Why Manual Saving Often Fails (And Automation Succeeds)

Saving money manually can feel like an uphill battle. You might start each month determined to put aside some cash, but common obstacles like impulse spending, forgetting to transfer funds, or making emotional financial decisions often get in the way. It’s all too easy to prioritize immediate wants over long-term savings goals.

Here’s where automation shines. Behavioral finance teaches us the value of “pay yourself first”—that means setting up automatic savings transfers right when you get paid, so your savings happen before you even see the money in your checking account. This simple step removes the guesswork and taps into your natural habits.

By automating your savings, you eliminate the need for willpower, making consistent growth effortless. Instead of relying on memory or discipline, your money moves on its own. This set-it-and-forget-it savings approach turns saving from a constant struggle into a smooth, reliable habit that protects your future wealth with minimal stress.

The Core Benefits of Automated Savings

Automated savings bring a bunch of advantages that help you build wealth without stressing over every deposit. Here’s why setting up automatic savings transfers is a smart move:

| Benefit | Why It Matters |

|---|---|

| Builds Consistency Without Effort | Automatically saving means you stick to your goals without thinking about it. No more forgetting transfers or skipping months. |

| Harnesses Compound Interest for Exponential Growth | Your money grows faster over time as interest builds on previous earnings, making every saved dollar work harder. |

| Reduces Financial Stress and Decision Fatigue | Eliminates the daily mental load of deciding how much to save, helping keep your finances calm and under control. |

| Protects Against Inflation and Unexpected Expenses | Regular savings help build a buffer that shields you from rising costs and emergencies without disrupting your budget. |

When your savings happen on autopilot, you tap into the power of pay yourself first—a key habit in behavioral finance—and let compounding do the heavy lifting. If you want to explore how to save efficiently and grow your emergency fund, check out practical strategies at how to save $2000 in a year on a $5000 monthly income. Automating this process is really the “set-and-forget” way to grow wealth steadily.

Getting Started: Essential Steps to Automate Your Savings

To automate your savings effectively, start by assessing your finances. Track your income and expenses for a few weeks to understand your cash flow. Then, set clear and realistic savings goals to stay motivated.

Next, choose the right accounts for your automated transfers. Consider:

| Account Type | Purpose |

|---|---|

| High-yield savings account | Grow your balance with better interest rates |

| Emergency fund | Cover unexpected expenses |

| Goal-specific buckets | Save for vacations, home, or big purchases |

Finally, decide on your automation amount. A good rule of thumb is to start small—about 10–20% of your income—and gradually increase as you get comfortable. This “set-and-forget” savings method helps build wealth without stress or extra effort.

For more tips on choosing the best savings options, check out strategies on why it may be a good time to cash out I Bonds to diversify and protect your savings.

Practical Ways to Set Up Automation

Setting up your automatic savings transfers is easier than you might think. Here are some straightforward methods to get started with your “set-and-forget” savings plan:

-

Direct deposit splits from payroll: Many employers let you split your paycheck, sending a portion directly into a high-yield savings account or an emergency fund. This is a hassle-free way to pay yourself first without even thinking about it.

-

Recurring bank transfers: Set up automatic transfers from your checking account to your savings on a regular schedule—weekly, biweekly, or monthly. This keeps your savings growing steadily without any extra effort.

-

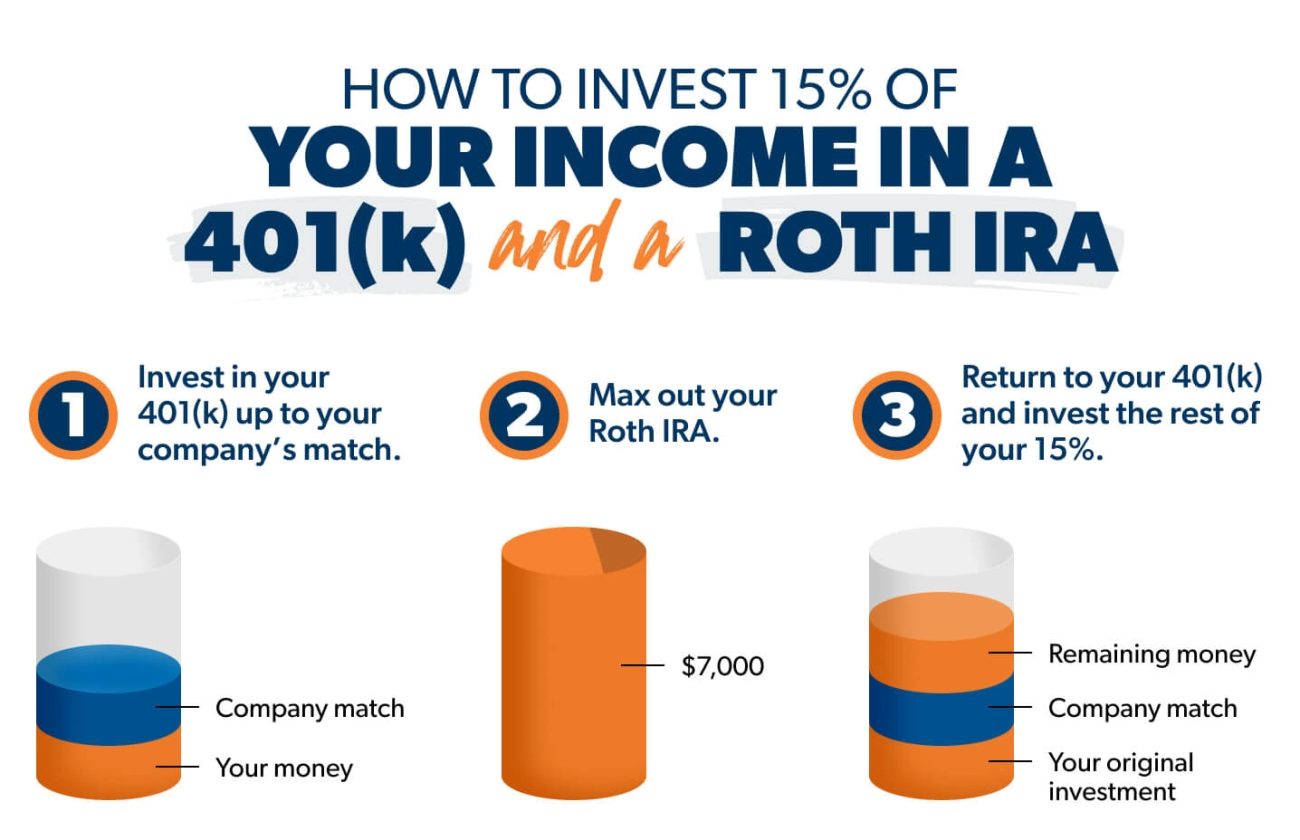

Employer-sponsored plans like 401(k) contributions: Take advantage of automatic deductions and employer matches. Contributing regularly to these plans builds retirement savings while reducing taxable income.

-

Micro-saving tools: Apps that round up your everyday purchases and move the spare change into savings or investment accounts offer a painless way to boost your nest egg. These round-up savings apps make it simple to grow wealth passively.

-

Advanced options: Once comfortable, consider linking your savings to investment accounts or robo-advisors. These platforms automate recurring investment contributions, using strategies like dollar-cost averaging to grow your portfolio over time.

By combining these tools, your savings can build consistently without adding stress or extra steps. For more guidance on budgeting to support your automation, check out these effective budgeting methods for beginners.

Best Tools and Accounts for Automated Wealth Building

When it comes to setting up automated savings, picking the right tools and accounts is key to growing your wealth effortlessly.

High-yield savings accounts offer competitive interest rates that beat traditional banks, helping your money grow faster while staying accessible. Many online banks update their rates regularly, so it’s worth shopping around to find the best option to maximize your compound interest growth.

Popular apps for round-ups and rule-based transfers make saving simple and automatic. These tools link to your checking account and round up purchases to the nearest dollar, transferring the spare change to your savings. Others let you set custom rules, such as saving a fixed amount each week, so your saving habits stay consistent without added effort.

For retirement planning, IRAs and Roth IRAs are excellent vehicles, especially when paired with automatic escalations that gradually increase your contributions as your income grows. Automating contributions here ensures you’re building a nest egg steadily, taking advantage of tax benefits and compounding returns.

Lastly, robo-advisors offer hands-off investing by automatically managing and rebalancing your portfolio based on your goals and risk tolerance. Linking your automated savings to robo-advisors can help transition from simply saving to smart investing for long-term wealth growth. If you’re interested in safer investment alternatives while automating, exploring low-risk investment options can provide valuable insights into protecting your automated contributions.

Using these tools together can create a seamless, “set-and-forget” system that builds wealth steadily without chewing up your time or mental energy.

Taking It Further: From Saving to Investing on Autopilot

Once you’ve built a habit of automated savings, the next step is growing your wealth by transitioning those savings into investments on autopilot. This “set-and-forget” savings approach works just as well when applied to investing, helping your money work harder for you over time.

One popular strategy is dollar-cost averaging—investing a fixed amount regularly regardless of market ups and downs. This reduces the risk of timing the market and smooths out your purchase price over time, making long-term growth more reliable.

When picking investments, think about diversified options like index funds or target-date funds. These funds spread your money across many stocks or bonds, lowering risk while offering steady returns. Target-date funds adjust your risk based on your age or retirement timeline, which is a smart way to balance growth and safety.

To keep your investments age-appropriate, adjust your allocations over time—more stocks for growth when you’re younger, shifting toward bonds or safer assets as retirement nears. Using robo-advisors can help automate these adjustments, so you don’t have to manage your portfolio actively.

By automating both your savings and investments, you set up a powerful system for passive wealth growth, letting compounding work in your favor without extra effort.

Common Pitfalls and How to Avoid Them

Automating your savings is a smart move, but it’s easy to slip into a few common traps if you’re not careful. Here’s what I’ve seen happen and how to avoid these mistakes with your set-and-forget savings system.

Starting too aggressively

Jumping in with a big chunk of your income can backfire, leading to overdrafts or missed bills. It’s better to start small—around 10-20% of your paycheck—and increase the amount as you get comfortable. This steady approach keeps your cash flow balanced and your automatic savings transfers safe.

Truly ‘forgetting’ without periodic reviews

Automation isn’t a “set it and never check it” deal. Life changes, priorities shift. You need to peek at your savings system at least once a year—or after major life events—to make sure your savings goals and amounts still make sense.

Ignoring life changes

A raise, a new expense, or changes like moving homes can mess with your budget. If your automated savings don’t adjust after these events, you might save too little or too much. Keep your system flexible by updating transfers to match your current financial situation.

Overlooking fees or low-interest accounts

Not all high-yield savings accounts or apps are created equal. Some have hidden fees or payout rates too low to make automatic savings worthwhile. Check regularly for better options and avoid letting your money sit in accounts that don’t help your compound interest growth.

By watching out for these pitfalls, you can keep your automated savings on track and steadily build wealth without the headaches.

Monitoring and Optimizing Your Automated Savings System

To make the most of your set-and-forget savings, regular check-ins are key. Aim to review your automated savings system at least once a year or after significant milestones, like a pay raise or a major expense. This keeps everything on track and helps you adjust as life changes.

Adjust for income growth or new goals:

Increase your automatic savings transfers when your income goes up.

Reassess your goals—whether that’s building an emergency fund, adding to retirement contributions automatic deposits, or saving for a big purchase.

Track your progress easily with tools:

Use apps or bank dashboards that visualize your savings growth and highlight the power of compound interest growth. Seeing your money grow can motivate you to keep going.

Signs it’s time to increase contributions:

- You’ve reached your current goal ahead of time.

- Budget feels comfortable enough to save more without stress.

- New financial priorities appear, like planning for retirement or emergencies.

Keeping an eye on your system ensures your automatic savings transfers continue working for your wealth-building habits—and help you grow your savings without extra effort.

Real-Life Success Stories and Projections

Seeing how small automated savings grow over time can be truly motivating. For example, imagine setting up automatic savings transfers of just $50 a month. Over 20 years, thanks to compound interest growth, that modest amount can turn into thousands — enough to build a solid emergency fund or jumpstart a retirement nest egg.

One real-life case showed someone using round-up savings apps, where every purchase was rounded up to the nearest dollar with the extra cents going straight to savings. This “set and forget it savings” habit quietly amassed over $3,000 in just one year without disrupting their daily budget.

Others rely on recurring investment contributions through employer-sponsored retirement plans, taking advantage of automatic increases and company matches. These steady contributions, combined with dollar-cost averaging, can significantly boost long-term wealth, even if you start small.

Whether you’re building for a down payment on a home, an emergency cushion, or retirement, automated savings consistently deliver results. Starting as little as 10–20% of your income creates opportunities for passive wealth growth that grow stronger as time goes by. The key is to begin now and let automation handle the rest.

FAQs About Automated Savings

How much should I automate initially?

Start small—around 10-20% of your income is a good ballpark. You want to build the habit without risking overdrafts. As your finances improve, you can increase your automatic savings transfers gradually.

Is automation safe and secure?

Yes, most banks and financial apps use strong security measures like encryption and two-factor authentication. Automated savings with direct deposit splitting or recurring transfers are generally very safe when set up through reputable banks or trusted robo-advisors.

What if my income is irregular?

If your paychecks fluctuate, consider automating a fixed dollar amount you’re comfortable with or a percentage of each incoming paycheck. You can adjust this over time as your income changes. Some apps also allow you to pause or modify transfers easily when needed.

Can automation help with debt payoff too?

Absolutely. You can set up automatic transfers toward your debt accounts, similar to savings. This “pay yourself first” strategy frees you from making emotional decisions and helps build consistent payment habits, speeding up debt payoff.

How does this work for retirement savings?

Automation works perfectly for retirement through employer-sponsored plans like 401(k)s or IRAs. Setting up recurring contributions, including automatic escalations, uses dollar-cost averaging to grow your nest egg steadily—without you having to think about it. It’s a classic ‘set-and-forget’ savings move for passive wealth growth.