The Real Costs of Renting vs. Buying

Many people say, “Renting is throwing money away,” but that’s a myth worth unpacking. Rent payments cover your shelter and utilities, while homeownership comes with additional hidden costs like mortgage interest, property taxes, maintenance, and repairs. Plus, there’s the opportunity cost of tying up a large sum in a down payment and home equity instead of investing elsewhere.

When comparing average monthly costs, mortgages often appear higher than rent. However, buying builds home equity over time, which can increase your long-term net worth. Renting, on the other hand, provides flexibility without the risks and extra expenses of property ownership.

Which option is better depends on various factors—current market conditions, interest rates, and your personal timeline all play major roles. For example, in rising housing markets, buying might accelerate wealth building. But in volatile markets or if you plan to move soon, renting could be smarter financially.

Understanding these real costs helps you make an informed choice tailored to your lifestyle and financial goals.

Type 1 – Frequent Movers and Career-Focused Professionals

For those who move often due to job relocations, promotions, or remote work, buying a home can be risky. Committing to a mortgage ties you down, creates selling costs, and limits your flexibility. Renting long term offers key benefits like:

- Easy lease termination without the hassle of selling property

- No costs for repairs or property taxes

- Freedom to chase career growth or new opportunities quickly

This group includes tech workers, military personnel, consultants, and others whose careers demand mobility.

Financial angle: Invest your down payment

Instead of locking your savings into a home, investing the down payment elsewhere often gives better returns. With market fluctuations and the opportunity cost of homeownership, putting funds in stocks, bonds, or other vehicles can build wealth faster. For smart investment ideas tailored to your financial goals, consider options like high-yield savings in a high-rate era or low-risk alternatives to the stock market.

| Renting Benefits for Movers | Buying Challenges for Movers |

|---|---|

| No selling hassles or commissions | Risk of losing money on quick sales |

| Flexibility to relocate anytime | Mortgage commitment locks you in |

| No maintenance costs | Unexpected repair bills |

Renting long term here means you keep financial freedom and career mobility—key for those who prioritize flexibility over settling down.

Type 2 – Those in High-Cost or Volatile Housing Markets

In major cities where home prices soar faster than rents—think coastal metros like San Francisco, New York, or Los Angeles—renting long term can often be the smarter financial move. Buying a home here comes with steep costs: intense property taxes, ongoing repairs, and the risk that your mortgage balance might exceed the home’s value if the market dips. These factors alone can turn homeownership into a money pit.

Renting in these markets offers clear advantages. You avoid property taxes and repair bills, plus you gain flexibility to wait out market downturns without being tied down. This market timing is crucial given the volatility in home values that can lead to underwater mortgages or forced sales at a loss.

Looking at price-to-rent ratios—a key data point to decide whether renting or buying pays off—many high-cost cities show renting is cheaper over the long term. When home prices are significantly higher than what it costs to rent comparable properties, renting not only lowers monthly expenses but also frees up capital to invest elsewhere. For example, renters in these areas can put their savings into tax-efficient investments, maximizing returns rather than being locked into home equity.

Considering these factors makes it clear why renting benefits people living in pricey or unstable housing markets—the financial flexibility alone often outweighs the supposed perks of ownership. For those interested in tax-efficient investing options alongside renting, checking out resources on tax-efficient investing strategies can be particularly helpful.

Type 3 – People Prioritizing Lifestyle and Financial Freedom

Some people simply value lifestyle and financial freedom over owning a home. For them, renting long term means fewer hassles and more flexibility.

Why They Rent:

- Simplicity: No worries about maintenance, repairs, or property taxes.

- Flexibility: Easy to downsize, upsize, or move on short notice.

- Financial Freedom: More cash available for travel, experiences, or investments.

Who Fits This Type?

| Example Group | Why Renting Works |

|---|---|

| Retirees | Avoid upkeep, free cash for lifestyle |

| Minimalists | Prefer less responsibility, easy living |

| High earners | Invest in stocks, not tied up in property |

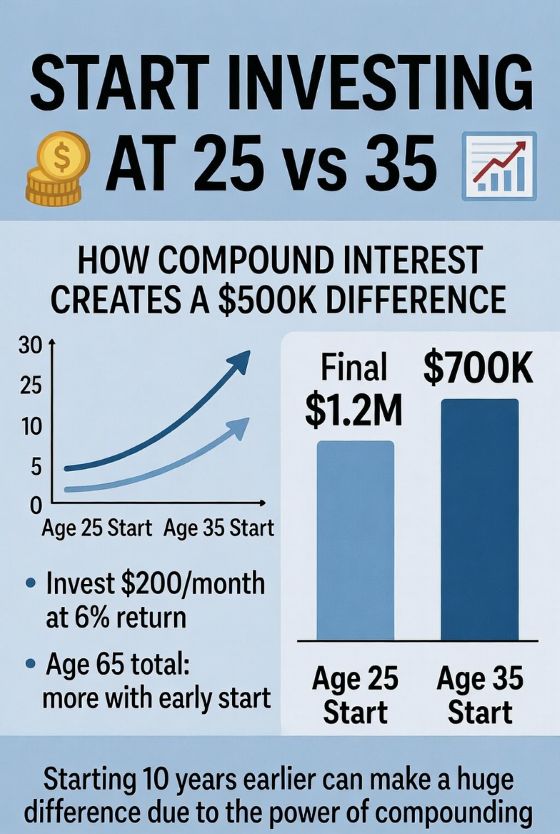

Many high earners choose to rent and invest their down payment in diversified stocks, which can often yield better long-term returns than home equity. This approach supports building wealth while renting and keeps financial options open. For those interested in investing strategies that complement renting, check out practical tips on starting early and the power of compound growth.

Renting + Investing vs. Owning

| Aspect | Renting + Investing | Buying Home |

|---|---|---|

| Maintenance & Repairs | None | Ongoing costs |

| Flexibility | High — move or change lifestyle easily | Low — selling takes time & money |

| Investment Growth | Potentially higher returns in stocks | Tied up in property, slower growth |

| Cash Flow | Frees up cash for other opportunities | Locked in mortgage & taxes |

By choosing renting, people focused on financial freedom avoid the hidden costs of homeownership and maintain flexibility, making it a smart move for those prioritizing lifestyle and control over their money.

When Buying Still Makes Sense

Buying a home isn’t always throwing money away. It makes sense in certain situations—like if you plan to stay put for years, have a family to settle, or find yourself in a favorable market with reasonable prices and interest rates. Stability is key here. Owning a home can provide long-term savings, build equity, and sometimes even tax benefits that renting doesn’t offer.

If you’re unsure whether to rent or buy, using a rent vs buy calculator can help you crunch the numbers based on your location, expected stay, and market conditions. These tools consider mortgage payments, property taxes, maintenance costs, and potential home appreciation to paint a clearer picture.

At the end of the day, there’s no one-size-fits-all answer. It’s about what fits your lifestyle, financial goals, and career plans best. Sometimes, renting long term has more advantages; other times, homeownership is the smarter move. Prioritizing personal fit over myths like “renting is throwing money away” ensures you make the right choice for your unique situation.

Practical Tips for Long-Term Renters

If you’re renting long-term, there are smart ways to make the most of it without feeling like you’re just throwing money away. Here’s how to maximize the benefits of renting:

- Negotiate Your Lease: Don’t hesitate to ask for better terms—lower rent, flexible lease lengths, or waived fees. Landlords often prefer keeping a good tenant rather than risking a vacancy.

- Build an Emergency Fund: Renting means you won’t have home equity as a safety net. It’s crucial to have savings ready for unexpected costs like moving, lease changes, or emergencies.

- Invest Savings Aggressively: The money you save by avoiding down payments and costly home repairs can be invested elsewhere. Automating your savings can build wealth faster; for practical ideas, check out this guide on how to automate your savings the set-and-forget way.

Don’t forget about renters insurance—it protects your belongings and can cover liability, often overlooked by renters focused solely on monthly costs.

Be aware of tax implications; unlike homeowners, renters usually don’t get deductions, so factor that into your financial planning.

Common pitfalls to avoid:

- Overcommitting to a lease that limits your flexibility.

- Ignoring maintenance responsibilities that could affect your living situation.

- Failing to invest the difference between rent and potential mortgage payments wisely.

With the right approach, renting long term isn’t just an alternative — it can be a strategic path to financial freedom and wealth building without the hidden costs of homeownership.