens per year

- t = number of years invested

- contributions = additional money regularly invested over time

Here’s a simple example: If you start with $1,000 at a 7% annual return, compounded monthly, your money keeps growing not just on the $1,000 but also on all the accumulated interest.

Visualizing Compound Growth Over Time

| Year | Principal + Contributions | Interest Earned That Year | Total Value by Year End |

|---|---|---|---|

| 1 | $6,000 ($500/month) | $210 | $6,210 |

| 10 | $60,000 | $19,921 | $79,921 |

| 20 | $120,000 | $101,697 | $221,697 |

| 40 | $240,000 | $1,326,993 | $1,566,993 |

Note: Assumes $500 monthly contributions at 7% annual return, compounded monthly.

This table clearly shows how compound interest accelerates growth, especially after many years. You don’t just earn on what you put in—you earn on the earnings from previous years. That’s the power of compounding working for your retirement savings and long-term investments.

Using a compound interest calculator or planning tool can help visualize this growth and highlight just how valuable starting early is for your financial future.

Keywords used: compound interest, compound interest calculator, power of compounding, retirement savings by age, stock market returns historical

Side-by-Side Comparison: Investing at 25 vs. 35

Let’s break down a simple scenario to see how starting 10 years earlier impacts your retirement savings:

- Monthly contribution: $500

- Average annual return: 7% (historical stock market returns)

- Investment period: Until age 65

| Age Started | Years Invested | Total Contributions | Estimated Final Balance* |

|---|---|---|---|

| 25 | 40 | $240,000 | $1.2M – $1.5M |

| 35 | 30 | $180,000 | $600K – $800K |

*Final balance range accounts for variations in market growth and reinvestment

The $500K+ Gap

Starting at 25 instead of 35 results in over $500,000 more by retirement. This difference comes from an extra 10 years of compound growth, highlighting the power of time in the market.

Interestingly, the early investor contributes just $60,000 more but ends up with nearly double the portfolio size. This is why those extra years counting can’t be overstated.

If you want to see how adjustments in contributions or returns affect outcomes, tools like a compound interest calculator can be a great way to experiment with different scenarios.

For more on managing your finances effectively, check out practical tips in 3 budgeting methods for beginners.

Real-World Examples and Variations

To see the true power of compound interest, let’s look at different rates and contribution amounts. Say you invest anywhere from $200 to $1,000 per month, with average annual returns ranging from 5% to 10%. At 5%, growth is steady but slower, while 8% or 10% reflects more aggressive stock market returns historically seen over the long term. Over 30-40 years, even small monthly contributions can grow significantly thanks to the power of compounding.

What about catch-up strategies? If someone starting at 35 doubles their monthly investment compared to a 25-year-old, the gap does narrow but doesn’t completely close. That extra 10 years of compounding still gives the earlier investor a substantial edge. This highlights how “time in the market” matters as much as the amount invested.

It’s important to factor in inflation and risk. Historically, real stock market returns (after inflation) hover around 7-10%, which means your investment’s purchasing power can stay intact or grow over time despite inflation pressures. Of course, higher returns often come with higher risks, so balancing your portfolio is key.

For those interested in safe ways to grow wealth or looking for alternatives to stocks, options like money market funds or bonds can play a role. You can explore more on low-risk alternatives to stock investing to diversify your strategy.

By adjusting your monthly contributions and understanding different return rates, you get a clearer picture of how much your money can grow over time — showing why starting earlier is such a game changer.

Why the 10-Year Head Start Matters So Much

Starting to invest at 25 instead of 35 gives you a crucial advantage because of exponential growth. Your early dollars have 40 years to compound instead of 30, which means they don’t just grow linearly—they grow faster over time as interest earns interest. This is the real power of compound interest and why time in the market beats timing the market.

The Rule of 72 helps illustrate this: at a 7% average annual return, your money roughly doubles every 10 years. So, money invested at 25 could double four times by retirement, while money invested at 35 only doubles three times. That extra doubling period alone can create a $500K+ difference in your final balance.

There are also psychological and practical barriers holding many people back from investing earlier: dealing with student debt, lifestyle inflation, or simply earning a lower salary in their 20s. Overcoming these obstacles early can lead to financial independence sooner and more comfortably. Recognizing these factors is key to adopting a long-term investment strategy that benefits from early retirement planning and exponential wealth growth.

Practical Steps to Start Investing Now

Getting started with investing doesn’t have to be complicated. Here’s a simple roadmap to help you build a solid foundation and take advantage of compound interest early:

1. Build an Emergency Fund

- Save 3–6 months of essential expenses in a separate savings account

- This fund protects you from dipping into investments during sudden costs

2. Pay Off High-Interest Debt

- Clear credit cards or loans with rates above 7%

- Reduces financial stress and frees up money for investing

3. Choose the Right Investment Accounts

| Account Type | Benefits | Notes |

|---|---|---|

| 401(k) | Employer match, tax advantages | Maximize your employer match first |

| Roth IRA | Tax-free growth, flexible access | Great for long-term growth |

| Brokerage | No contribution limits, flexible | For extra investing beyond retirement accounts |

4. Start with Low-Cost Index Funds

- S&P 500 ETFs are ideal for beginners

- Offer broad market exposure with low fees

- Proven track record of solid stock market returns over decades

5. Automate Your Contributions

- Set up monthly automatic transfers to your investment account

- Keeps your investing consistent, benefiting from time in the market and the power of exponential wealth growth

Taking these steps early can make your path to financial independence smoother and less stressful. For more investment basics and strategies, check out our detailed investment guides.

Common Myths and Counterarguments

“I’ll invest more later” is a common excuse, but it misses the power of compound interest. Starting early means your money has more time to grow exponentially. Waiting even a few years can cost you hundreds of thousands because compounding rewards time in the market, not just bigger contributions.

| Myth | Reality |

|---|---|

| “I’ll invest more later” | Early contributions grow more due to compound interest |

| “Stocks are too risky now” | Time in the market generally smooths out volatility |

| “I’ll wait to be financially stable” | Inflation erodes cash, so waiting reduces buying power |

| “It’s too late if I’m 35+” | Starting at 35 still builds significant retirement wealth |

Another myth is that stocks are too risky, so it’s safer to wait. However, inflation silently eats away at cash savings. Historically, stock market returns after inflation average 7–10%, making investing the smarter long-term strategy.

Finally, it’s important to know it’s never too late to start investing. Even if you begin at 35+, you can still build a solid nest egg with consistent contributions. The key is to get started now and automate your investments. For a deeper dive into managing risk and smart investment choices, check out strategies on financial independence and retirement savings by age.