What Diversification Really Means

Diversification is more than just owning a bunch of stocks—it’s a smart strategy to spread your investments across different assets to minimize the impact if one investment performs poorly. Think of it as not putting all your eggs in one basket. This idea goes beyond just owning multiple stocks; it involves balancing investments across various asset classes like bonds, real estate, and commodities.

At its core, diversification aims to reduce portfolio volatility without sacrificing potential returns. According to modern portfolio theory, a well-diversified portfolio can weather market ups and downs better by balancing risk and reward. By mixing assets that don’t move in sync, you can protect your investments from the impact of a single asset’s drop—helping you stay on track with your long-term financial goals.

Common Myths About Diversification

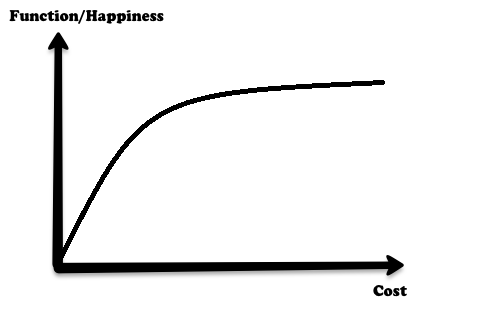

Many investors believe that owning 10 to 30 stocks automatically means they have a well-diversified portfolio. However, studies show that risk reduction from holding this number of stocks is limited, as company-specific risk only drops so far. Beyond about 20 to 30 stocks, adding more stocks offers diminishing returns in risk reduction.

Another myth is that piling on more stocks always improves diversification. In reality, over-diversification can dilute potential gains and complicate portfolio management without significantly cutting risk. Diversification isn’t just about quantity—it’s about quality and how investments interact.

Some also think diversification guarantees no losses or protection during market crashes. Unfortunately, no level of diversification can fully shield you from systematic risks like recessions or market-wide downturns.

Lastly, many believe diversification applies only to stocks. True portfolio diversification requires multi-asset exposure—across bonds, real estate, commodities, and cash—to manage risk effectively and improve returns.

Understanding these common misconceptions helps avoid pitfalls and build smarter, truly diversified investments. For ideas on balancing risk, exploring low-risk alternatives to stocks can be a smart next step.

Why Just Owning Multiple Stocks Falls Short

Owning several stocks does help reduce some risk, but only to a point. This is because diversification in stocks mostly tackles unsystematic risk—the risk specific to individual companies or sectors. Adding more stocks reduces the chance that one company’s poor performance will tank your whole portfolio. However, it doesn’t protect you from systematic risk, which affects the entire market, like recessions or global crises.

Stock-only portfolios face another challenge: during bull or bear markets, stocks tend to move in the same direction. This high correlation means that even owning multiple stocks doesn’t fully shield you from broad market swings. Research consistently shows that the benefits of adding stocks to your portfolio hit a limit after about 20 to 40 holdings. Beyond that, the risk reduction is minimal.

For true portfolio diversification and risk reduction, you need to go beyond just picking a bunch of stocks. That means including other asset classes and strategies to better manage overall portfolio volatility and guard against market-wide downturns.

The Key Elements of Effective Diversification

True diversification goes far beyond just owning many stocks. To build a well-rounded, risk-managed portfolio, you need to spread your investments across several important dimensions.

Across asset classes: Combining stocks with bonds, cash, real estate, and commodities helps reduce risk. Each asset class behaves differently in various market conditions, so this mix smooths out portfolio volatility and improves risk-adjusted returns.

Within stocks: Diversify across sectors and industries, like technology, healthcare, or consumer goods. Also, vary company sizes from large-cap to small-cap and balance growth versus value stocks to capture different market opportunities and reduce sector-specific risks.

Geographic exposure: Don’t limit yourself to domestic stocks. Adding international and emerging market investments diversifies risks related to any single economy or region.

Other important factors: Pay attention to correlation between assets—aim for those that don’t move in sync. Including different investment styles and non-correlated assets can further enhance diversification benefits.

By combining these elements—asset allocation, sector diversification, and geographic spread—you create a more resilient portfolio. For those interested in building such diversified portfolios, exploring index funds or ETFs can be an easy way to access this broad exposure efficiently and cost-effectively.

For a deeper understanding of how to automate diversified investing strategies and maintain a balanced portfolio over time, check out practical tips on automate your savings the set-and-forget way to grow wealth.

Asset Allocation: The Foundation of True Diversification

While diversification means spreading your investments, asset allocation is about how you divide your money across different asset classes based on your financial goals, risk tolerance, and time horizon. It’s the blueprint that determines your portfolio’s balance between stocks, bonds, cash, and other investments.

Key Differences Between Diversification and Asset Allocation

| Aspect | Diversification | Asset Allocation |

|---|---|---|

| Focus | Variety within and across investments | Percentage split across asset classes |

| Purpose | Minimize risk from individual holdings | Align risk and return with personal goals |

| Scope | Stocks, bonds, sectors, regions, investment styles | Stocks, bonds, cash, real estate, commodities |

| Outcome | Reduces unsystematic risk | Controls overall portfolio volatility and growth |

Sample Asset Allocation Models

| Portfolio Type | Stocks (%) | Bonds (%) | Cash (%) | Other Assets (%) | Risk Level |

|---|---|---|---|---|---|

| Aggressive | 80-90 | 10-15 | 0-5 | 0-5 | High risk, high growth |

| Moderate | 50-60 | 30-40 | 5-10 | 0-10 | Balanced risk and return |

| Conservative | 20-40 | 50-60 | 10-20 | 0-10 | Low risk, capital preservation |

Why Rebalancing Matters

As markets move, your initial allocation will shift — stocks may grow faster, pushing the ratio out of balance. Regular portfolio rebalancing ensures you maintain your intended asset mix, managing risk and optimizing returns over time.

If you’re just getting started with budgeting for investing, this guide on budgeting methods for beginners can help you plan your contributions effectively.

Asset allocation is the foundation of a truly diversified portfolio. Without it, simply owning a bunch of stocks doesn’t protect you against market ups and downs or align with your personal financial situation. Focus on spreading investments thoughtfully across asset classes and revisit your allocations regularly to stay on track.

Practical Strategies to Build a Diversified Portfolio

Building a truly diversified portfolio takes more than just picking a bunch of stocks. For stock pickers, start with a minimum guideline of 20+ stocks spread across different sectors to avoid concentration risk. Balancing sectors like tech, healthcare, finance, and consumer goods helps reduce the impact of a downturn in any one area.

If you want a simpler route, consider index funds, ETFs, or mutual funds. These options offer broad exposure across multiple asset classes, industries, and geographies with minimal effort. They’re cost-effective and automatically handle diversification, making them ideal for those who prefer a hands-off approach.

When selecting investments, pay attention to correlation between assets—choose ones that don’t move in sync to reduce overall portfolio volatility. Tools like correlation analysis can be invaluable for identifying this. Also, keep costs low to maximize returns, and watch out for over-diversification, which can dilute gains without adding meaningful protection.

As a rule of thumb, combining 20+ individual stocks with other asset classes like bonds, real estate, or commodities usually creates more effective portfolio diversification than simply holding more stocks. For more insights on creating balanced investing strategies, check out our detailed posts on investing basics and expert guidance by trusted authors.

Benefits and Potential Drawbacks of Diversification

Diversification brings solid benefits, mainly lower portfolio volatility and better risk-adjusted returns. By spreading investments across different assets and sectors, your portfolio is less likely to take a big hit from any single market drop. This helps create peace of mind, knowing your money isn’t tied to just one outcome.

On the flip side, diversification can limit your upside during strong bull markets. A highly diversified portfolio may not soar as high as a concentrated one focused on a few high performers. Also, maintaining a diversified portfolio requires regular monitoring and rebalancing to stay aligned with your investment goals and risk tolerance.

Benefits vs. Drawbacks Snapshot

| Benefits | Potential Drawbacks |

|---|---|

| Lower overall portfolio volatility | Possibly lower returns in bull runs |

| Improved risk-adjusted returns | Ongoing maintenance and rebalancing |

| More consistent long-term growth | May feel slower in hot markets |

| Peace of mind and less stress | Complexity in managing multiple assets |

Long-term studies support that a diversified portfolio outperforms concentrated investments over full market cycles—handling downturns better and capturing steady gains. This aligns perfectly with modern portfolio theory and its focus on reducing risk without sacrificing returns.

For practical insights on managing your diversified holdings efficiently, you might find helpful tips in this guide on capital gains tax rates, as tax considerations can also impact the net benefit of your portfolio strategy.