Automate Savings From Every Paycheck

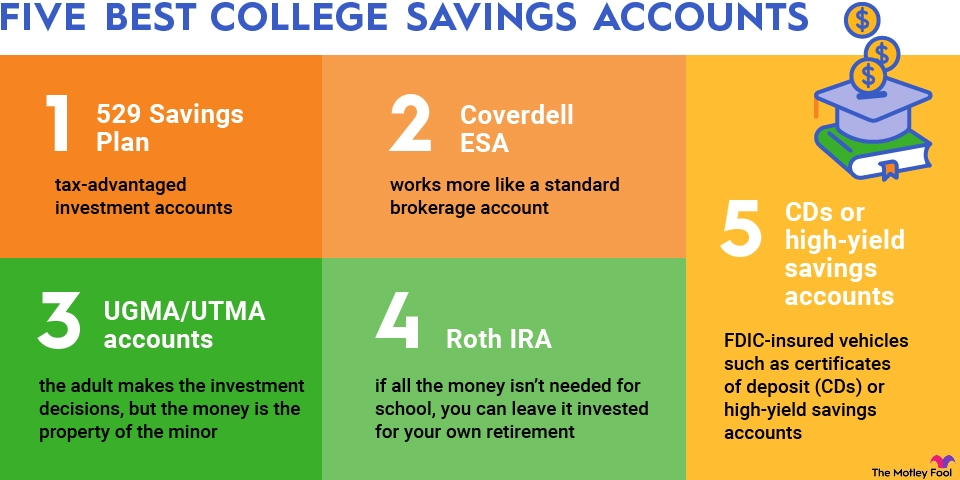

One of the smartest habits 25-year-olds who saved $10K swear by is automating savings from every paycheck. Instead of leaving savings to chance, they set up a system that transfers a fixed percentage—usually between 10% and 20%—straight into a separate high-yield savings account as soon as payday hits. This simple step removes the temptation to spend extra cash and quietly grows their savings without any extra effort.

Why is this so effective? Because automation takes the decision-making out of your hands. You don’t have to think twice or worry about forgetting—it just happens. Over time, those steady deposits add up, building a comfortable cushion without cramping your lifestyle.

Take Sarah, a 25-year-old marketer making $50K annually. She automated 15% of her salary each month and reached her $10K goal in just 18 months. The best part? She still enjoyed dining out and weekend outings without stress because her savings were already on autopilot.

Here’s how you can do it as well:

- Set up direct deposit with your employer or bank to funnel a percentage of each paycheck into a high-yield savings account.

- Use apps that round up purchases to the nearest dollar and save the difference automatically.

- Allocate any bonuses or extra income directly to savings right away.

It’s a simple, low-effort habit that fits perfectly into busy lives and makes saving money in your 20s feel totally doable. Want to grow your savings without thinking about it? Automation might just be your best friend.

Habit 2: Tracking Expenses Ruthlessly (But Without Deprivation)

Keeping a close eye on your spending each week helps spot where money leaks out without feeling like you’re missing out. By tracking expenses, you get a clear picture of what’s necessary and where you can cut back—usually on non-essentials like unused subscriptions or impulse buys. This kind of awareness naturally shifts your habits and frees up cash for saving.

Take the example of a recent graduate who used a budgeting app to monitor her expenses closely. She found she was spending about $200 monthly on dining out and entertainment. By trimming that back and redirecting the money into savings, she reached her $10K goal by age 25—all while still enjoying life. This shows that tracking spending doesn’t mean deprivation; it’s about spending smarter.

Actionable tips:

- Categorize your spending into needs vs. wants to spot easy savings

- Review bank and card statements monthly for unexpected charges

- Use budgeting apps that alert you when you’re close to limits

Start adopting these personal finance habits for young adults today to build a strong foundation for saving money in your 20s. If you want a deeper dive into effective budgeting strategies, check out this guide on how to save $2,000 in a year on a $5,000 monthly income.

Habit 3: Boosting Income with Side Hustles or Negotiations

One powerful way to save $10K by 25 is to increase your income beyond your day job. Taking on side hustles like freelance gigs, tutoring, or selling services online can add extra cash flow without tightening your budget further. Alternatively, negotiating your salary early in your career can lead to significant boosts in earnings over time.

Why does this habit work? It’s simple: earning more means you don’t have to rely solely on frugal living to reach your savings goals. A steady income increase speeds up building that emergency fund or hitting milestone savings targets.

For example, a 25-year-old freelancer combined side projects with smart salary negotiations, earning an additional $5,000+ per year. This allowed them to hit the $10K savings mark faster while maintaining a reasonable lifestyle.

Here’s how you can start:

- Explore gig platforms like Upwork, Fiverr, or local freelance opportunities.

- Prepare and practice negotiation scripts for performance reviews or job interviews.

- Keep track of your extra income to funnel it directly into your savings.

Increasing income, paired with solid budgeting, is a proven personal finance habit for young adults aiming to break the $10K barrier quickly. For more on smart ways to grow your savings reliably, consider alternatives like a money market fund to maximize your returns without risk.

Habit 4: Living Below Means with Intentional Choices

Living below your means means making smart, intentional choices every day. This could be picking affordable housing, cooking at home instead of eating out, and finding fun that doesn’t break the bank. These habits free up hundreds of dollars monthly without feeling like a sacrifice.

Why it works:

When you cut costs on big-ticket items like rent and meals, you gain extra cash to save or invest. Plus, choosing low-cost fun helps you enjoy life without overspending.

Real story

A 25-year-old who roomed with friends and meal-prepped weekly saved about $300 each month. This habit helped them reach $10K in savings while still traveling occasionally.

Actionable tips

| Tip | How to Apply |

|---|---|

| Use the 50/30/20 Budget | Allocate 50% to needs, 30% wants, 20% savings — a proven budgeting method for beginners |

| Cook at home regularly | Plan meals in advance; prep bulk meals to save time and money |

| Choose affordable housing | Consider roommates or smaller spaces |

| Prioritize free/low-cost fun | Explore parks, community events, or friends gatherings |

| Shop thrift or second-hand | Save on clothes, furniture, and more |

By living below your means with these simple choices, saving money in your 20s becomes natural rather than a battle against lifestyle inflation.

Habit 5: Building an Emergency Mindset and Celebrating Milestones

Treating your savings like a non-negotiable bill is key to building a strong financial foundation. When you commit to saving as if it were a monthly expense, it shifts your mindset from scarcity to abundance. This helps you stay consistent and motivated, even when money feels tight.

Why does this work? Thinking of savings as a must-pay “bill” makes you less likely to skip it. Plus, celebrating progress with small rewards turns saving into a positive habit you actually enjoy.

Take the real story of a 25-year-old who faced job instability and saw building a $10K emergency fund as crucial for security. Instead of getting discouraged, they celebrated every $2,000 milestone with a small treat—keeping motivation high and stress low.

Here’s how you can build this mindset and save smarter:

- Visualize your savings goals regularly to stay focused.

- Treat savings deposits as fixed bills and automate them if possible.

- Use high-yield savings accounts to grow your money faster while keeping it accessible.

- Celebrate milestones in small, meaningful ways to keep your motivation up.

If you want to explore how to maximize your savings growth and emergency funds, consider resources like high-yield savings accounts that offer better interest rates—helping your $10K build steadily without extra effort.

With the right mindset and simple strategies, saving money in your 20s doesn’t have to feel impossible. It becomes a habit that protects you and builds financial independence for the future.

Overcoming Common Obstacles in Your 20s

Saving money in your 20s isn’t always easy, especially with challenges like student loans, low entry-level pay, and lifestyle inflation pulling you in different directions. These are real barriers, but you can overcome them with simple, practical steps.

Here’s how to stay on track:

- Start small with achievable goals: Instead of aiming for huge savings right away, set manageable targets—like saving your first $500. Small wins build momentum.

- Tackle high-interest debt first: Paying off credit cards or other high-interest loans frees up more cash to save and prevents your debt from ballooning.

- Watch out for lifestyle inflation: As your income grows, it’s tempting to spend more. Stay aware and keep living below your means to boost savings.

- Find accountability partners: Share your saving goals with friends or join online communities focused on personal finance habits for young adults. This support keeps you motivated.

By sticking to these habits, you’ll build a solid emergency fund and grow your savings faster—even with limited income. Using a high-yield savings account can help your money work harder, especially after clearing debt. For more on low-risk ways to grow savings steadily, check out this guide on low-risk alternatives to stocks.

Remember, the key is consistency over perfection. Start today, adjust as needed, and your $10K goal will be within reach before you know it.