Why Traditional FIRE Feels Out of Reach for Regular People

The classic FIRE (Financial Independence Retire Early) model often feels unrealistic for many of us. It demands saving an eye-popping 50-75% of your income and retiring within 10-15 years—a pace that few can sustain. This intense savings rate is tough when you consider real-life challenges like:

- Median household incomes that barely stretch to meet monthly needs

- Rising childcare costs eating deep into budgets

- Skyrocketing housing prices making homeownership or rent unaffordable

- Burdensome student loans that take years to pay off

- Growing healthcare expenses that can derail savings plans

Looking at the data, the picture gets clearer. Most people save far less than what classic FIRE requires. The average savings rate hovers closer to 10-15%, and the typical retirement age in the U.S. is around 62. This means only a tiny percentage actually achieve extreme early retirement.

Beyond finances, there are psychological barriers, too. The constant pressure to cut costs often leads to frugality burnout—people feel exhausted and miss out on valuable life experiences, like travel, social events, or hobbies. The sacrifice can feel too high, making traditional FIRE feel more like a fantasy than a feasible plan for regular folks.

In short, while the dream of financial independence is powerful, the original FIRE path can seem out of reach for anyone without a high income or unusual circumstances. Fortunately, there are modified FIRE strategies designed to fit everyday lives without extreme sacrifice.

The Good News: Modified FIRE Approaches for Everyday Lifestyles

The great news is that financial independence retire early (FIRE) doesn’t have to mean extreme sacrifice or impossible saving rates. For regular people juggling day-to-day expenses, modified FIRE strategies make early retirement or financial freedom on a moderate salary much more achievable. Instead of aiming to save 50-75% of your income, these adapted versions focus on realistic goals that fit your life and budget.

Here are three popular and practical options: Lean FIRE, Coast FIRE, and Barista FIRE. Each offers a different path to financial independence, tailored to varying income levels, family needs, and lifestyle preferences. Whether you want minimalist independence, enjoy working but want less pressure, or prefer semi-retirement with part-time work, these versions balance saving and living well without burning out.

These approaches help regular people build momentum while still enjoying life—no superhero savings required. If you’d like to learn practical ways to increase your savings without cutting your fun, check tips on how to save for retirement without a 401k or plug the big money leaks young adults face.

Modified Version 1: Lean FIRE – Minimalist Independence on a Moderate Budget

Lean FIRE focuses on covering your essential expenses with a smaller investment portfolio, relying on ongoing frugality to keep costs low. Instead of aiming for a massive nest egg, Lean FIRE targets an annual spending range around $40,000 to $60,000, making financial independence more achievable for regular people.

What It Is

Lean FIRE is about living simply and controlling expenses tightly so your savings stretch further. Your FIRE number—the amount you need saved—will be lower because you plan to spend less each year. This approach embraces minimalist independence, prioritizing essentials while cutting back on extras.

How to Achieve Lean FIRE

- Budget smart: Track every dollar and focus spending on needs, not wants.

- Low-cost living: Consider downsizing, choosing affordable locations, and limiting expensive habits.

- Side hustles for average incomes: Supplement your earnings with part-time gigs or freelance work to boost savings without extreme sacrifice. For tips on managing extra income effectively, check out strategies on how to save side hustle income using the bucket strategy.

Pros and Cons

Pros:

- Faster path to independence than traditional FIRE’s massive savings rate

- Less pressure to climb the career ladder or work long hours

Cons:

- Discipline is key; lifestyle flexibility is limited

- Fewer splurges or luxuries compared to traditional retirement planning

Who It’s For

Lean FIRE suits singles or couples without kids who want a simple life and are comfortable with minimalism. If you’re looking for financial freedom on a moderate salary and don’t mind keeping a tight budget, this version could fit you well.

Modified Version 2: Coast FIRE – Build Early, Relax Later

Coast FIRE is all about front-loading your savings early in your career so that compound interest does the heavy lifting for your traditional retirement years. Once you hit your Coast FIRE number—the amount you need invested to reach full retirement without additional contributions—you can “coast” by reducing or stopping new savings and focus on enjoying your work or family life.

Calculating your Coast FIRE number depends on your age, expected retirement age, and investment growth assumptions. Using online FIRE calculator tools can help you find this number based on your starting point and timeline. For example, a 25-year-old with a solid portfolio may only need to save aggressively for 10 years before letting their investments grow on autopilot.

The key strategies for Coast FIRE include maxing out early retirement accounts like Roth IRAs or 401(k)s, investing aggressively while young, and then gradually shifting toward income sources that you find fulfilling rather than purely lucrative. This method lets you balance saving with living now, easing the pressure of extreme frugality.

The pros of Coast FIRE are significant: it lowers long-term stress by securing your financial future early and gives you freedom later without demanding full deprivation. On the downside, it still requires discipline when you’re young, and like all investing strategies, it carries market risks that can impact your progress.

Coast FIRE fits younger professionals or parents who want to spend quality time with family without sacrificing their financial independence goals. If you want to avoid burnout but still retire comfortably at a traditional age, this approach might suit you best.

For more on maximizing early retirement accounts and smart investing, check out this detailed guide on how to choose between a 401(k) and Roth IRA to fit your life stage.

Modified Version 3: Barista FIRE – Semi-Retirement with Flexibility

Barista FIRE is all about saving enough to cover your core expenses with investments, while still working part-time to fill in gaps like health insurance or extra spending money. Think of it as a semi-retirement option that lets you ease into financial independence without going “full FIRE.”

What Barista FIRE Looks Like

- Save for essentials: Build a portfolio to cover your basic costs, usually lower than traditional FIRE targets.

- Part-time work: Earn around $20,000-$30,000 a year in low-stress roles, such as freelancing, café jobs, or consulting.

- Why work? To keep health benefits, social connections, and a steady supplement to your investments.

Real-World Benefits of Barista FIRE

| Pros | Cons |

|---|---|

| Easiest way to transition into retirement | Not fully independent from work |

| Maintains purpose and daily routine | Job availability can be uncertain |

| Reduces risk of depleting investments early (sequence of returns risk) | Income may be unpredictable |

| Keeps healthcare coverage without full reliance on market | Part-time jobs may not suit everyone |

Who Should Consider Barista FIRE?

- People who enjoy some work or want to stay active

- Those needing employer health insurance benefits

- Anyone seeking a less stressful shift from full-time to financial freedom

This style of FIRE blends investing smartly with steady part-time income, making retirement more realistic and less rigid for average earners. For more info on managing ongoing expenses and side jobs, checking financial guides on balancing work and healthcare can be useful. For example, a freelancer’s guide to social insurance explores protecting benefits while working part-time or gig jobs.

Barista FIRE offers a practical, flexible bridge to independence—perfect if you want to avoid burnout but still enjoy financial freedom on a moderate salary.

Comparing the 3 Modified FIRE Versions: Which Fits Your Life?

Choosing the right modified FIRE approach depends on your lifestyle, goals, and finances. Here’s a quick side-by-side look to help you decide which version suits you best:

| Version | Savings Rate Needed | Timeline to FIRE | Lifestyle Impact | Ideal Income Level |

|---|---|---|---|---|

| Lean FIRE | 30-50%+ | 10-15 years (faster path) | Frugal living, limited luxuries | Moderate income ($40k-$60k) |

| Coast FIRE | 50-70% early, then low | Early heavy saving, then coast till 60s | Balanced saving and spending | Mid to high incomes |

| Barista FIRE | 20-35% | Flexible; semi-retire anytime | Part-time work required; more flexibility | Varies, suits moderate income |

Key Factors to Consider

- Age & Career Stage: Younger professionals might favor Coast FIRE, using time and compound interest to their advantage. Older individuals may lean into Barista FIRE, balancing work and retirement easier.

- Family Status: Those with dependents might find Lean FIRE challenging due to higher child-related costs, making Coast or Barista FIRE more realistic.

- Risk Tolerance: Lean and Coast FIRE often rely heavily on market returns; if you’re wary of risk, Barista FIRE provides an income cushion with part-time work.

- Location & Cost of Living: High-cost areas can make Lean FIRE tougher unless you relocate or cut expenses drastically. Barista FIRE’s part-time work can offset living costs better in expensive cities.

Deciding on a tailored path helps maintain momentum and avoids burnout, making financial independence achievable for regular people. If you want to explore practical tips on increasing your income without extreme sacrifice, tools like the step-by-step monetization map offer great guidance to boost your savings strategically.

Practical Steps to Start Your Modified FIRE Journey

Starting your modified FIRE plan begins with a clear picture of your current finances. Track your expenses closely for a few months to see where your money goes. From there, calculate your personal FIRE number — the amount you need saved to cover your desired annual spending using the 4% rule explained in simple terms.

Next, boost your savings in ways that fit your lifestyle. Look for side hustles for financial independence that bring in extra income without burning you out. At the same time, cut non-essential spending thoughtfully without going to extremes that cause frustration or burnout.

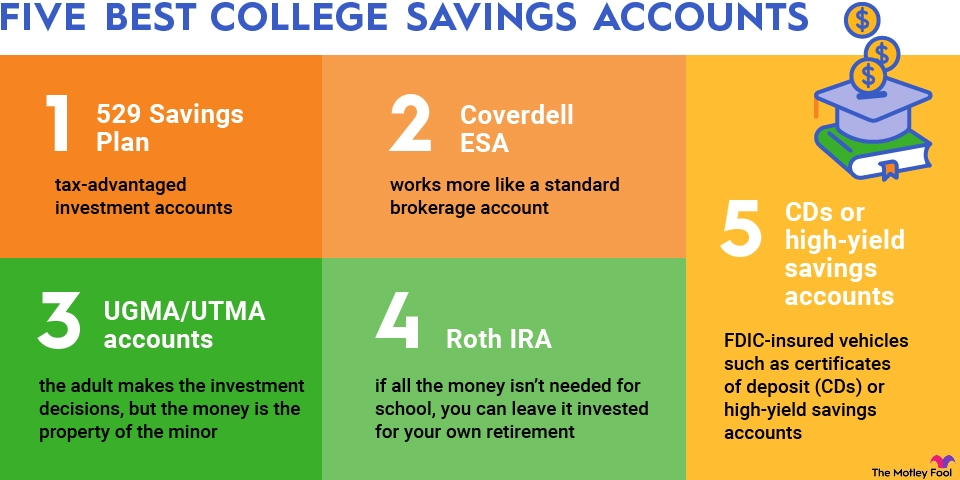

When it comes to investing, keep it simple and smart. Index funds are a great choice for steady growth, combined with tax-advantaged accounts like IRAs or 401(k)s to maximize returns. Remember to diversify your portfolio to balance risk.

Beware of common pitfalls:

- Lifestyle creep — avoid increasing spending as income grows.

- Trying to time the market — stay consistent with investments.

- Ignoring healthcare — essential for long-term security and often overlooked by early retirees.

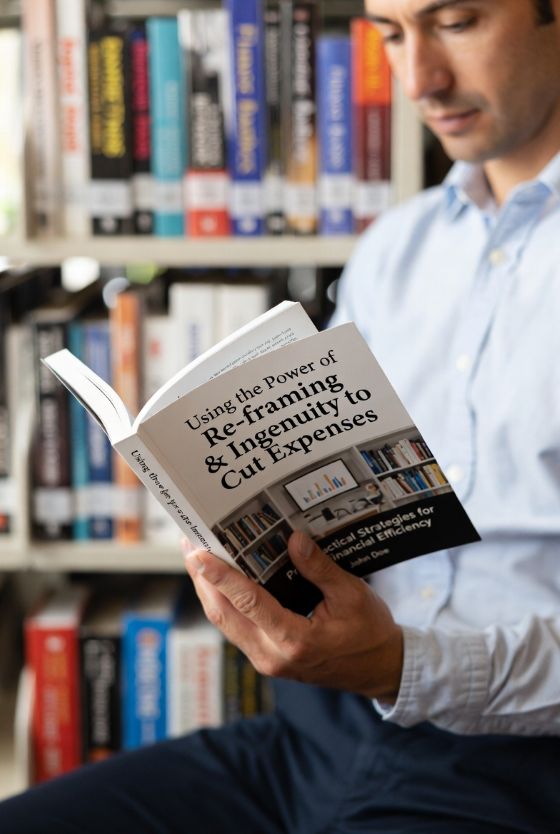

To stay on track, use FIRE calculator tools to monitor progress, read actionable books on financial independence, and join online communities for support and motivation.

If you need help setting up your emergency savings before diving deeper into investing, check out this guide on why you need an emergency fund and how to build it effectively. It’s a solid foundation for any FIRE journey.

Real-Life Success Stories and Inspiration

Many regular people have reached financial independence by following modified FIRE strategies, proving early retirement is realistic without extreme sacrifice. Take, for example, Sarah, a single teacher who pursued Lean FIRE by cutting costs and freelancing on the side. She managed to retire comfortably on a $50,000 budget, enjoying freedom without burnout. Then there’s Mark and Lisa, a young couple who embraced Coast FIRE, maxing out retirement accounts in their 20s so they could focus on family life without financial stress later. Finally, Dave chose Barista FIRE, working part-time at a local bookstore to cover health benefits while drawing from his investments for core expenses.

These stories show that patience and flexibility matter most. The goal isn’t necessarily retiring early at all costs but carving out financial independence that fits your lifestyle. You learn to balance saving with enjoying life, avoiding burnout from frugal living while still making progress toward freedom.

If you want ideas on building savings steadily without harsh deprivation, check out these 5 habits of 25-year-olds who saved $10k. Their approaches highlight how consistent small steps add up over time, a useful mindset for any modified FIRE journey.