0% APR Offers Explained Benefits Risks and Best Use Tips

Explore if 0% APR offers on credit cards are smart tools for debt payoff or risky traps with fees high interest and repayment tips.

Explore if 0% APR offers on credit cards are smart tools for debt payoff or risky traps with fees high interest and repayment tips.

Discover how to escape broke but chic with minimalist money tips for mindful spending and building wealth in today’s high-spend era.

Learn how to save side hustle income with the Bucket Strategy to manage taxes reinvestments emergencies and build long-term wealth effectively

Struggling to stay afloat paycheck to paycheck Discover how paying yourself first builds savings and breaks the cycle of being broke by Friday

Learn how to stop revenge spending with this guide to emotional money management using practical steps to curb impulse buying and build financial control

One of my very favorite personal finance metrics to calculate, monitor, and compete against is my personal inflation rate (as one half of a married couple, it could more rightfully be referred to as “household inflation rate” since my wife and I share all costs). Whatever you want to call it, I’d put it second …

Discover 7 practical ways to budget for travel without going broke with smart tips on saving, affordable stays, cheap flights, and free activities.

Learn how to start investing with 100 dollars using beginner tips, fractional shares, no minimum apps, and smart long-term strategies for growth.

Discover why index funds are the best first investment for young adults offering low costs diversification and long-term wealth building strategies.

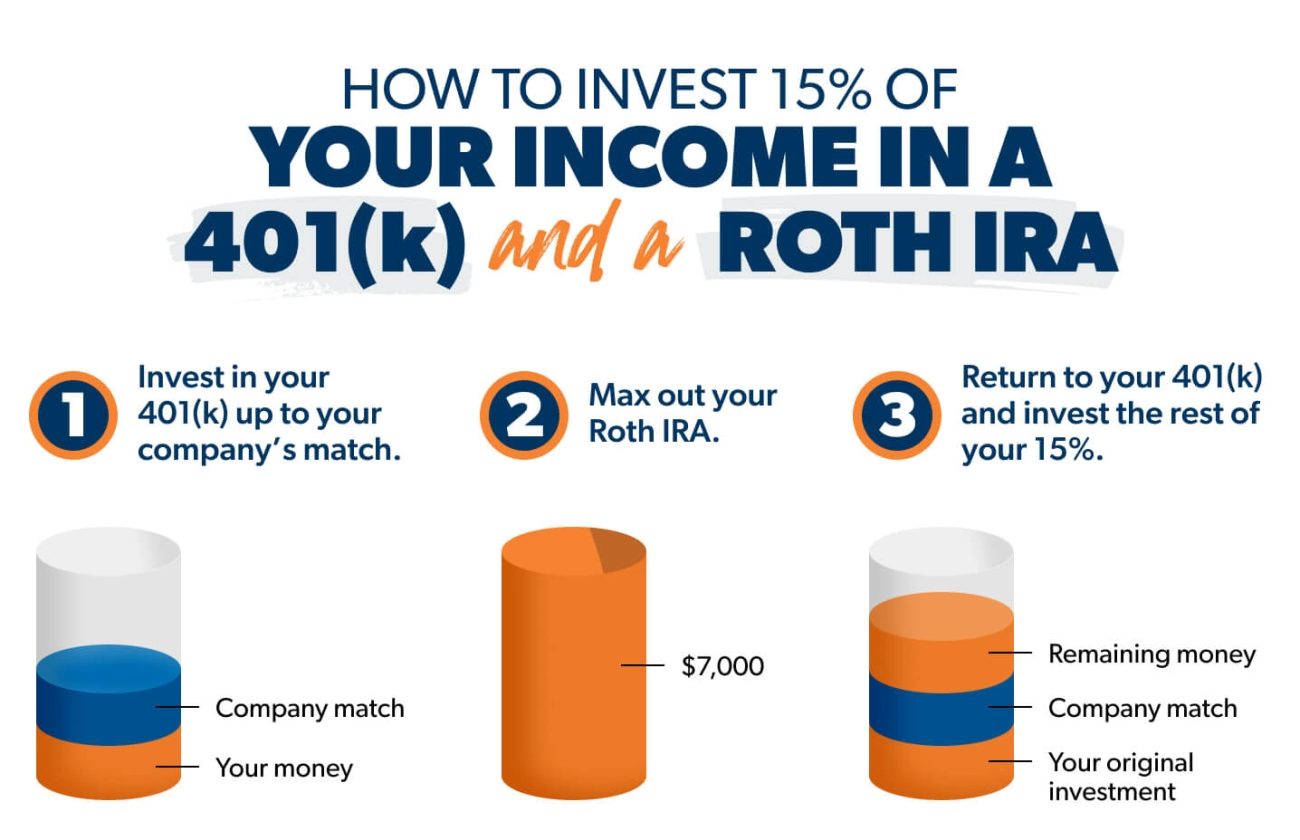

Compare 401(k) vs Roth IRA to find the best retirement account for your life stage with tips on contributions tax benefits and withdrawal rules