What Are Index Funds and How Do They Work?

If you’re new to investing, you might wonder what exactly an index fund is and how it works. Simply put, index funds are a type of passive investing vehicle that tracks a specific market index, like the popular S&P 500 index fund. Instead of trying to pick individual stocks or beat the market, these funds aim to mirror the performance of the entire market index by holding the same companies in roughly the same proportions.

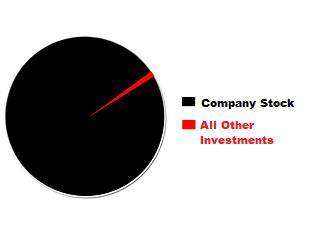

This is different from active funds, where managers buy and sell stocks trying to outperform the market, which often results in higher fees and unpredictable returns. Also, unlike buying single stocks, which can expose you to higher risk if one company’s value drops, investing in index funds means you own small pieces of hundreds of companies in one simple purchase—giving you built-in broad market exposure and diversification from day one.

Index funds come in two main formats: ETFs (Exchange-Traded Funds) and mutual funds. ETFs trade like stocks on exchanges, so you can buy and sell them anytime during market hours, often with lower minimum investments. Mutual funds, on the other hand, buy or sell shares only at the end of the trading day. Both types are widely accessible and commonly offered by trusted providers like Vanguard, Fidelity, and Schwab, making it easy for beginners to get started with low-cost index funds.

In short, index funds let you invest in the overall market without the headache of selecting winners, making them an excellent choice for young adults starting their investment journey.

The Power of Starting Early: Compounding and Time Horizon

One of the biggest advantages young adults have when investing in index funds is time. Compounding interest works like magic over long periods: the money you earn gets reinvested and starts making its own money. For example, if you invest $5,000 in a low-cost index fund at age 25 and let it grow at an average of 8% annually, by age 65 it could grow to over $70,000. But if you start that same $5,000 at age 35, you might only end up with about $32,000 by retirement. That’s the power of an extra decade working for you.

Young investors also have the luxury of riding out market dips. The stock market naturally fluctuates, but over the long term, it has historically returned around 7-10% per year after inflation. This means that short-term losses are usually recovered over time, especially if you stay invested and keep contributing regularly.

Starting early with index funds gives you decades to benefit from compounding, minimize risks related to market volatility, and build long-term wealth. For a beginner, this time horizon is one of the strongest reasons to choose a simple, diversified, low-cost approach. If you want to learn how to complement your early investment with budgeting basics, check out these 3 budgeting methods for beginners that help you save more effectively.

Key Advantages of Index Funds for Beginners

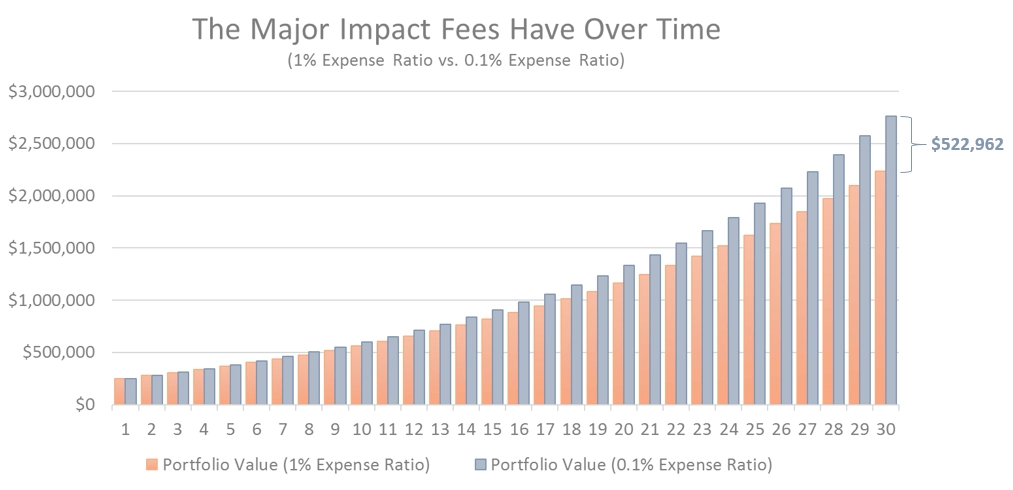

Index funds are perfect for beginners mainly because of their low costs and fees—expense ratios often come in at under 0.1%. That means more of your money stays invested and working for you instead of being eaten up by management fees.

Another big plus is the built-in diversification. When you buy an index fund, you’re basically owning a tiny piece of hundreds (or even thousands) of companies at once, which spreads out your risk. This is a safer way to grow your money compared to buying a few individual stocks.

Because index funds follow a passive strategy—simply tracking a market index—they often outperform most active funds over time. Studies like SPIVA show that the majority of active managers fail to beat their benchmark indexes, so passive investing tends to win in the long run.

For beginners, this means there’s no need to guess which stocks to buy or spend hours monitoring the market. Index funds offer a hands-off investing experience that’s less stressful and easier to maintain.

Lastly, index funds are generally more tax-efficient in taxable accounts, often generating fewer capital gains than actively managed funds. This helps you keep more of your investment returns, especially important if you’re just getting started building your portfolio.

Why Index Funds Beat Common Alternatives for Young Investors

Index funds offer clear advantages compared to other popular investment options for young adults. Unlike individual stocks, index funds carry lower risk because they spread your money across hundreds of companies. This diversification means you don’t have to worry about picking winners or stressing over daily market swings—no emotional investing required.

Compared to active mutual funds, index funds usually deliver better net returns. That’s mainly due to their low expense ratios, often under 0.1%, which means fewer fees eating into your gains. Active funds often charge higher fees but rarely beat the market over the long term, according to SPIVA data showing most active managers underperform.

Saving money in a bank account might feel safer, but it can’t match the growth potential of index funds. Bank savings typically offer minimal interest, often below inflation, so your money loses purchasing power over time. Index funds, especially S&P 500 index funds, have historically returned about 7-10% annually after inflation, making them a stronger choice for building long-term wealth.

Some people say index funds are “boring,” but that’s actually a good thing. Consistent, slow, and steady growth beats unpredictable or overly complicated investment strategies. For young investors, this reliability is key to creating lasting wealth without the stress of trying to beat the market.

For a simple proven way to grow wealth steadily, setting up automated contributions helps you stick to investing without second-guessing your choices—check out this guide on how to automate your savings the set-and-forget way.

Potential Risks and How to Manage Them

Investing in index funds isn’t risk-free—market volatility can cause your portfolio’s value to dip in the short term. This means you might see losses when the market drops, which can feel unsettling, especially for beginners. However, it’s important to remember that these short-term ups and downs are normal in investing.

To manage this volatility, dollar-cost averaging is a smart approach. By investing a fixed amount regularly, you buy fewer shares when prices are high and more when prices are low, which smooths out your purchase price over time. Staying invested with a buy and hold strategy allows you to benefit from the market’s long-term upward trend, helping you ride out downturns.

Before jumping into investing, make sure you have a solid emergency fund and have taken care of any high-interest debt. This foundation protects you from needing to pull money out prematurely during a market dip—something that can disrupt compounding growth and set back your long-term wealth building.

For more on building financial stability before investing, you might find helpful tips in our investing category resources.

Recommended Index Funds to Get Started

For young adults just beginning their investment journey, picking the right index funds is key. Starting with broad U.S. stock funds, like an S&P 500 index fund or total market trackers, gives you exposure to hundreds of leading companies in one simple purchase. These funds offer a solid foundation for building a diversified portfolio starters.

To add more balance, consider including international exposure options. Adding funds that track developed and emerging markets worldwide helps spread risk and capture global growth opportunities.

If you prefer a more hands-off approach, target-date funds are a great choice. These automatically adjust the asset mix over time, making portfolio management easier as you get closer to retirement.

When choosing index funds, focus on:

- Low expense ratios (ideally under 0.1%) to keep more of your returns

- Reputable providers known for quality and reliability, such as Vanguard, Fidelity, and Schwab

Starting with these types of low-cost index funds sets you up for long-term wealth building while minimizing fees and hassles. For more on managing investments tax-efficiently, you can check out insights on capital gains tax rates that affect index fund returns.

Step-by-Step Guide to Investing in Index Funds

Starting your journey with index funds is straightforward if you follow a few key steps. First, focus on building your financial basics: have an emergency fund that covers 3-6 months of expenses and clear any high-interest debt. This foundation protects you from dipping into investments when unexpected costs arise.

Next, open the right investment accounts. A taxable brokerage account is a good start for flexibility, but consider tax-advantaged options like a Roth IRA or your employer’s 401(k) to maximize growth over time. Many platforms now offer easy access to low-cost index funds and ETFs from well-known providers.

Once your accounts are set up, automate your contributions. Regular, consistent investments—known as dollar-cost averaging—help smooth out market ups and downs and build wealth steadily without trying to time the market.

Finally, set a schedule to rebalance your portfolio periodically, maybe once or twice a year. Rebalancing keeps your allocation aligned with your goals but avoid overtrading, which can increase fees and reduce returns.

For more helpful tips on building wealth early, check out these real saving habits of 25-year-olds who reached $10,000.

By following these simple steps, you can confidently start growing your money with index funds and benefit from long-term compounding.

Real Success Stories and Long-Term Outlook

Many everyday investors have found success by starting early with low-cost index funds. Take Jane, who began investing $200 a month into an S&P 500 index fund in her mid-20s. Over 30 years, thanks to compounding interest and steady contributions, her investment grew significantly—enough to fund a comfortable retirement. Stories like Jane’s show how passive investing beginners can build wealth without trying to time the market or pick individual stocks.

Even Warren Buffett, one of the most respected investors, recommends index funds for most people. He’s said that for long-term wealth building, low-cost index funds are the smartest choice for anyone who doesn’t have time or expertise to manage their portfolio actively.

Looking ahead, the historical trends of the stock market provide a strong outlook. Over decades, broad market exposure through index funds has averaged a 7-10% annual return after inflation. While past performance doesn’t guarantee future results, this consistent growth trend highlights why beginning with index funds is a solid strategy for young adults planning their financial future.

Key takeaways:

- Everyday investors gain long-term wealth by sticking to low-cost index funds.

- Warren Buffett and other experts endorse index funds as beginner investment strategies.

- Historical stock market returns suggest steady growth for patient investors.

- Dollar-cost averaging and buy and hold strategies help manage market volatility.

Starting with index funds isn’t just safe—it’s a proven path to building wealth over time.