Understanding Credit Card Interest Rates

When you’re trying to reduce credit card interest, the first step is knowing what APR means and how it impacts your balance.

APR stands for Annual Percentage Rate — it’s the yearly interest rate you pay if you carry a balance. The higher your APR, the more interest you get charged, which can make your debt grow fast.

Here are the main types of credit card APRs you should know:

| APR Type | Description |

|---|---|

| Purchase APR | Interest on everyday purchases you don’t pay off in full. |

| Balance Transfer APR | Interest on balances moved from another card, often lower during intro periods. |

| Penalty APR | Higher rates that kick in after missed payments or other violations. |

Your current APR depends on several factors:

- Credit score: A better score usually means a lower rate.

- Payment history: Consistently paying on time can help you negotiate a lower APR.

- Issuer policies: Each credit card company has different rules and flexibility.

- Account status: How much you owe and how long you’ve been a customer.

Temporary vs. Permanent Rate Reductions

- Temporary reductions: Sometimes issuers offer lower rates for a few months, like during hardship.

- Permanent reductions: These last until you or the issuer change them again, usually granted after successful negotiations.

Understanding how these APRs work and what affects your rate is the first step to negotiating credit card APR and saving on interest.

Assessing Your Eligibility for a Lower Rate

Before you call to negotiate a lower credit card interest rate, it’s important to assess whether you qualify for a rate reduction. Key factors that lenders look at include:

- Good payment history: Consistently paying at least the minimum on time is one of the strongest qualifiers.

- Loyalty as a customer: Longtime account holders with minimal late payments have better chances.

- Improved credit score: If your credit score has increased since you opened the account, that’s leverage for a lower APR.

To check your credit score and report, use free services from major bureaus or trusted credit monitoring sites. Having a clear picture of your credit standing strengthens your negotiation position.

Also, review your account details:

- Balance amount: Lower balances might prompt better rates but showing responsible usage helps.

- Credit utilization: Keeping your utilization ratio below 30% signals good credit management.

- On-time payments: Highlight your steady payment track record to improve your chances.

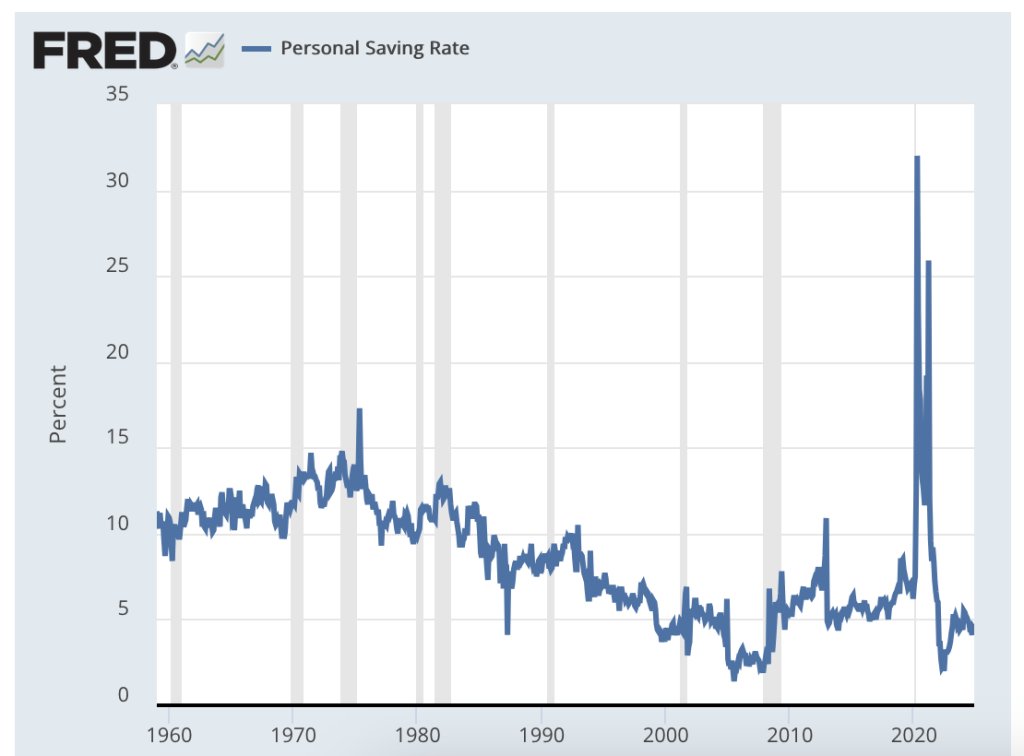

Knowing where you stand helps you approach the call confidently and boosts your chances to negotiate credit card APR reductions successfully. For more tips on managing your finances efficiently, you might want to explore strategies on automating your savings to grow wealth, which supports overall credit health.

Preparing to Negotiate

Before you call your credit card issuer to negotiate a lower interest rate, it’s important to do your homework. Start by researching competing credit card offers and current market rates to see what’s available. Understanding where your card’s APR stands compared to others gives you solid leverage in the conversation.

Next, gather all relevant account details: your current balance, APR, payment history, and any recent statements. Also, note the APRs from other credit cards you qualify for—these will be key when you bring up competing offers during your negotiation.

Timing your call matters. The best days to call are usually midweek—Tuesday, Wednesday, or Thursday—in the late morning or early afternoon. Avoid calling right after the statement closing date or during weekends when customer service is busiest. It’s a good idea to negotiate your rate annually or whenever you notice a higher rate or an opportunity to save.

When you’re on the call, keep your tone polite and confident. Be clear about your goal but ready to escalate the call to a retention specialist or supervisor if necessary. Staying calm and prepared makes a big difference in successful credit card APR negotiation.

For more insight on managing your finances and smart payment strategies, you can check out helpful guides like Paid and Broke by Friday: Try Pay Yourself First for budgeting tips that complement your negotiation efforts.

Step-by-Step Guide to Calling Your Issuer

When you’re ready to negotiate a lower credit card interest rate, the first step is knowing who to contact. Start by calling the retention department or asking specifically to speak with a supervisor. These teams handle requests to keep customers happy and may have more authority to offer a credit card APR reduction than regular customer service reps.

Here’s how to approach the call effectively:

- What to ask for: Clearly state that you want to negotiate a lower interest rate on your card. Use phrases like, “I’m calling to discuss lowering my current APR” or “I’d like to explore options for a better rate based on my good payment history.”

- Handling objections: If they say no, stay calm and polite. Ask what you need to qualify or if they can offer a temporary hardship rate. Sometimes simply asking if there are any promotions or loyalty discounts available can open doors.

- Mention transferring balance or closing accounts: If the issuer hesitates, politely mention you’re considering transferring your balance to a card with a lower APR or even closing your account if you don’t get a competitive rate. This can motivate them to negotiate.

- Document everything: Take notes during the call—names, dates, what was said, and any offers made. If an agreement is made, ask for confirmation in writing via email or letter.

- Follow up: If they need time to review your request, schedule a follow-up call. Persistence is key but always remain courteous.

By preparing this way, you improve your chances of successful credit card rate negotiation and potentially reduce your interest costs significantly. For some extra help, check out these APR negotiation tips to better understand the timing and strategy for your call.

Proven Negotiation Scripts for Lower Credit Card Interest Rates

When you’re ready to negotiate credit card APR, having a clear script can boost your confidence and results. Here are some proven negotiation scripts you can use, tailored for different situations:

Basic Polite Request Script

“Hello, I’ve been a customer for a while and always make on-time payments. I was wondering if you could help me lower my current interest rate to save on monthly interest?”

Loyalty and Payment History Script

“Hi, I’ve maintained a perfect payment history and have been a loyal customer for years. Given my record, could you offer me a better APR? I’d like to continue using this card but need a lower interest rate to manage my balance effectively.”

Using Competing Offers as Leverage

“I’ve recently been offered a 12% APR from another issuer on a similar card, but I’d prefer to stay with you. Can you match or beat this rate to keep my business?”

Escalation Script for Supervisors

“I appreciate your help so far. If it’s possible, I’d like to speak to a supervisor or someone in the retention department to discuss options for lowering my APR. I’m serious about finding the best rate to continue my account.”

Hardship Situation Variation

“Due to some recent financial difficulties, I’m struggling to keep up with my payments. Is there a hardship program or temporary rate reduction available to help me get back on track?”

Using these scripts when you call your credit card company for a lower rate can improve your chances of success. Stay calm, polite, and ready to explain why a lower rate matters to you. Document your conversations and follow up if needed.

For additional tips on timing your calls and handling responses, check out our guide on effective APR negotiation tips to maximize your savings.

What to Do If Negotiation Fails

Sometimes, despite your best efforts, negotiating a lower credit card interest rate doesn’t go as planned. Don’t worry—there are still effective options to help reduce your credit card interest and manage your debt.

1. Request a Temporary Hardship Rate Reduction

If you’re facing financial challenges, ask your issuer about a credit card hardship program. Many companies offer temporary APR reductions or payment plans that can ease your burden. Be honest about your situation and request a temporary rate cut to help you get back on track.

2. Explore Balance Transfer Cards with 0% Intro APR

Another smart move is to transfer your balance to a card offering a 0% introductory APR on balance transfers. This can save you significant interest while you pay down your debt. Just be sure to check any transfer fees and the length of the introductory period to maximize your savings.

3. Consider Debt Consolidation or Personal Loans

Debt consolidation loans or personal loans with lower interest rates can replace high APR credit card debt. These options simplify payments and often come with better rates, helping you save on interest and accelerate payoff. Always compare loan terms to find the best fit.

4. Work on Improving Your Credit for Future Negotiations

If your credit score isn’t in the best shape, take steps to improve it. Pay bills on time, reduce your credit utilization, and avoid opening multiple new accounts. A stronger credit profile gives you more leverage when asking for a lower credit card APR in the future.

By combining these strategies, you can effectively reduce your interest costs even if direct negotiation doesn’t succeed. For ongoing financial health, review articles on topics like diversification in owning stocks to build a broader understanding of managing your finances more confidently.

Long-Term Strategies to Maintain or Achieve Lower Rates

Lowering your credit card interest rate isn’t just a one-time win—it requires ongoing effort to keep rates low or improve them over time. Here are proven strategies to help you maintain or achieve a lower credit card APR:

Build and Monitor Your Credit Health

Your credit score heavily influences the rates you get. Regularly check your credit report for errors and stay on top of your score. Tools and apps can help you track changes and spot issues early. Improving your score with steady, on-time payments makes you a better candidate for a lower credit card interest rate.

Avoid Common Pitfalls That Trigger Higher Rates

Lenders can increase your APR when you miss payments, exceed your credit limit, or make late payments. Avoid these by paying bills on time, keeping below your credit limit, and watching for any account alerts. These habits prevent penalty APRs from kicking in.

Pay More Than the Minimum and Reduce Utilization

Carrying high balances relative to your credit limit signals risk. Aim to pay more than the minimum monthly and keep your credit utilization below 30%. This not only improves your credit score but also positions you well to negotiate credit card APR reductions in the future.

Know When to Switch Cards Permanently

If your issuer won’t budge on your rate or offers limited benefits, it might be time to consider switching cards. Look for new cards with lower ongoing rates, better rewards, or 0% balance transfer offers. Just be sure to weigh any fees and how switching affects your credit before making a move.

Taking these long-term steps helps you build credit strength and avoid triggers for higher rates, making future negotiations or credit card choices more favorable.

For more on managing your finances and budgeting effectively, check out these 3 budgeting methods for beginners.

Real Success Stories and Potential Savings

Many people have successfully negotiated a lower credit card interest rate, saving hundreds or even thousands in interest over time. For example, one user with a $5,000 balance reduced their APR from 22% to 12%, cutting their monthly interest charge nearly in half. Another cardholder saw their rate lowered temporarily during a hardship, giving them breathing room to catch up on payments.

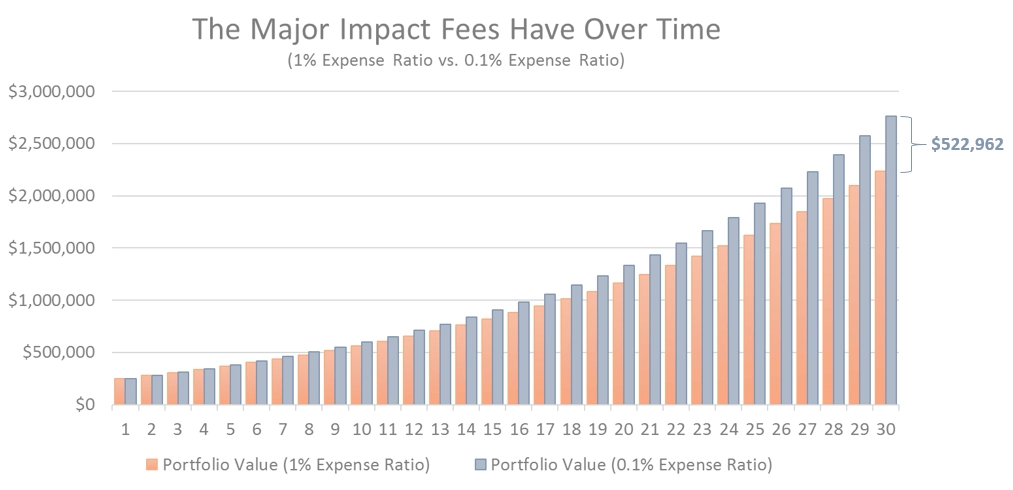

Using simple credit card interest savings calculators can show you how much you could save by reducing your rate. For instance, dropping your APR by just 5% on a $3,000 balance can save you several hundred dollars annually. These savings add up even more if you pay down your balance faster.

Common outcomes from negotiating credit card APR include:

- Lower monthly payments, creating easier debt payoff options

- Avoiding higher penalty APRs triggered by late payments

- Gaining access to balance transfer options with 0% intro APRs

- Improved financial flexibility and peace of mind

Real-life stories prove that with good payment history and a well-prepared negotiation, reducing your credit card rate is very achievable. To maximize your success, be sure to document your conversations and follow up as needed.

For more strategies on managing and paying off credit card debt effectively, you might find valuable insights in this guide to credit card debt payoff strategies.

FAQs About Negotiating Lower Credit Card Interest Rates

Can anyone negotiate a lower credit card rate?

Yes, most credit card holders can try negotiating their APR, especially if they have a good payment history and a decent credit score. Issuers are more likely to consider requests from loyal customers who pay on time consistently. However, success isn’t guaranteed and depends on your specific account and the issuer’s policies.

How much can I realistically lower my APR?

Typically, you might reduce your credit card APR by 1% to 5%, depending on factors like your creditworthiness and current market rates. Some people have secured even bigger cuts, but that usually requires strong leverage like competing offers or a flawless payment record.

Will negotiating hurt my credit score?

Calling your card issuer to ask for a lower interest rate doesn’t directly impact your credit score. Just avoid requesting a hard credit inquiry unless you apply for a new card. The goal is to lower your APR without risking negative hits to your credit file.

What if I have multiple credit cards?

You can negotiate rates on each card individually. Prioritize cards with the highest interest rates or largest balances to maximize savings. Keep track of each call, and use your improved credit or recent history on one card to support negotiations on others.

Are rate reductions permanent?

Rate reductions can be temporary or permanent. Some issuers offer a temporary hardship rate reduction if you’re facing financial challenges, while others may approve a permanent APR cut based on your account history. Always ask how long the reduced rate will last before accepting any offer.

Implementing these negotiation strategies and scripts can help you reduce credit card interest and save money. For more on managing finances effectively, consider learning about portfolio rebalancing strategies to balance your overall financial health.