Why Bank Balance Is a Misleading Metric

Ever checked your bank balance and felt financially secure, only to find yourself stressed a week later? That’s because your bank balance is often a misleading short-term snapshot of your financial health. It doesn’t tell the whole story.

Limitations and Hidden Risks

Your checking or savings account balance shows only the cash you have right now—not the full picture. It ignores:

- Pending bills or upcoming expenses: Those $500 in your account might disappear fast once rent, utilities, and groceries hit.

- Debt obligations: High-interest credit card debt or loans aren’t reflected in your bank balance but can drain your finances.

- Lack of emergency savings: You might have cash today but no financial buffer for unexpected events like car repairs or medical bills.

- Inflation impact: Money sitting idle loses buying power over time, weakening your actual financial position.

Real-World Examples

Think about two people: one living paycheck-to-paycheck with $1,000 in the bank but no savings or emergency fund, and another with $500 in checking plus a solid emergency fund covering six months of living expenses. Who do you think is financially healthier? Obviously, the latter has more financial resilience despite a smaller bank balance.

Expert Holistic Views

Financial experts agree that relying solely on your bank balance overlooks deeper personal financial health metrics. They emphasize a holistic money management approach—considering net worth, debt levels, savings rate, and emergency fund coverage—to truly gauge your financial wellness. It’s about the full financial landscape, not just what’s sitting in your checking account.

In short, your bank balance is just one small piece of your financial health puzzle—not the real metric you should trust.

The Core Pillars of Financial Health

True financial health goes beyond just how much money sits in your bank account. It’s about managing four core pillars: Spend, Save, Borrow, and Plan. These areas form the foundation of holistic money management and help create lasting financial resilience.

-

Spend: Smart spending means keeping your expenses in check without sacrificing your quality of life. Tracking everyday costs and cutting down on impulse buys helps maintain positive cash flow. Mindful spending also prevents creeping debt and financial stress.

-

Save: Saving isn’t just about putting money aside occasionally—it’s about setting clear savings rate goals and building an emergency fund that covers 3-6 months of expenses. This fund acts as your safety net during unexpected events, boosting financial security.

-

Borrow: Not all debt is bad, but understanding your debt-to-income ratio and managing high-interest loans carefully is crucial. Healthy borrowing includes usage of credit in a way that enhances your net worth without dragging you down with excessive interest or hidden fees.

-

Plan: Long-term planning ties everything together. This involves monitoring retirement savings progress, reviewing insurance and protection coverage, and having realistic financial goals. Planning ensures you’re prepared for life’s ups and downs, helping you avoid common pitfalls of financial letdowns.

Mastering these pillars gives you a clear framework for tracking personal financial health metrics and working toward genuine financial wellness. It’s the best way to measure your money’s true strength, beyond just a checking account balance. For tips on saving consistently and smart budgeting, check out practical guides like how to save $2,000 in a year on a $5,000 monthly income.

Key Metrics to Measure True Financial Health

Understanding your personal financial health requires looking beyond just your bank balance. Several key metrics give a clearer picture of your overall financial wellness and resilience.

Net Worth Calculation and Tracking

Your net worth is the total value of your assets (like savings, investments, and property) minus your liabilities (debts and loans). Regularly calculating and tracking your net worth helps you see real progress and spot areas that need attention.

Emergency Fund Coverage and Benchmarks

A solid emergency fund acts as a safety net during unexpected expenses or income loss. Ideally, it should cover 3 to 6 months of essential living costs. For detailed steps on building this, check out this guide on why you need an emergency fund and how to build it.

Debt-to-Income Ratio and Targets

This ratio measures your monthly debt payments against your income. Keeping this below 36% is generally recommended to maintain financial stability and avoid overleveraging.

Savings Rate Goals

Tracking the percentage of your income you save is essential. A good savings rate shows discipline and readiness for future goals. Aim for at least 15%-20% of your income to go toward savings and investments.

Cash Flow Management Signs

Positive cash flow means you bring in more money than you spend, which is crucial for building financial health. Watch for steady income streams and controlled expenses to maintain this balance.

Credit Score and Debt Quality Insights

Your credit score impacts loan interest rates and financial opportunities. Maintaining a good score involves paying bills on time and managing credit utilization. Also, evaluate the quality of your debts—favour low-interest, manageable loans over high-interest debt.

Retirement Readiness Progress

Tracking your retirement savings relative to your target helps you ensure long-term security. Consistent contributions to retirement accounts and reviewing your expected needs keep you on track.

Insurance and Protection Coverage

Adequate insurance (health, life, disability) protects your financial foundation from unexpected risks. Regularly reviewing coverage ensures you’re not underinsured or paying for unnecessary policies.

Together, these metrics provide a full picture of financial health, going far beyond what your everyday bank balance can show. They form the basis of a holistic money management approach, critical to building lasting financial security.

How to Assess Your Own Financial Health

Assessing your personal financial health metrics doesn’t have to be complicated. Here’s a simple step-by-step guide to help you get a clear picture using your financial statements and tools:

-

Gather Your Financial Statements

Collect recent bank statements, credit card bills, loan statements, and investment accounts. Having these documents in one place makes it easier to analyze your financial situation.

-

Calculate Your Net Worth

List all assets (savings, investments, property) and subtract all liabilities (credit card debt, loans). This net worth calculation is a core indicator of your true financial health.

-

Check Your Emergency Fund Coverage

Determine if you have enough savings to cover 3 to 6 months of essential expenses. This emergency fund basics metric is crucial to financial resilience.

-

Evaluate Your Debt-to-Income Ratio

Divide your monthly debt payments by your gross monthly income. Aim for a ratio under 36% so you’re not overburdened by debt.

-

Review Your Cash Flow

Track your income versus expenses to ensure you maintain a positive cash flow each month. This habit is essential for good money management.

-

Analyze Your Savings Rate

Calculate the percentage of your income that you save regularly. A solid savings rate contributes to building long-term financial security.

-

Assess Credit Score and Debt Quality

Review your credit report to spot any issues and understand the impact of credit utilization on your financial health.

-

Look at Retirement Readiness

Check your progress towards retirement savings goals, considering any plans you have in place like a 401(k) or Roth IRA, which can be automated for growth. Automating savings is a smart move to stay on track for retirement.

-

Review Insurance and Protection

Confirm you have adequate insurance coverage to protect your assets and income against unexpected events.

Self-Assessment Checklist and Red Flags

- Are you living paycheck to paycheck without savings?

- Is your debt-to-income ratio higher than recommended benchmarks?

- Do you lack an emergency fund or have less than 3 months’ coverage?

- Is your credit score declining or affected by high utilization?

- Are you behind on retirement savings?

If you checked “yes” to any of these, it’s a signal to reassess your financial habits and make adjustments.

Interpreting Your Financial Health Status

Once you’ve gathered data and checked your personal financial health metrics, you can categorize your status:

- Healthy: Positive net worth, strong emergency fund, manageable debt, steady savings, and good retirement progress.

- Moderate: Some debt concerns, but working on savings and cash flow. Room to improve budget and protections.

- At Risk: Negative net worth, no emergency fund, high debt, irregular savings, and no retirement planning. Immediate action required.

Use this honest evaluation to focus on areas that need attention. Sound financial management is about balancing spending, saving, borrowing, and planning—beyond just your bank balance.

For practical tips on automating your savings to improve your financial health, check out this guide on the set-and-forget way to grow wealth.

Common Pitfalls and Misconceptions

One of the biggest mistakes in measuring personal financial health metrics is over-relying on your income or bank balance. Just because you see a healthy number in your account doesn’t mean your overall financial picture is strong. Many people live paycheck-to-paycheck, where a good-looking balance can quickly vanish with unexpected expenses or a missed paycheck.

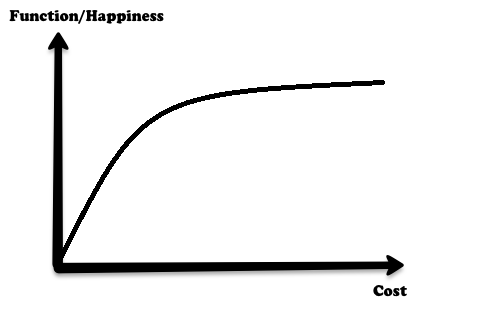

Another common trap is ignoring inflation and hidden fees. Inflation quietly erodes your purchasing power, so your money today won’t stretch as far tomorrow. Meanwhile, bank fees, investment costs, and loan interest can chip away at your savings and debt reduction efforts. Overlooking these factors can paint a misleading picture of your true financial resilience.

Finally, it’s important not to confuse wealth with financial health. Wealth often means having assets, but health means managing those assets wisely to provide security and growth. Someone with a high net worth but mounting high-interest debt or no emergency savings isn’t truly financially healthy. The focus should be on sustainable progress across the core pillars—spend wisely, save regularly, manage debt well, and plan for the future.

Avoid these pitfalls by looking at a full range of metrics—from emergency fund coverage and debt-to-income ratio to retirement savings progress and credit quality. Doing so gives a clear view of your real financial wellness and helps you steer clear of costly misconceptions.

For those tackling high-interest debt or seeking a smarter payoff plan, resources like our guide on debt consolidation and its hidden risks can provide valuable insights.

Actionable Steps to Improve Financial Health

Improving your financial health takes focused actions that build resilience and long-term security. Here are practical steps to get started:

-

Build an Emergency Fund: Aim to save at least 3 to 6 months’ worth of essential expenses. This buffer protects you from unexpected shocks like job loss or medical bills, boosting your financial resilience.

-

Reduce High-Interest Debt: Prioritize paying down debts with the highest interest rates first, such as credit cards or payday loans. Managing high-interest debt improves your debt-to-income ratio and frees up cash flow for savings.

-

Automate Savings and Investments: Set up automatic transfers to your savings account or investment funds. This way, you won’t have to rely on willpower, and you’ll consistently build your savings rate without extra effort.

-

Budget for Positive Cash Flow: Track your income and expenses closely to ensure you’re regularly spending less than you earn. Positive cash flow is a key financial wellness indicator that allows you to save, invest, and reduce debt.

-

Review Insurance and Retirement Plans: Regularly check your coverage to make sure you’re protected against risks like illness, disability, or property loss. Also, monitor your retirement savings progress—whether through a workplace plan or personal accounts—to ensure long-term financial security. For freelancers or those without a 401(k), understanding alternative retirement saving options is essential.

-

Develop Habits for Long-Term Success: Commit to ongoing financial education, regularly revisit your goals, and adjust plans as life changes. Consistent habits like tracking net worth and managing credit utilization impact your overall financial health positively.

Taking these steps will help you move beyond simply checking your bank balance and toward a stronger, more holistic picture of financial health. For insights on managing your savings efficiently in today’s environment, you can explore strategies on where to park your cash during high-rate periods.

By focusing on these core areas, you build the foundation for lasting financial wellness and confidence.

FAQs on Financial Health Metrics

What is the best metric for financial health?

There isn’t a single number that tells you everything. Instead, focus on a combination of personal financial health metrics like your net worth, debt-to-income ratio, savings rate, and emergency fund coverage. Together, these give a clearer picture of your financial resilience beyond just your bank balance.

How much should my emergency fund be?

A solid emergency fund typically covers 3 to 6 months of essential expenses. This buffer protects you from unexpected setbacks like job loss or medical bills, making it one of the strongest indicators of financial security.

How important is my credit score?

Your credit score affects more than just borrowing costs—it impacts your overall financial wellness. A healthy score shows good credit utilization and responsible borrowing, two key signs of long-term financial health. For daily tips on boosting your credit score, check out our guide on habits of people with 700+ credit scores.

How does inflation affect my financial health?

Inflation can quietly erode your purchasing power and savings if you’re not accounting for it in your financial plans. That’s why tracking metrics like your savings rate and retirement readiness is crucial to ensure your money keeps pace with rising costs.

When should I seek professional financial advice?

Consider professional help if you struggle with managing debt, planning for retirement, or dealing with complex insurance needs. Experts can offer personalized guidance to improve your holistic money management and help you build long-term financial security.

By understanding these FAQs and monitoring key financial health metrics, you can maintain a strong financial wellness checklist tailored to your goals.