Supporting aging parents financially is a challenge many adult children face sooner than expected. With longer lifespans and rising care costs, knowing when and how to plan financially can make all the difference between stress and security. Whether you’re just starting the conversation or already managing bills and healthcare expenses, having a clear, proactive strategy helps protect both your parents’ independence and your own financial future. In this guide, you’ll discover practical steps to recognize the right timing, organize finances effectively, and navigate complex resources—so you can support your aging parents with confidence and care. Let’s get started.

Recognizing the Signs It’s Time to Step In

Supporting aging parents financially starts with knowing when it’s necessary to step in. Often, early signs of financial vulnerability are subtle but important to catch. Keep an eye out for:

- Unpaid or late bills: Missed payments might mean they’re struggling to keep track of expenses.

- Confusion handling money: Trouble balancing a checkbook, misunderstanding bank statements, or repeating questions about finances.

- Frequent scams or suspicious calls: Older adults are often targeted by fraudsters, so increased phone scams or unusual financial activity are red flags.

Certain age milestones and life events also signal that financial planning is urgent:

- Retirement: Income sources change, so reviewing and adjusting budgets becomes critical.

- Health changes: Memory loss, mobility issues, or hospitalizations can impact their ability to manage money.

- Widowhood: Losing a spouse often disrupts financial routines and decision-making.

At the same time, it’s essential to balance respect for your parents’ independence with the need for intervention. Let them lead where possible but be ready to assist before problems escalate. Encouraging open communication and gently monitoring their financial situation will help you support them without overstepping. This proactive approach can prevent elder financial abuse and protect your parents’ assets while preserving their dignity.

Starting the Conversation: How to Talk About Finances Sensitively

Knowing when and how to bring up financial planning for elderly parents can be tricky. Choose a calm, private moment—perhaps during a family gathering or a relaxed weekend. Avoid times when your parents feel rushed or stressed. The goal is to create a safe space where they feel heard and respected.

Frame the discussion around care and security, not control. Emphasize that your aim is to support their independence and protect their financial future, not to take over. For example, you might say, “I want to make sure we’re prepared for anything, so you can stay comfortable and secure.”

Here are some gentle questions to open the conversation:

- “Can we review your current financial setup together to see if anything needs updating?”

- “Are there any worries you have about managing money or healthcare costs?”

- “Would you feel comfortable sharing details about your budget or bills so I can help if needed?”

If you have siblings, involve them in the conversation early to share responsibilities and avoid misunderstandings. Sometimes, bringing in a neutral third party, like a financial planner or elder law attorney, can help provide an unbiased perspective and make parents feel more at ease.

This sensitive approach will pave the way for effective financial planning and strengthen trust within the family. For help with managing day-to-day expenses and automating bills, see how building a sustainable budget can ease the process.

Assessing Your Parents’ Current Financial Situation

The first step in supporting aging parents financially is to get a clear picture of their current financial status. Start by gathering essential documents like bank statements, investment account details, debts, income sources, and bills. This helps create a complete inventory of assets—such as savings, real estate, and retirement funds—as well as liabilities, including loans or credit card balances.

Understanding their cash flow is key: track regular income (like Social Security or pensions) against monthly expenses to spot any shortfalls. At this stage, look for gaps in their financial safety nets. Are retirement savings enough to cover future needs? Do they have adequate insurance, including health and long-term care coverage? Is there an emergency fund to handle unexpected costs?

Taking this thorough approach to financial planning for elderly parents prevents surprises and sets a strong foundation for ongoing support. For those looking to better manage everyday finances or plan for future care, it’s also useful to explore strategies for budgeting and automating bills, which we’ll discuss in the next sections.

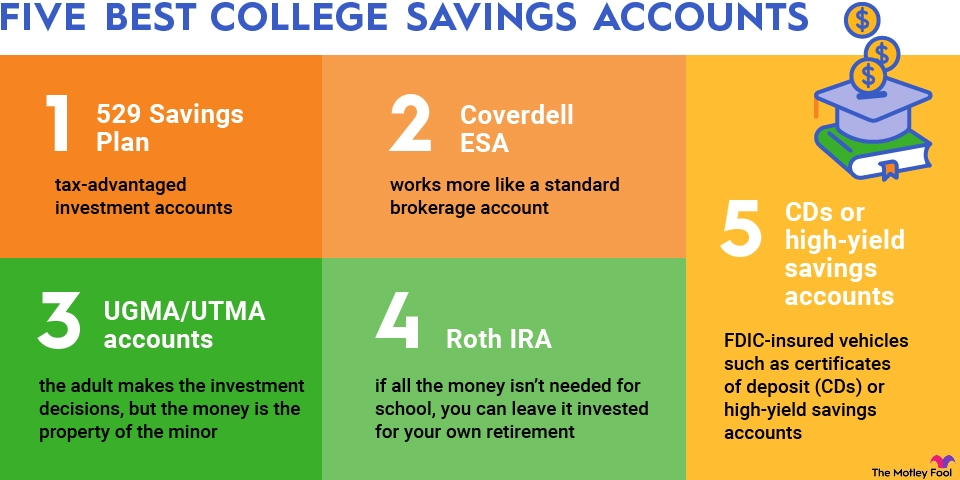

If you want to understand more about building a secure savings strategy, check out how high-yield savings accounts can play a role in managing cash flow effectively.

Essential Legal Tools and Documents

When supporting aging parents financially, having the right legal documents in place is crucial. Power of attorney is one of the most important tools—it allows a trusted person to manage your parents’ financial and healthcare decisions if they become unable to do so. There are two main types: financial power of attorney, which covers money matters, and healthcare power of attorney, which relates to medical decisions.

Next, ensure your parents have updated wills, trusts, and advance directives. Wills specify how assets should be distributed, trusts can help manage and protect assets, and advance directives outline healthcare wishes if they can’t communicate their preferences.

Review beneficiary designations and joint accounts carefully. These often override wills, so keeping them current prevents surprises and legal confusion.

If the situation feels complex or sensitive, consider when and how to consult an elder law attorney. These specialists can help with Medicaid planning for parents, estate planning for seniors, and navigating long-term care costs for seniors, ensuring all legal documents align with your parents’ wishes and financial safety.

Having these tools set up early can prevent elder financial abuse and make caregiving smoother for adult children financially responsible for their parents. For more on protecting your family’s finances, check out strategies on portfolio rebalancing and how to manage savings effectively.

Budgeting and Managing Day-to-Day Finances

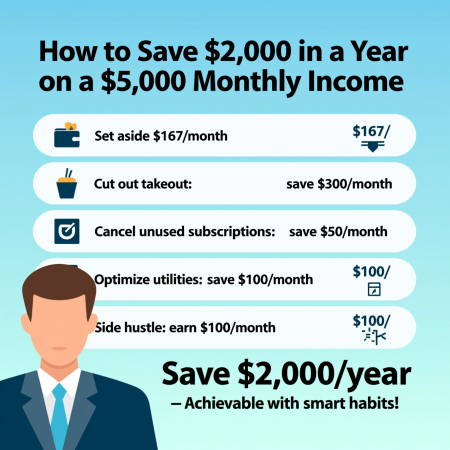

Creating a sustainable budget for your aging parents is a vital step in supporting their financial stability. Start by listing all monthly income sources—Social Security, pensions, investments—and subtract fixed expenses like housing, utilities, and healthcare costs. Make sure to allocate funds for variable expenses such as groceries, transportation, and leisure, keeping their lifestyle in mind.

Automating bill payments can reduce the risk of missed payments and ease the daily management of finances. Set up alerts to monitor transactions for unusual activity, which helps protect against elder financial abuse or scams. Regular reviews of bank and credit card statements are key to catching fraud early.

To stretch resources further, consider practical strategies like downsizing their living space to reduce maintenance and utility bills or consolidating multiple bank and investment accounts to simplify management and minimize fees. These moves can free up funds for additional needs, such as long-term care or emergency expenses.

For help with budgeting tools, exploring user-friendly options like reliable budgeting apps that actually work can make it easier for both you and your parents to keep track of finances day-to-day.

By managing these basics proactively, you’ll provide a solid foundation for healthy financial planning for elderly parents and help preserve their independence while ensuring their needs are met.

Planning for Long-Term Care and Healthcare Costs

When supporting aging parents financially, understanding the costs tied to long-term care and healthcare is crucial. Medicare covers many healthcare services but has limits, especially for long-term care. Medicaid eligibility varies by state and often helps cover nursing home costs for those with limited income and assets. Exploring supplemental options like Medicare Advantage or Medigap plans can help fill coverage gaps.

Evaluating long-term care insurance is an important step to consider. These policies can help cover expenses for in-home care, assisted living, or nursing facilities. If insurance isn’t an option, alternative funding methods such as veterans’ benefits or personal savings are worth looking into. Estimating future costs based on care preferences will give a clearer financial picture.

Also, remember that caregiving expenses may have tax implications. Some costs could be deductible or qualify for tax credits, so keeping thorough records is key when planning a family caregiving budget. This kind of elder financial planning for seniors helps ease the burden and ensures your parents get the care they deserve without unexpected financial strain.

Government and Community Resources for Financial Assistance

When supporting aging parents financially, tapping into government and community resources can make a big difference. Federal programs like Social Security provide steady retirement income for aging adults, while Supplemental Security Income (SSI) offers help to those with limited income and resources. Veterans benefits are another valuable option for eligible seniors, often covering healthcare, housing, and other essentials.

At the state and local level, Area Agencies on Aging offer a range of services—from meal delivery programs to transportation and caregiver support—which can ease the financial and daily living burdens for seniors and their families. These agencies also help connect families with resources tailored to their situation.

Many non-profit organizations provide financial assistance or services specifically for low-income seniors. Qualifications vary, but these groups often support elder financial abuse prevention and offer counseling or emergency aid to help cover unexpected costs. Exploring these options can fill gaps where traditional savings or insurance may fall short.

For more practical tips on managing the day-to-day spending and avoiding unnecessary expenses, consider reviewing guides on emotional money management to better handle financial conversations and decisions surrounding your parents’ care.

By leveraging these government and community resources, you can build a stronger safety net and ensure your parents get the support they deserve without overwhelming your own finances.

Options for Family Financial Support

Supporting aging parents financially can take many forms, but it’s important to do so in ways that don’t risk their eligibility for government aid or create family tension. Here are some practical options:

Direct Contributions Without Affecting Aid

- Gifts under the limit: Many aid programs, like Medicaid, have strict income and asset limits. Small, direct financial contributions from family members may be allowed if kept under certain thresholds.

- Paying bills directly: Instead of giving cash, pay regular expenses like utilities, rent, or medical bills to avoid increasing your parents’ reportable income.

Shared Family Plans & Sibling Coordination

- Pooling resources: Family members can create joint budgets or funds to cover your parents’ needs without overwhelming one person.

- Clear communication: Set expectations with siblings on who pays what to avoid conflicts.

| Benefit | Strategy | Notes |

|---|---|---|

| Dividing expenses | Monthly contributions from siblings | Use shared spreadsheets or apps to track |

| Avoiding duplication | Assign specific bills or types of care | Keeps everyone accountable |

| Flexibility | Adjust contributions based on capacity | Helps during unexpected expenses |

Reverse Mortgages and Home Equity Options

- Reverse mortgage: Allows seniors to access the equity in their home without monthly payments, supplementing retirement income or healthcare costs.

- Home equity line of credit (HELOC): A traditional loan against home value that can fund medical bills or caregiving expenses but must be repaid.

Life Insurance Solutions

- Life insurance cash value: Some policies build cash value that your parents can borrow against.

- Selling a policy: Life settlement programs let seniors sell unnecessary policies for immediate funds.

Before using these options, it’s wise to consult professionals to understand implications on retirement income, tax consequences, and aid eligibility. This kind of multigenerational financial planning helps protect your parents’ future while balancing the family’s resources.

For more on managing ongoing expenses and planning finances responsibly, explore strategies on managing social obligation spending without guilt.

Protecting Your Own Financial Future

Supporting aging parents financially is important, but it shouldn’t come at the cost of your own financial security. Avoiding burnout means setting clear boundaries on how much time, money, and energy you can realistically contribute. It’s okay to say no or delegate tasks to siblings or other trusted helpers to keep your balance.

Make sure to include your parents’ care needs in your own retirement and emergency planning. This means factoring in potential expenses, like long-term care costs for seniors, and adjusting your savings goals accordingly. Creating a sustainable plan helps protect your future while providing reliable support.

When managing these complexities, consider seeking professional financial advice. An elder law attorney or a financial planner experienced in multigenerational financial planning can help navigate legal documents like power of attorney, as well as optimize resources without jeopardizing benefits. Getting expert guidance early ensures you’re making thoughtful, sustainable decisions for both your parents and yourself.

Common Mistakes to Avoid and Real-Life Scenarios

When supporting aging parents financially, some mistakes can be costly and stressful. One big error is delaying conversations about money. Assuming “they’re fine” often leads to missed signs of financial trouble, like unpaid bills or vulnerability to scams. Starting discussions early helps avoid surprises and sets a foundation for solid financial planning for elderly parents.

Another common pitfall is overlooking fraud risks or not having proper legal documents in place. Without tools like a power of attorney or updated wills, managing your parents’ finances can get complicated, especially during emergencies. Elder financial abuse prevention should be a priority—regularly monitoring accounts and being vigilant about unusual activity is vital.

Real-life cases show how planning can change outcomes:

- Successful scenario: A family gathered early, involved siblings, and consulted an elder law attorney. They created a clear budget, legal protections, and long-term care plan—reducing stress and preserving assets.

- Challenging scenario: Another family ignored early signs, delayed paperwork, and missed chances to qualify for Medicaid assistance. This led to financial strain and difficult care decisions.

Avoiding these mistakes and learning from real examples can strengthen your approach to caring for aging parents financially. For multigenerational planning insights, it’s wise to seek professional advice to protect both your parents’ and your own financial future.