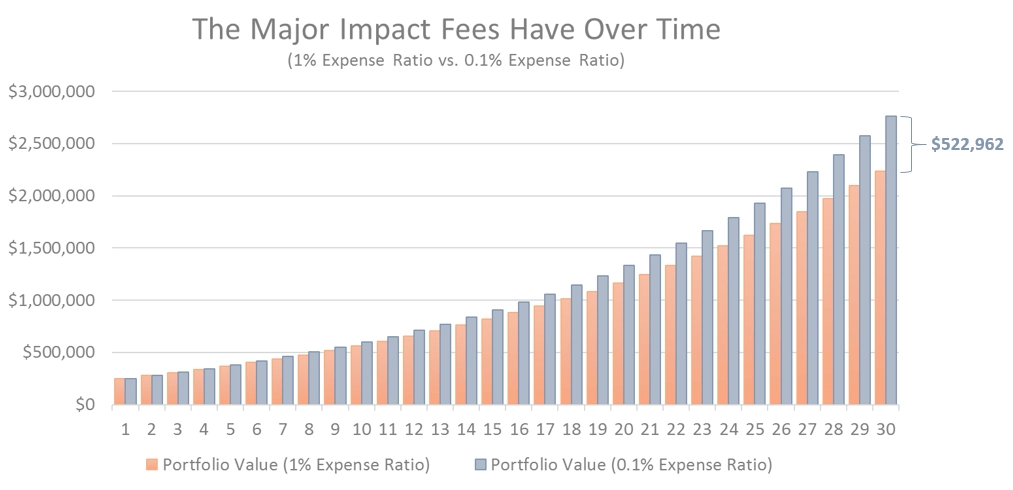

Expense Ratios Explained How a 0.97 Percent Fee Can Cost You Thousands

Learn how a 0.97% expense ratio can drain $100,000 from your retirement savings and why low-cost investing boosts long-term returns.

Learn how a 0.97% expense ratio can drain $100,000 from your retirement savings and why low-cost investing boosts long-term returns.

Discover 3 psychology hacks to overcome emotional barriers and build consistent investing habits for long-term financial success.

Discover which is simpler and cheaper for beginners ETFs or mutual funds with clear comparisons of costs ease and investment features.

Explore a data-driven 5-year cost comparison of renting vs buying with real numbers to help you decide the best financial choice in 2026.

Learn how to negotiate medical bills effectively with step-by-step tips to reduce costs avoid collections and get financial assistance.

Discover whether dollar-cost averaging or lump-sum investing saves better for you with expert insights and historical data comparisons.

Discover if young people should trade stocks through behavioral finance insights highlighting risks biases and smart investing strategies for Gen Z and millennials

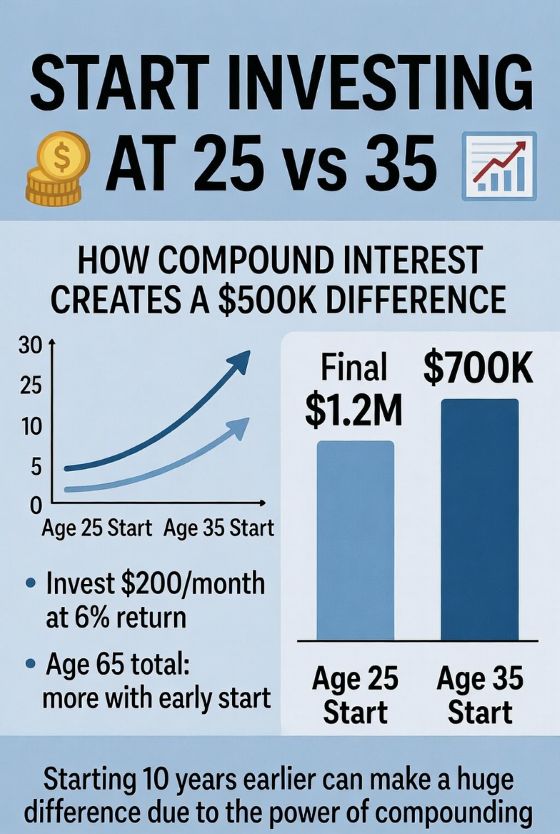

Discover how starting to invest at 25 vs 35 can create a 500K difference through compound interest and smart long-term strategies.

Discover why the debt avalanche method feels harder and get practical tips to stay motivated while paying off high interest debt faster and smarter.

Learn how unpaid utilities or security deposits can impact your credit score and steps to protect your credit from collections and negative reporting.