You’re Saving on Commute—What’s That Really Worth?

Cutting out your daily commute sounds like a dream, right? But before you start dreaming about all the extra cash flowing in, let’s get real and break down what this “remote work windfall” actually looks like for most people in 2026.

Quick Commute Savings Breakdown

When you add up gas, tolls, car maintenance, parking fees, and even the value of your time spent in traffic, that savings starts to look pretty solid. Don’t forget the less obvious stuff, like reduced wear-and-tear, fewer professional clothes to clean (hello, dry cleaning bills!), and the mental energy you save not being stuck behind the wheel.

Here’s a quick example of what you might save monthly by skipping the commute:

| Expense | Monthly Cost Saved |

|---|---|

| Gas & tolls | $150 – $300 |

| Car maintenance & repairs | $50 – $100 |

| Parking | $100 – $200 |

| Time value (hourly wage × hours saved) | $200 – $500 |

| Clothing & dry cleaning | $30 – $60 |

| Total Estimated Savings | $530 – $1,160 |

Of course, your numbers will vary depending on where you live and how you usually get to work. If you’re in a big city like New York or San Francisco and rely on public transport, your savings might lean more toward transit fares and time saved. If you live in a suburban or rural area and drive daily, these savings could be even more significant.

Typical Monthly Savings Range in 2026

- Tier 1 Cities (e.g., NYC, LA, Chicago): $400 to $900

- Tier 2 Cities (e.g., Austin, Denver, Raleigh): $300 to $700

- Tier 3 Cities + Suburbs: $250 to $600

- Public Transit Users: $150 to $450 (mostly fare + time saved)

- Car Drivers: $500 to $1,200+ (fuel, tolls, parking, maintenance)

Beware the Lifestyle Creep Trap

Here’s the kicker: saving on commute costs feels like found money, but it’s also a prime setup for lifestyle creep—the sneaky habit of letting expenses rise right alongside your newfound windfall. Suddenly that “extra” $600 a month disappears on new gadgets, frequent takeout, or upgrading to a swankier neighborhood.

So before you blow your commuting savings on stuff you don’t need, let’s get strategic about where that money should go. Because the best use of commute savings isn’t just about what feels good now—it’s about what makes your future self thank you.

Ready to decide how to redirect commuting expenses like a pro? Let’s dive into the psychology of spending that leftover cash and smart ways to put your remote work bonus to work.

The Three Main Psychological Buckets People Fall Into

When you start saving on your commute, your mindset about what to do with that extra cash often falls into one of three psychological buckets. Understanding which one fits you best is key to making smart choices with your newfound money.

The Invisible Spenders

This is the most common trap. Invisible Spenders don’t consciously track where their commuting savings go—they just quietly let it slip away on small, unnoticed purchases. Think: coffee runs, snacks, or a few extra takeout meals. Because the money never really “feels” like it’s there, it disappears without making much of a dent in your financial goals. If you recognize this pattern, it’s a good idea to pinpoint your hidden spending habits before they cause lifestyle creep as you enjoy your remote work windfall.

The Extreme Savers/Debt Crushers

On the other end, Extreme Savers are those who funnel all their extra cash into paying down debt or stashing it away. This group prioritizes financial freedom and uses the commuting cost savings aggressively to dump high-interest balances or ramp up savings fast. While this approach is great for long-term stability, it can sometimes lead to burnout, feeling like you’re endlessly depriving yourself. For those fiercely committed to debt elimination, even small monthly saving boosts can make a huge impact on timelines.

The Balanced Enjoyers

Most financial advice nudges toward the Balanced Enjoyers—the sweet middle ground. These people split their commuting savings between practical financial goals and life-enhancing spending. They might pay down some debt, boost their emergency fund, and still set aside guilt-free money for hobbies, travel, or upgrading their home office. This balanced mindset helps maintain financial health while also keeping morale and motivation high as you enjoy the benefits of hybrid work budget changes.

Knowing your psychological bucket will help you avoid common pitfalls while getting the most out of your remote work monthly savings ideas. If you want to dive deeper into managing extra money smartly, check out this guide on how to save side hustle income with a bucket strategy for more practical tips.

Prioritization Framework: The 4-Level Decision Tree

When deciding where your commuting savings should go, it helps to follow a clear, step-by-step framework. Think of it as a 4-level decision tree designed to guide you from financial basics toward smarter, more fulfilling uses of your extra money from remote work.

Level 0 – Emergency Buffer Not in Place?

If you don’t have an emergency fund yet, this is your very first priority. Life can throw curveballs, and having cash set aside for 3 to 6 months of essential expenses protects you from unexpected shocks. Building this safety net reduces stress and gives you peace of mind, making it the smartest use of your commute refund. For tips on starting your emergency fund, check out our guide on why you need an emergency fund and how to build it.

Level 1 – High-Interest Debt Exists?

Once your emergency buffer is secured, tackle any high-interest debts (credit cards, payday loans) aggressively. This stage follows pure math: the cost of interest often outweighs any gains you might see by investing. Paying down these debts is one of the most effective ways to use your remote work windfall wisely because it frees up future cash flow faster.

Level 2 – Basic Financial Security Missing?

If you’ve cleared high-interest debt, focus on building fundamental financial stability—this means finishing a full 3–6 months emergency fund if not done yet, and making consistent basic retirement contributions. Starting or growing funds like a Roth IRA or contributing to your 401(k), especially to capture employer matches, accelerates your future security. Resources like after debt freedom, where to put your first free paycheck can help you map this out.

Level 3 – Everything Above Is Covered

Once you’re secure on the basics, split your commute savings between improving current quality of life and future acceleration. This might include funding professional development, adding to a health savings account, or investing in life-quality upgrades that also boost your productivity or happiness at home.

By following these prioritized steps, you ensure that your commuting savings are put to the best use—building a foundation first, then steadily growing both your financial security and life enjoyment. Avoid the common trap of lifestyle creep by committing to this decision tree before upgrading your spending habits.

Concrete Ways to Allocate Your Commute Savings by Financial Impact

When redirecting commute savings, think about where each dollar can do the most good. Here’s a clear breakdown from highest financial efficiency to personal enjoyment, with realistic spending ranges.

Ultra-High Impact: The Math-Backed Priorities

- Knock down highest-interest debt first (credit cards, payday loans). This is almost always the smartest move—your money works hardest here.

- Max out Roth IRA and HSA catch-ups if you’re eligible by age. These accounts grow tax-advantaged and boost your long-term wealth.

- Grab your full 401(k) employer match if you’re not already. That’s free money you don’t want to miss.

These are top priority because they either reduce costly debt or amplify tax benefits and compound growth. If you want to dive deeper, this article on why index funds are a great investment for young adults can help guide your retirement choices.

High-Impact Medium-Term Security Moves

- Finish building your emergency fund up to 3–6 months of expenses if you haven’t yet.

- Start or boost sinking funds for future costs like car replacement, home maintenance, or a new laptop for work.

- Pay extra principal on your mortgage—but only if your interest rate is above about 4.5–5% in the 2026 borrowing environment.

These steps aren’t flashy, but they smooth out bumps before they become big problems and keep your finances stable over time.

Strong Life-Quality + Future Value Combos

- Increase retirement contributions beyond the bare minimum for extra growth.

- Boost 529 college savings or other education funds if you have kids.

- Upgrade health-related coverage—better dental, vision, or health insurance plans protect your well-being and finances.

- Invest in professional development and certifications that can increase your income potential.

This balanced approach enhances both your present stability and future prospects, blending financial security with meaningful personal growth.

High Personal Satisfaction with Reasonable Efficiency

- Create a travel fund for trips and experiences you couldn’t enjoy during your old commute.

- Prioritize physical and mental health by investing in gym memberships, therapy, massage, or improving your sleep setup.

- Consider a housing upgrade: a bigger place, better location, or a home office that supports productivity and comfort.

- Buy back your time with services like house cleaning, meal delivery, or childcare.

These choices balance joy and practicality without compromising your financial goals. For some helpful budgeting tips that make managing extra money easier, check out 5 budgeting apps that actually work.

Pure Enjoyment & Celebration (Keep It Small)

- Set up a “Commute Freedom Fund” as guilt-free, monthly spending money on whatever makes you happy.

- Plan one bigger reward purchase after 6 to 12 months of consistent saving or investing—celebrate your progress!

Treating yourself occasionally keeps motivation high and prevents the dangerous lifestyle creep that often eats up newfound savings.

Redirecting that extra cash from no commute is a smart move when you know where to place it. Prioritize high-impact financial steps first, then sprinkle in quality-of-life upgrades and a little fun money for peace of mind.

Quick Decision Helper Table: Where Should Your Commute Savings Go?

Here’s an easy-to-follow table to help you quickly decide how to redirect your extra cash from no commute. Whether you’re aiming to crush debt, build security, or boost your lifestyle, this visual guide breaks down your best moves for that remote work windfall.

| Priority Level | Financial Focus | Action Steps & Examples | Ideal For |

|---|---|---|---|

| Level 0: Emergency | Build or top up emergency buffer | Save until 3-6 months of essential expenses covered | If you lack any safety net |

| Level 1: Debt Focus | Pay down high-interest debt | Avalanche method: credit cards, personal loans | Aggressive debt crushers |

| Level 2: Basic Security | Strengthen long-term stability | Max employer 401(k) match, open/boost Roth IRA or HSA | For balanced enjoyers & savers |

| Level 3: Quality of Life & Future | Split between lifestyle upgrades + future growth | Travel fund, home office upgrade, professional development, 529 college savings | People ready to enjoy and grow |

How to Use This Table:

- No emergency fund? Prioritize Level 0 before anything else—nothing beats peace of mind.

- Carrying high-interest debt? Focus commute savings here to stop financial leaks quickly.

- Secure and debt-free? It’s time to boost retirement accounts or health savings, tapping into financial freedom commuting cost savings.

- Want more joy & growth? Don’t shy from spending on experiences, better health, or future career moves that expand your earnings potential.

This decision tree keeps you from the dangerous “lifestyle creep” trap many fall into after saving on commute costs. It ensures your remote work budget changes add real financial value or genuine life energy, instead of disappearing into invisible spenders.

For more ideas on where to park your extra cash efficiently, check out our guides on high-yield savings in a high-rate era and smart budgeting for lifestyle changes.

Use this quick helper anytime you wonder what to do with commuting savings—it’s your shortcut to smarter money moves and true financial freedom from your remote work windfall.

Real-life Reader Stories / Archetypes

To make these ideas more relatable, here are three common reader archetypes showing how they redirected their extra cash from no commute:

The 28-year-old aggressive debt killer

Fresh out of school with some lingering credit card debt, this young professional used their remote work windfall to smash high-interest debt fast. Every extra dollar saved on commuting went straight into a debt avalanche strategy, cutting interest costs and freeing up future income quicker. For tips on sticking with this method, check out strategies on why the debt avalanche feels harder and how to stick with it.

The 41-year-old burned-out parent who bought back time

After years juggling long commutes and family, this parent prioritized buying time over everything else. Their commute savings funded housecleaning services, meal delivery, and occasional childcare so they could finally reclaim evenings and weekends. This approach gave them peace of mind and better work-life balance, turning financial freedom from commuting cost savings into actual life energy.

The 34-year-old who split 50/50 future vs present

This individual balanced smart financial moves with quality of life improvements. Half their extra money went into building up a 529 education fund and maxing out retirement contributions, while the other half was spent guilt-free on travel and wellness. This hybrid approach used the commute refund to boost both immediate satisfaction and future security.

Each story shows a different way to prioritize savings, depending on your personal goals and current financial picture. Identifying your archetype helps avoid the “lifestyle creep” trap and guides smarter decisions with your newfound remote work monthly savings.

Common Mistakes & Warning Signs to Avoid

When redirecting your commuting expenses, it’s easy to fall into traps that can undo your financial progress. Here are some common mistakes to watch out for—and warning signs that your extra money might not be working as hard as it could.

1. Falling Into “Lifestyle Creep”

The biggest danger with extra cash from no commute is spending it as if it’s free money. Upgrading every aspect of your lifestyle just because you have more disposable income is a quick way to lose the financial freedom you gained. Keep an eye on subtle inflation of expenses, especially on dining out, shopping, or premium subscription services.

2. Ignoring Emergency Buffers or Debt Priorities

Throwing all commute savings into fun or non-essential purchases before you have a solid emergency fund or have tackled high-interest debt is risky. Remember the prioritization framework: safety nets and eliminating expensive debt come first. Otherwise, you’re setting yourself up for financial setbacks.

3. Overestimating Your Monthly Savings

People often over-calculate what they’re truly saving by skipping the commute. Gas, tolls, and parking are obvious, but don’t forget car maintenance, wardrobe costs (professional dry cleaning), and the time-value of your saved hours. Using a realistic commuting cost calculator savings tool can prevent overconfidence.

4. Neglecting Medium- and Long-Term Goals

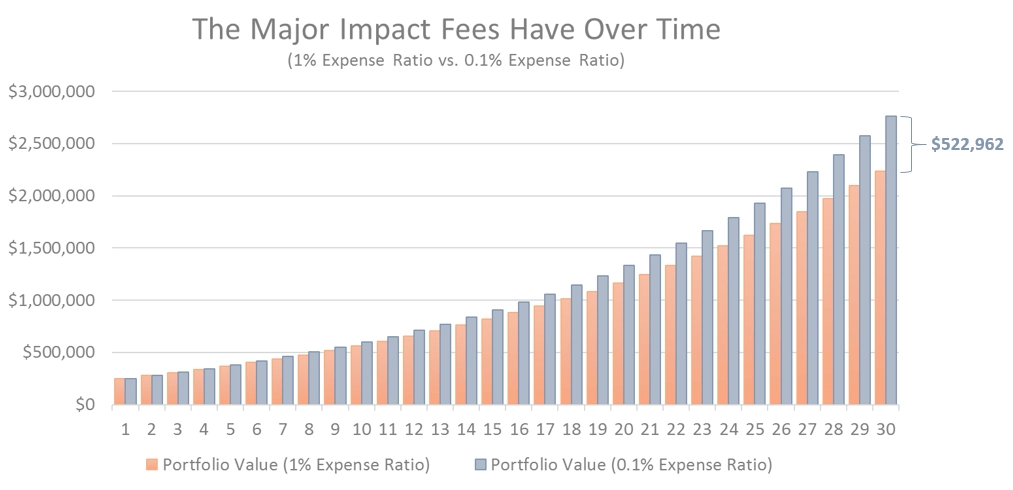

Dumping all commute windfall money into short-term spending means missing out on powerful compounding benefits with retirement accounts like a Roth IRA or maximizing your employer’s 401(k) match. Balancing guilt-free spending with smart investing is key to sustainable financial freedom.

5. No Tracking or Plan for the “Found Money”

Without a clear plan, extra money from remote work can just disappear. Make a simple budget update that specifically tracks your commute savings and decides its allocation every month. This helps avoid the invisible spender trap and keeps you aligned with your financial goals.

Avoid these pitfalls to ensure your hybrid work budget changes translate into actual long-term gains, not just temporary financial relief. For more on plugging common money leaks early in your financial journey, check out strategies like those in the big 3 money leaks for young adults.

Final Recommendation Framework: Your Personalized Quick Test

To figure out the smartest use for your extra money from remote work or commuting savings, answer these 7 quick questions. Your responses will help pinpoint the best path for your situation right now:

- Do you have an emergency buffer of at least 3 months’ living expenses?

- Is there any high-interest debt (credit cards, payday loans) you haven’t paid off yet?

- Are you consistently contributing to basic retirement plans like a 401(k) or IRA?

- Do you have a savings stash for medium-term needs, such as home repairs or a new car?

- Are you happy with your current health insurance or benefits, or could better coverage improve your financial security?

- Do you want to prioritize accelerating wealth growth, improving quality of life, or both?

- Are you mindful of lifestyle creep, ensuring the extra cash isn’t just fueling bigger spending without goals?

If you answered “no” to questions 1 or 2, focus first on building your emergency fund and paying off high-interest debt—the highest-impact moves for financial freedom and stress relief. Those steps protect you from risks and costs that can wipe out any commuting cost savings.

If you have those basics covered but skipped questions 3 or 4, then leveling up retirement contributions or setting aside realistic sinking funds is key. This helps balance long-term security with manageable expenses.

For those comfortable with the above and looking to build future wealth while enjoying life now, it’s a good idea to split your commute refund between tax-advantaged accounts (like Roth IRA or HSA) and quality-of-life perks (professional development, health, and time-saving services).

Finally, ask yourself #7 often—avoiding lifestyle creep remote work savings means your windfall money smart choices pay off in actual peace of mind or life energy, not just fancy gadgets or impulse buys.

This quick test is designed to guide your decisions, so your commuting savings become a real financial boost instead of invisible spending. For more detailed money automation tips, you can check out strategies to automate your savings the set-and-forget way and stay on track with your goals.

Save this checklist, revisit it anytime your situation changes, and start making your commute savings work harder for you today.

Where Should Your Commute Savings Go? Final Thought & Call to Action

The best place for your extra money from remote work or hybrid work budget changes is wherever it gives you peace of mind or actual life energy back. Whether that means shoring up your emergency buffer, knocking down high-interest debt, or even investing a bit more in experiences that enrich your life, the key is making the savings from no commute work for you—financially and emotionally.

Don’t let lifestyle creep sneak in to chip away at this windfall money. Instead, take a moment to calculate your personal savings number—how much you’re really redirecting from commuting costs like gas, tolls, parking, and time value—and decide where it fits best in your financial goals. Drop your savings estimate in the comments; it’s a simple but powerful step toward smarter money choices.

If you want some fresh ideas to prioritize that found money financial windfall or avoid common mistakes in managing it, check out practical tips on prioritize financial goals with commute refund and strategies for consistent investing with psychology hacks.

Remember, the smartest use of commute savings is the one that strengthens your financial freedom while adding real value to your day-to-day life.