If you’ve ever felt stuck in the cycle of looking sharp yet living paycheck to paycheck, you’re not alone. The “Broke but Chic” vibe—pulling off style without the cash to back it up—is tempting but often a financial trap in today’s high-spend era. What if there’s a way to break free? Embracing minimalist money isn’t about sacrificing your style; it’s about mastering intentional spending to build real wealth and freedom. Ready to escape superficial frugality and start thriving financially—while staying effortlessly elegant? Let’s dive into how smart minimalism can rewrite your money story.

Understanding the “Broke but Chic” Trap

We’ve all seen it—those perfectly curated social media feeds showcasing stylish outfits, trendy gadgets, and dreamy vacations. It’s the age of broke but chic, where spending heavily on appearances creates a glossy image but often masks financial stress underneath. This phenomenon is fueled by the dopamine rush that comes from chasing the latest trends and social media validation, making lifestyle inflation feel almost addictive.

But here’s the catch: while your frugal chic lifestyle may look enviable online, it can hide serious money pitfalls. People caught in this trap tend to pour cash into costly wardrobes and status symbols, often neglecting essential savings or ignoring mounting debt. The signs are subtle yet telling—racking up credit card balances, paying minimal attention to budgets, and constantly needing the next “must-have” item to keep up appearances.

The real cost? Beyond the consumerism escape façade lies mounting anxiety, financial strain, and stalled life goals like homeownership or emergency funds. Living this way can trap you in a cycle where mindful money management takes a backseat, and true financial freedom seems out of reach. Recognizing these patterns is the first step toward breaking free and embracing a healthier, minimalist money mindset.

The High-Spend Era: Why Minimalism is More Relevant Than Ever

We live in a high-spend era shaped by constant cultural pressure to buy more. Consumerism is everywhere, pushing fast fashion trends that encourage frequent, cheap purchases and the rise of quiet luxury—where subtle, expensive-looking items signal status without shouting it. These forces fuel lifestyle inflation, tempting us to spend beyond our means just to keep up appearances.

At the same time, economic realities make overspending riskier. Inflation drives up everyday costs while wages remain largely stagnant, squeezing budgets tighter. Credit cards and buy-now-pay-later schemes create an illusion of wealth, masking the real consequences of debt. This makes minimalist money management—not just a style choice but a financial necessity—an urgent shift.

Moving away from spending for aesthetics towards purposeful, intentional spending helps break this cycle. It’s about focusing on what truly adds value to your life, from lasting quality to experiences and security. This mindset shift supports smarter financial decisions that build long-term wealth and promote peace of mind in a consumer-driven world.

For practical tips on safeguarding your finances, consider strategies like building an emergency fund with reliable methods explained in guides on how to build it efficiently.

Core Principles of Minimalist Money Management

At the heart of financial minimalism is a simple truth: spend less than you earn. This is the first step to escaping debt and building real wealth. Without this foundation, any attempt at mindful money management will struggle to gain traction.

Next, focus on intentional purchasing. This means buying only what adds lasting value to your life—not quick thrills or items bought just for status. Whether it’s investing in durable essentials or choosing experiences that enrich you, every dollar should have a clear purpose.

Adopting a value-based budgeting approach helps align your spending with what truly matters—experiences, health, and financial security. Instead of chasing trends or trying to keep up appearances, minimalist budgeting prioritizes what brings genuine happiness and long-term stability.

If you’re new to budgeting, frameworks like the 50/30/20 budget method can help you allocate your income intentionally. This shift from lifestyle inflation to financial clarity is key to mastering minimalist money habits.

Practical Steps to Escape and Build Wealth

To break free from the “broke but chic” cycle and start building real wealth, practical action is key. Begin by auditing your finances: track every dollar you spend for at least a month. This helps spot leaks like forgotten subscriptions and impulse buys that silently drain your wallet. Next, declutter your possessions to simplify your life—embrace a capsule wardrobe by choosing quality, versatile pieces and explore thrifting for style without overspending.

Creating a minimalist budget is another essential step. Frameworks like the 50/30/20 rule or budgeting strictly for needs help you prioritize intentional spending. The goal? Spend less than you earn to escape lifestyle inflation and reduce debt. Speaking of debt, aggressively paying off high-interest balances should become a top priority, saving you money on interest that you can redirect toward savings.

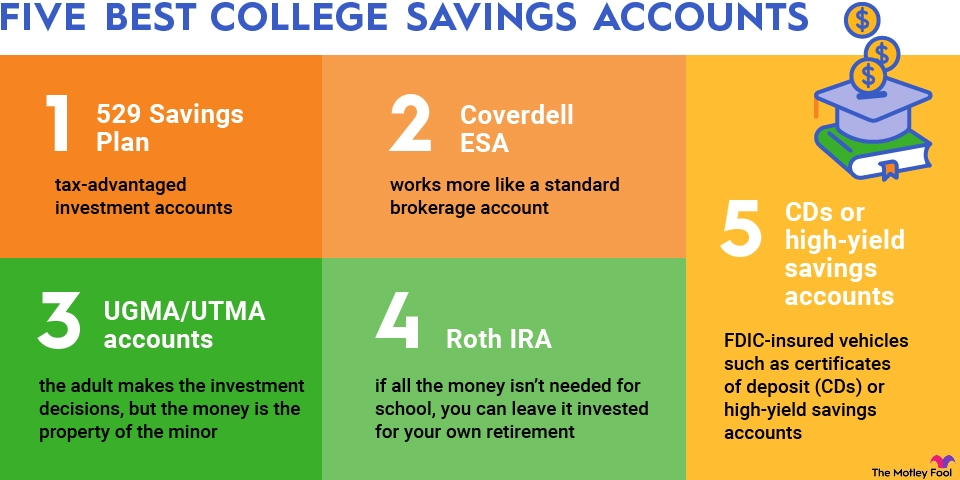

Building saving and investing habits is crucial for long-term financial security. Automate contributions to emergency funds and retirement accounts to make this process effortless. For a great guide on automating your savings, check out how to grow wealth the set-and-forget way. Finally, upgrade your spending by investing in durable, high-quality items that last longer and bring lasting value—this frugal chic approach balances style with financial minimalism effectively.

These practical steps combine mindful money management and value-based finances, empowering you to escape consumerism traps while steadily building wealth.

Maintaining Style and Joy on a Minimalist Path

Minimalist money management doesn’t mean sacrificing style or happiness. You can maintain a frugal chic lifestyle by curating a timeless, elegant wardrobe filled with neutral tones and classic pieces that reflect quiet luxury on a budget. Focus on wardrobe essentials like capsule collections that mix and match effortlessly, which cuts down on unnecessary purchases while keeping your look polished.

Here are some practical frugal chic tactics to stay stylish without overspending:

- Thrifting for style: Hunt for high-quality secondhand items that bring character and durability.

- Tailoring: Invest in tailoring to fit affordable basics perfectly, elevating your style.

- Mindful indulgences: Allocate funds for occasional treats that focus on experiences—like a nice meal or special event—rather than just material goods.

Beyond fashion, real joy on the minimalist path comes from prioritizing non-material joys. Engage deeply with hobbies, nurture relationships, and create meaningful experiences that don’t drain your finances. This approach supports a balanced life and reduces reliance on spending for happiness. Adopting these mindful money management habits helps break the consumerism escape cycle and builds lasting fulfillment.

Long-Term Benefits and Success Stories

Embracing financial minimalism isn’t just about cutting costs—it’s about gaining financial freedom. Living debt-free, growing your net worth steadily, and feeling less stressed about money become the new normal. When you stop trying to keep up with high spenders, you actually push ahead faster in wealth building habits.

Many people who adopt a frugal chic lifestyle see results quickly:

| Benefit | What It Means | Why It Matters |

|---|---|---|

| Debt-free living | No high-interest payments | More disposable income, less stress |

| Growing net worth | Saving and investing regularly | Long-term security and freedom |

| Reduced financial stress | Less worry about bills or debt | Better health and well-being |

| Faster wealth building | Prioritizing value-based finances | Outpace peers caught in lifestyle inflation |

| Lower environmental impact | Buying less, choosing quality | Supports sustainability goals |

Success stories from around the world show minimalist budgets and intentional spending leading to earlier retirements, paid-off mortgages, and a boost in overall happiness. Plus, living with less means a smaller carbon footprint, which adds to the wider benefit of sustainable personal finance.

By focusing on quality over quantity and ditching wasteful consumerism, you protect your future and the planet—all while maintaining your style and joy. This is financial minimalism in action: smart money choices with big rewards over time.