Facing $20K credit card debt can feel overwhelming—with high interest rates piling up and monthly payments eating into your budget. But here’s the real question: when it comes to paying off that balance faster, which works better—the debt snowball or debt avalanche method? Both strategies promise a way out, but one could save you months and hundreds—or even thousands—in interest. In this post, we’ll break down exactly how each method tackles your $20,000 debt, which one speeds up your payoff, and how to pick the right approach to get you debt-free sooner. Let’s cut through the confusion and find the fastest path to financial freedom.

What Is the Debt Snowball Method?

The debt snowball method is a popular strategy to pay off credit card debt by focusing on small wins first. Here’s how it works step-by-step:

- List your debts from smallest to largest balance, regardless of the interest rate.

- Make the minimum payments on all your cards.

- Put any extra money toward paying off the smallest debt first until it’s gone.

- Once that smallest debt is cleared, roll its payment amount into the next smallest debt.

- Repeat this process until all your debts are paid off.

Real Example: $20K Across 4 Credit Cards

Imagine you owe a total of $20,000 spread over four credit cards with balances of $2,500, $4,500, $6,000, and $7,000. Using the snowball method, you’d focus on paying off the $2,500 card first by throwing extra payments at it while making minimum payments on the others. After clearing that, move on to the $4,500 card, and so on.

Pros of the Debt Snowball Method

- Quick wins build motivation early by knocking out smaller debts fast.

- Creates a strong psychological boost that keeps you committed.

- Easier to stay focused without feeling overwhelmed by large balances.

Cons of the Debt Snowball Method

- You might end up paying more in interest because bigger, higher-interest debts get paid off later.

- Could mean a slower overall payoff compared to methods that target high-interest debts first.

The debt snowball method is great if you need early motivation and clear progress to stick to your credit card debt payoff plan. But for minimizing interest costs, another method might work faster.

What Is the Debt Avalanche Method?

The debt avalanche method tackles credit card debt by focusing on the highest interest rate balances first. Here’s how it works step-by-step:

- List your debts from highest to lowest interest rate.

- Pay the minimum amount on all cards.

- Put any extra money toward the card with the highest interest rate.

- Once that card is paid off, move on to the next highest interest rate card, repeating the process.

Using the same $20K credit card debt spread across 4 cards, imagine one card carries a 22% APR, another 18%, then 15%, and finally 10%. With the avalanche method, you’d throw extra payments at the 22% card first, while maintaining minimum payments on the others.

Pros:

- Minimizes the total interest paid over time.

- Often faster mathematically, especially if you have high-interest credit cards.

Cons:

- Progress might feel slower since the highest interest card might also have the largest balance.

- Requires more discipline and patience because the small wins are fewer and farther between.

For those looking to understand how interest combines with payment strategies, digging into tools like a debt repayment calculator can provide a clearer view of potential savings and payoff timelines.

Which Method Pays Off Debt Faster? Head-to-Head Comparison

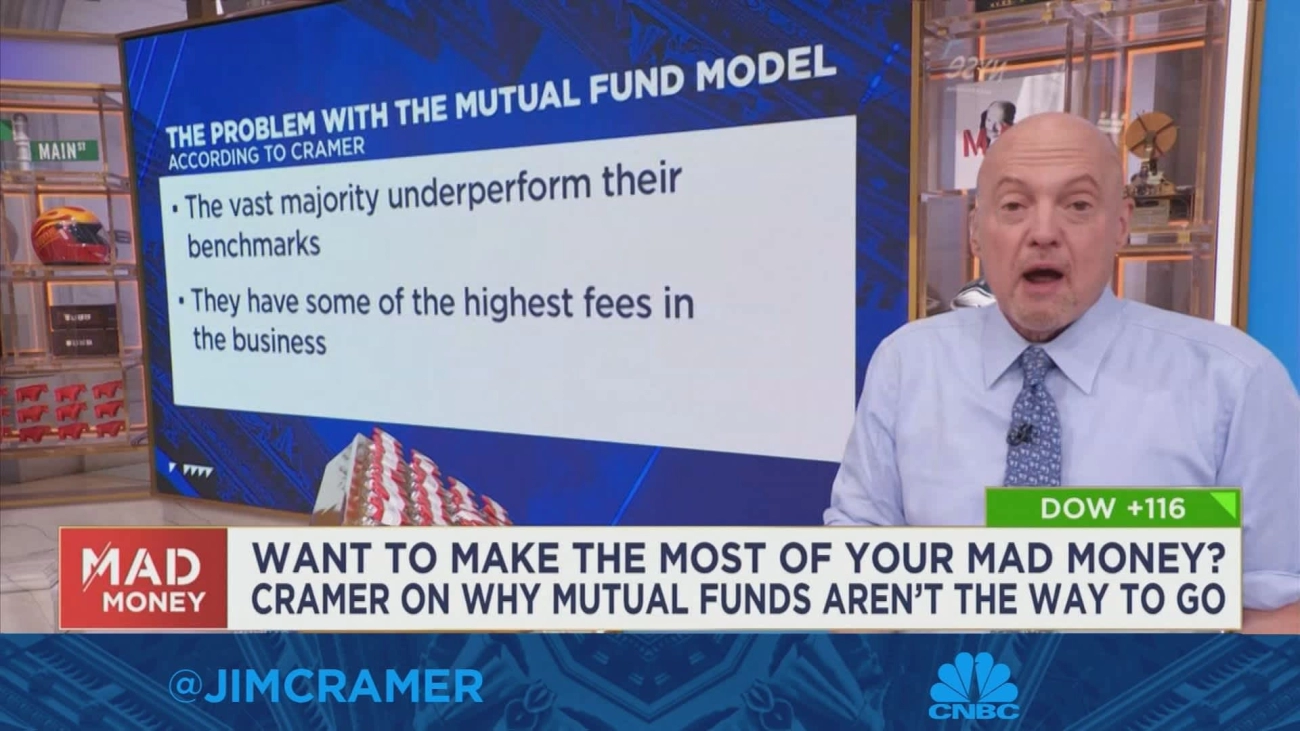

When it comes to paying off $20K credit card debt, the debt avalanche method usually works faster than the snowball, especially if you can put $500–$600 extra toward debt monthly.

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Time to Payoff | Slower by 1–6 months | Typically faster |

| Interest Savings | Potentially more interest | Saves hundreds to thousands |

| Psychological Boost | Quick wins stay motivating | Slower visible payoff |

Why Avalanche Is Often Faster

Avalanche targets the highest interest rates first, which cuts down total interest paid, speeding up payoff. This matters most when debts have varied and high APRs.

When Snowball Can Win

If your cards have similar interest rates or you struggle with motivation, snowball’s quick wins might help you stick to the plan better—even if it costs a bit more in interest.

Test Your Payoff Plan

Use a debt repayment calculator to plug in your $20K balance, interest rates, and monthly payment amounts. This personalizes your payoff timeline and shows potential savings.

For guidance on budgeting extra cash toward debt, check this helpful resource on how to maximize your savings and side income to speed up your payoff journey.

When to Choose Debt Snowball for $20K Credit Card Debt

The debt snowball method works best when you have several small-to-medium credit card balances to tackle. If you find it hard to stay motivated or feel emotionally burnt out by debt, focusing on quickly paying off the smallest balances first can give you fast wins that boost your confidence.

Why it feels faster:

| Benefit | Explanation |

|---|---|

| Quick wins | Paying off a card completely every few months feels rewarding |

| Psychological momentum | Seeing debts disappear pushes you to keep going |

| Easier motivation | Small victories build a habit of consistent payments |

Many people share success stories about how the snowball method helped them stick to their plan without giving up, even if it costs a bit more in interest overall. This method keeps motivation high, especially when managing $20K across multiple cards feels overwhelming.

If motivation is your main challenge, or you prefer a straightforward path, snowball might be the right choice for you. For other strategies on managing your money emotions and keeping spending in check, check out this guide on emotional money management.

When to Choose Debt Avalanche for $20K Credit Card Debt

The debt avalanche method is ideal if you want to minimize the total cost of paying off your $20K credit card debt, especially when you have high-interest cards (20% APR or higher). This strategy targets the debts with the highest interest rates first, which helps you cut down the overall interest paid over time.

Who Benefits Most from Debt Avalanche?

- High-interest credit card debt (20%+ APR)

- Disciplined payers who can stay focused without quick wins

- Anyone looking to minimize total interest and pay off debt faster

Why Debt Avalanche Often Works Faster

| Advantage | Explanation |

|---|---|

| Lowers total interest cost | Paying high-rate debts first reduces extra interest |

| Shortens payoff time | Less interest means more money goes to principal faster |

| Straightforward for disciplined | Requires sticking to plan without needing quick wins |

If you’re motivated by numbers and want to pay the least in interest, the debt avalanche beats the snowball method in speed and savings. Tools like a debt repayment calculator can help you see exact payoff timelines and interest saved in your unique $20K scenario.

For more handy tips on saving and managing your money while tackling debt, check out our lifestyle finance insights.

Hybrid Approach: Best of Both Worlds

A smart way to tackle $20K credit card debt is to start with the debt snowball method to build momentum. Paying off the smallest debts first gives quick wins that boost motivation. Once you’ve cleared a few smaller balances, switch to the debt avalanche method to focus on larger balances with higher interest rates and save more money over time.

Other effective strategies include:

- Balance transfers: Moving high-interest debt to a card with a 0% introductory rate can reduce interest costs while you pay down the principal.

- Consolidation loans: Combining multiple debts into a single loan with a lower interest rate simplifies repayment and often lowers your monthly payments.

- Debt management programs: For those struggling to keep up, professional programs negotiate lower interest rates and offer structured payment plans.

Using a hybrid approach with these tools can accelerate your credit card debt payoff while balancing motivation and cost savings. For more strategies on budgeting and managing money effectively during your debt journey, check out this detailed guide on 5 budgeting apps that actually work.

Additional Strategies to Accelerate Payoff

If you want to pay off your $20K credit card debt faster, it helps to go beyond just choosing between the snowball and avalanche methods. Here are some practical ways to speed up your debt payoff:

-

Cut Expenses and Boost Income

Look closely at your monthly spending and find areas to trim, like subscriptions, dining out, or impulse buys. Even small savings add up. At the same time, consider side gigs or freelance work to bring in extra cash. More money means more to throw at those credit cards.

-

Avoid New Debt and Track Progress

It’s key to stop adding new charges to your credit cards while paying them down. Creating a budget can help keep spending on track. Also, regularly tracking how much you’ve paid off keeps motivation high and highlights progress. You can use a debt repayment calculator to see how extra payments impact your timeline and interest.

-

Consider Balance Transfers or Credit Counseling

Balance transfer credit cards with 0% intro APR can lower or pause interest, saving you money while you pay down principal. Just watch for fees and the length of the promotional period. If managing debts feels overwhelming, credit counseling services offer personalized plans that may include negotiation with creditors or debt consolidation—both good alternatives to consider.

By combining these strategies with your chosen repayment plan, you’ll improve your chances of paying off credit card debt faster and more efficiently while minimizing interest and stress.